Franchising has become a popular investment strategy for individuals looking to expand their business portfolio. It offers a unique opportunity for brokers and their clients to achieve financial success through a proven business model and established brand.

In this comprehensive guide, we will explore every aspect of building a successful franchise portfolio. Providing valuable insights and strategies to help navigate its dynamic world.

Understanding the Basics of Franchising

Before diving into the intricacies of building a franchise portfolio, it’s crucial to have a solid understanding of the basics. It’s is a business relationship in which the franchisor grants the franchisee the rights to operate a business using its established brand, systems, and support.

This relationship requires an initial investment from the franchisee, usually in the form of franchise fees and ongoing royalty payments.

Return on this initial investment:

- Gains access to a proven business concept

- Receives training and support

-

Given an established brand and customer base

Franchising offers numerous advantages, making it an attractive investment option for brokers and their clients.

The Benefits of Investing in Franchises

Investing in franchises comes with a plethora of benefits that can set you up for long-term success.

They offer a higher likelihood of success compared to starting a business from scratch. The franchisor provides a proven business model, comprehensive training, and ongoing support, which reduces the risk and uncertainty associated with new ventures.

Additionally, franchises often have a recognized brand presence and a loyal customer base, giving you a head start in establishing your business and attracting customers.

Furthermore, you benefit from collective marketing efforts and economies of scale. As part of a franchise network, you can leverage national or global advertising campaigns, allowing you to reach a wider audience without shouldering the full cost.

Additionally, by pooling resources with other franchisees, you can negotiate better deals for supplies and services, resulting in cost savings.

Choosing the Right Franchise for Your Portfolio

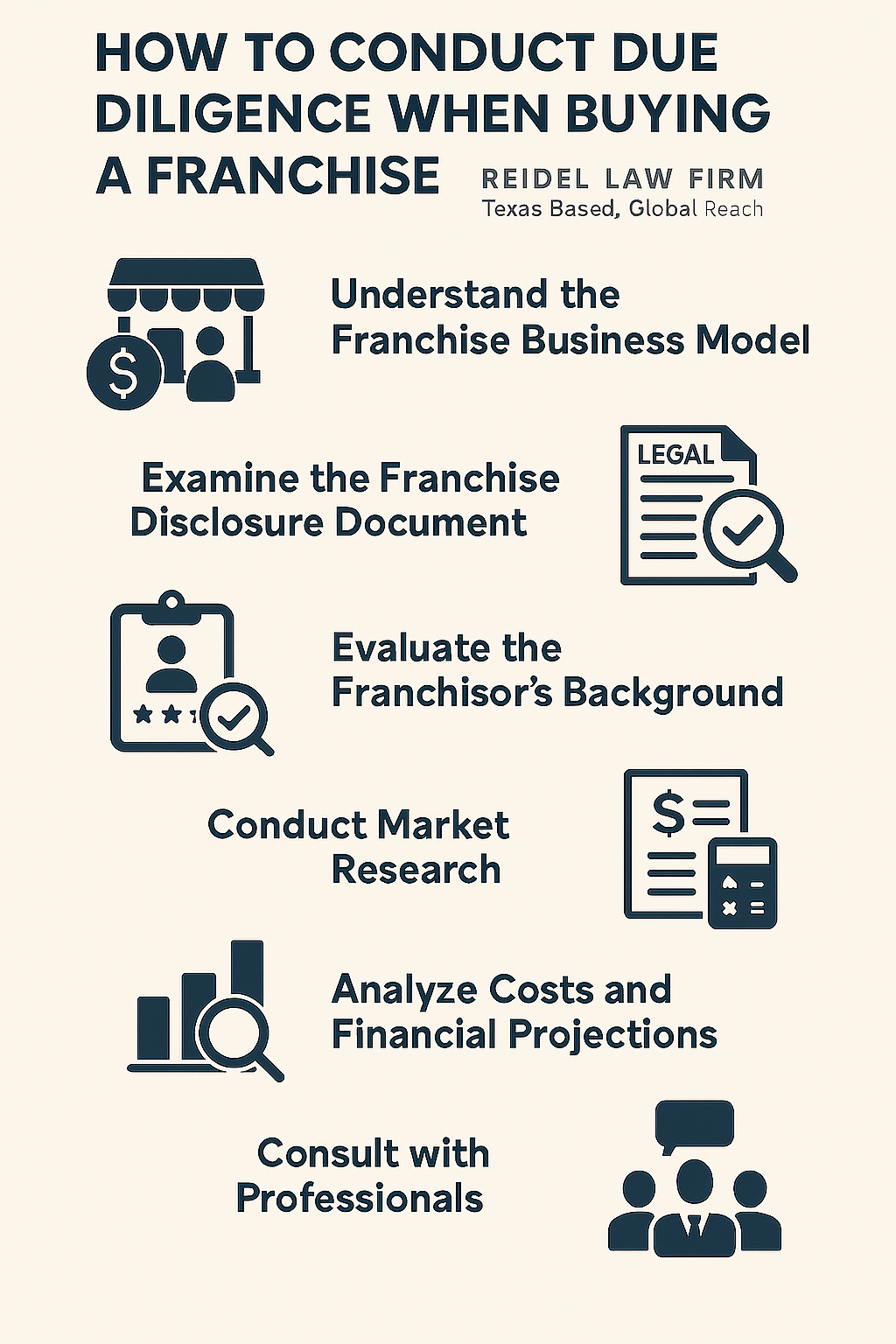

One of the most critical decisions in building a successful portfolio is choosing the right franchises to invest in. The selection process should be rigorous and based on thorough market research and due diligence.

Factors to consider:

- Demand for the product or service

- Competitiveness of the industry

- Reputation and track record of the brand

A careful evaluation of financial projections, franchise disclosure documents, and conversations with current franchisees can provide valuable insights.

Additionally, assess the compatibility between the business and your personal goals, interests, and strengths. A franchise that aligns with your skills and passions will increase the likelihood of long-term satisfaction.

Take your time and weigh all the factors before making a decision, as the right choice is instrumental in building a profitable franchise portfolio.

Conducting Market Research for Franchise Opportunities

Market research is a crucial step in identifying viable opportunities and ensuring the long-term viability of your franchise portfolio.

Steps to begin with:

- Analyze the industry trends, market size, and growth potential of the products or services offered by potential franchises

- Look for gaps in the market that your chosen ventures can fill and assess the competition you will face

-

Conduct a thorough analysis of the target market and demographics in the locations where you plan to operate

Understanding the preferences, buying behaviors, and needs of your target customers will enable you to tailor your business strategies and marketing efforts to effectively capture their attention and generate sales.

Evaluating the Financial Viability of Franchise Options

Carefully review the franchise’s financial disclosures, including the initial investment costs, ongoing fees, and potential return on investment.

Analyze:

- Revenue potential

- Profitability

- Cash flow projections

It is essential to have a clear understanding of all financial obligations and potential risks associated with owning and operating. Consider factors such as the franchise’s historical financial performance, the support provided by the franchisor, and the revenue potential of your chosen location.

Conducting a realistic financial analysis will help you make an informed investment decision and avoid unforeseen financial challenges down the road.

Assessing the Track Record and Reputation of Franchise Brands

Research the franchise’s history, including its growth trajectory, number of successful and failed locations, and the reasons behind any closures or terminations. Establish open communication with current and former franchisees to gain insights into their experiences and satisfaction with the franchisor.

Additionally, assess the franchisor’s support and training programs. Plus their commitment to ongoing innovation and adaptation to industry trends.

A franchise with a strong track record, positive reputation, and a commitment to supporting its franchisees’ success is more likely to be a valuable addition to your portfolio.

Developing a Strategic Plan for Building a Franchise Portfolio

Start by defining your portfolio goals.

Examples:

- Number of franchises you aim to acquire

- Desired geographic locations

-

Industry diversity you want to achieve

Consider your risk tolerance, investment capacity, and management capabilities when formulating your plan. Collectively evaluate the financial requirements of your plan, including the initial investment, ongoing fees, and working capital needs. Create a timeline for each step, considering the time required for franchise selection, due diligence, negotiations, and operations.

Establishing a clear roadmap will guide your decision-making process and ensure that you stay on track toward your portfolio-building goals.

Identifying Target Markets and Demographics for Franchise Expansion

Consider the characteristics of your chosen franchise and conduct market research to identify locations that align with your target customer base.

Evaluate:

- Population density

- Income levels

- Competition

- Growth potential

By identifying target markets and demographics, you can direct your marketing efforts, tailor your products or services to meet specific customer needs, and optimize your franchise’s profitability. A focused approach to expansion will maximize your chances of success and minimize the risk of entering unsuitable markets.

Diversifying Your Franchise Portfolio for Maximum Profitability

By investing in franchises from different industries or sectors, you can mitigate the risks associated with a single industry’s economic fluctuations. Diversification also allows you to tap into multiple revenue streams and cater to different customer segments.

Carefully consider the balance between established franchise brands with proven track records and emerging franchises with high growth potential. Strive for a mix of franchises that complement one another, enabling cross-promotion and shared resources. Diversification safeguards your portfolio against unforeseen challenges and enhances your overall profitability.

Negotiating Franchise Agreements and Contracts

Engage qualified legal counsel to review all documents and ensure that your rights and interests are protected. Negotiate favorable terms such as royalty fees, marketing contributions, and territory protections.

Remember, the franchise agreement will govern the relationship between you and the franchisor. So it is essential to fully understand and negotiate the terms that will impact your business’s profitability and growth potential.

Seek clarity on support and training obligations, renewal and termination rights, and any restrictions on the transfer or sale of franchises.

Managing Risk in Your Franchise Portfolio: Tips and Strategies

Implement strategies to monitor and mitigate risks:

- Conducting regular financial audits

- Staying informed about industry trends

-

Maintaining strong relationships with your franchisors

Additionally, diversify your franchise portfolio to minimize the impact of economic challenges in any specific industry. Ensure that you have sufficient working capital to weather unforeseen circumstances and invest in insurance coverage to protect your assets.

Regularly review your portfolio’s performance, identify areas of weakness, and take proactive measures to address them.

Leveraging Technology to Optimize Franchise Performance

Adopt technological advancements and invest in systems that enhance operational efficiency, streamline communication, and improve customer experience. From point-of-sale systems and inventory management software to CRM solutions and marketing automation tools, technology can revolutionize your franchise operations.

Maximize the potential of online marketing and social media platforms to reach and engage with your target audience. Embrace e-commerce and delivery services when applicable and invest in data analytics to gain insights into customer behavior and preferences.

Staying ahead in the technological landscape will give you a competitive advantage and strengthen your position.

Creating a Marketing and Advertising Plan for Your Franchise Portfolio

A well-executed marketing and advertising plan is essential for promoting your franchise portfolio and driving customer acquisition. Define your brand identity and positioning. Plus ensure consistency across all marketing channels

Develop a comprehensive marketing strategy:

- Digital marketing

- Traditional advertising

- Public relations

- Social media

Collaborate with your franchisors to leverage collective marketing efforts and customize campaigns based on local market needs and demographics. Allocate an appropriate budget for marketing activities and regularly evaluate their effectiveness through analytics and key performance indicators.

Building a Strong Support Network for Your Franchisees

Establish open lines of communication and set clear expectations from the start. Provide comprehensive training programs that equip franchisees with the skills and knowledge necessary to operate their businesses successfully.

Regularly check in with franchisees, offer ongoing support, and address any concerns or challenges they may face. Foster a collaborative environment by facilitating networking opportunities for them to share best practices and learn from one another.

A strong support network will enhance franchisee satisfaction, reduce turnover, and drive the overall success of your franchise portfolio.

Implementing Effective Training and Development Programs for Franchisees

Design comprehensive training programs that cover all aspects of operating the franchise.

Including:

- Operations

- Customer service

- Marketing

-

Financial management

Continuously update and enhance these programs to incorporate emerging trends and best practices. Provide ongoing learning opportunities, such as webinars, workshops, and conferences. And help franchisees stay ahead of industry changes, plus maintain a competitive edge.

Monitoring and Analyzing Key Performance Indicators (KPIs) in Your Portfolio

Define relevant KPIs that align with your portfolio goals and track them consistently. Key metrics to consider include sales growth, customer satisfaction scores, employee turnover, and average revenue per location.

Regularly review KPI reports and analyze the data to identify trends and areas that require attention. Use this valuable information to make informed decisions and implement strategies to optimize performance and profitability.

Expanding Internationally: Opportunities and Challenges in Global Franchising

Assess the feasibility and scalability of your chosen franchises in international markets.

Consider:

- Cultural differences

- Local regulations

- Consumer preferences

Research and understand the legal and regulatory requirements for franchising in each target country. Ensure that you have a robust support system in place to manage overseas operations effectively.

This includes a thorough understanding of local market conditions, hiring local management, and adapting your marketing and operations strategies to suit the specific country or region.

Adapting to Changing Consumer Trends in the Franchise Industry

The franchise industry is constantly evolving, driven by changing consumer trends and preferences. Stay abreast of these trends and adapt your portfolio accordingly. Monitor emerging industries and identify opportunities to diversify and cater to evolving consumer demands.

Keep a pulse on technology advancements and consumer behavior shifts. Embrace innovation and consider incorporating new technologies or services that align with market trends.

By staying agile and responsive to consumer demands, you can retain a competitive edge.

Exit Strategies: Selling or Exiting Your Franchise Portfolio

At some point, you may decide to sell or exit your franchise portfolio. Having a well-defined exit strategy is essential for maximizing your returns and ensuring a smooth transition.

Sections:

- Market conditions

- Value of your portfolio

-

Personal goals and timeline

Engage with experienced professionals, such as business brokers or investment advisors, who can guide you through the selling process and help you achieve the best possible outcome. Prepare your franchise portfolio for sale by ensuring all financial records are in order and by addressing any operational challenges that may deter potential buyers.

Remember, building a franchise portfolio is not a race but a thoughtful and deliberate process. Take your time, seek expert advice, and leverage the valuable resources available to you to make informed decisions and achieve your goals.

With diligence and perseverance, you can create a thriving franchise portfolio that brings financial success to both you and your clients.

Reidel Law Firm Franchise Broker Services

As experts in franchise law, we can help your franchisee clients with FDD reviews.

In addition, our legal team can advise on ways to shore up gaps in the following areas:

- Review personal guaranty and real estate control docs

- Franchisee formation, guidance, and asset protection

- Franchise operating compliance audit and coaching

By effectively managing risk and maximizing opportunities for businesses we answer the needs of our clients wherever and whenever they arise.

Call Reidel Law Firm today at (832) 510-3292 or fill out our contact form. And see how our advice can provide a solid foundation for your brokerage.