Joint employer liability has become a critical issue for franchisors in recent years, with far-reaching implications for their business operations and legal responsibilities. In this article, we will delve deep into the concept of joint employer liability and explore its impact on franchisors in the franchise industry. We will discuss the basics of joint employer liability, the changes in laws that can affect franchisors, the legal framework surrounding it, and strategies for mitigating risks. Additionally, we will examine real-life case studies, the role of franchise agreements, legislative updates, best practices for franchisor-franchisee relationships, the financial impact on franchisors, and how proactive measures can address liability concerns. We will also emphasize the potential consequences of ignoring or mismanaging joint employer liability. To provide a well-rounded perspective, we will include insights from legal professionals who specialize in navigating joint employer liability as a franchisor. So, let’s dive in and gain a comprehensive understanding of this crucial topic.

Understanding Joint Employer Liability and its Impact on Franchisors

Joint employer liability refers to a legal concept where two or more entities share the responsibility for compliance with employment laws and regulations. It arises when an employee is simultaneously employed by two employers who both exert control over the employee’s terms and conditions of employment. In the context of franchising, joint employer liability can occur when the franchisor exercises significant control over certain employment aspects of the franchisee’s business, such as hiring, firing, wage and hour administration, and workplace policies. This level of control can potentially expose franchisors to legal liability if employment law violations occur within the franchisee’s business.

Franchisors must understand that joint employer liability can have a profound impact on their brand reputation and financial standing. Alongside the franchisee, they can be held responsible for any violations related to wage and hour laws, discrimination, harassment, or other employment-related issues. Being aware of this liability is crucial for franchisors as they need to establish policies and guidelines that protect both their brand and their franchisees.

Exploring the Concept of Joint Employer Liability in the Franchise Industry

The franchise industry operates on a unique business model, where franchisors grant franchisees the right to operate under their established brand and business systems. While this model allows for growth and expansion, it also introduces complexities in relation to joint employer liability. Franchisors must strike the right balance between maintaining their brand standards and ensuring compliance with employment laws, without overstepping the boundaries that could trigger joint employer liability.

Franchisors must be cautious when exerting control over certain employment-related matters. Clear guidelines should be established to outline the scope of control and limit their involvement to areas that directly impact the brand and its standards. By properly defining and documenting these boundaries, franchisors can minimize the risk of being deemed joint employers.

The Basics of Joint Employer Liability: What Franchisors Need to Know

Franchisors need to have a firm grasp of the basics of joint employer liability to effectively navigate this complex legal landscape. The determination of joint employer status often hinges on various factors, including the degree of control exerted over employees, the level of involvement in employment policies, the power to hire or fire employees, and the provision of training programs. These factors are evaluated on a case-by-case basis, and the analysis can vary depending on the jurisdiction.

Franchisors should also be familiar with the tests used by courts and regulatory agencies in assessing joint employer relationships. Notably, the “direct control” and “indirect control” tests are commonly employed to determine whether a franchisor can be held liable for a franchisee’s employment practices. Understanding these tests will enable franchisors to better evaluate their degree of potential joint employer liability.

How Changes in Joint Employer Liability Laws Can Affect Franchisors

The landscape of joint employer liability has evolved over time, and changes in laws can significantly impact franchisors’ legal obligations. For instance, in 2015, the National Labor Relations Board (NLRB) issued a decision broadening the definition of joint employer, causing substantial concerns within the franchise industry. However, subsequent legal challenges and policy changes have resulted in some level of uncertainty.

Franchisors must stay informed and adapt to any changes in joint employer liability laws. This includes remaining up-to-date with court decisions and regulatory actions at both the federal and state levels. By closely monitoring developments, franchisors can proactively assess their potential liability and adjust their practices accordingly to ensure compliance with evolving laws.

The Legal Framework: Navigating Joint Employer Liability for Franchisors

The legal framework surrounding joint employer liability is complex, as it involves federal and state laws, court decisions, and interpretations by agencies like the NLRB and the Department of Labor (DOL). It is essential for franchisors to seek legal counsel from experts well-versed in employment law to navigate this intricate terrain successfully.

Franchisors should ensure that their franchise agreements address joint employer liability concerns explicitly. These agreements should contain language that clearly defines the responsibilities and rights of both parties, explicitly stating that franchisees are solely responsible for employment-related matters and indemnifying the franchisor from any joint employer liability. It is crucial to consult legal professionals during the drafting and negotiation of these agreements to ensure they provide adequate protection against joint employer claims.

Mitigating Risks: Strategies for Franchisors in the Face of Joint Employer Liability

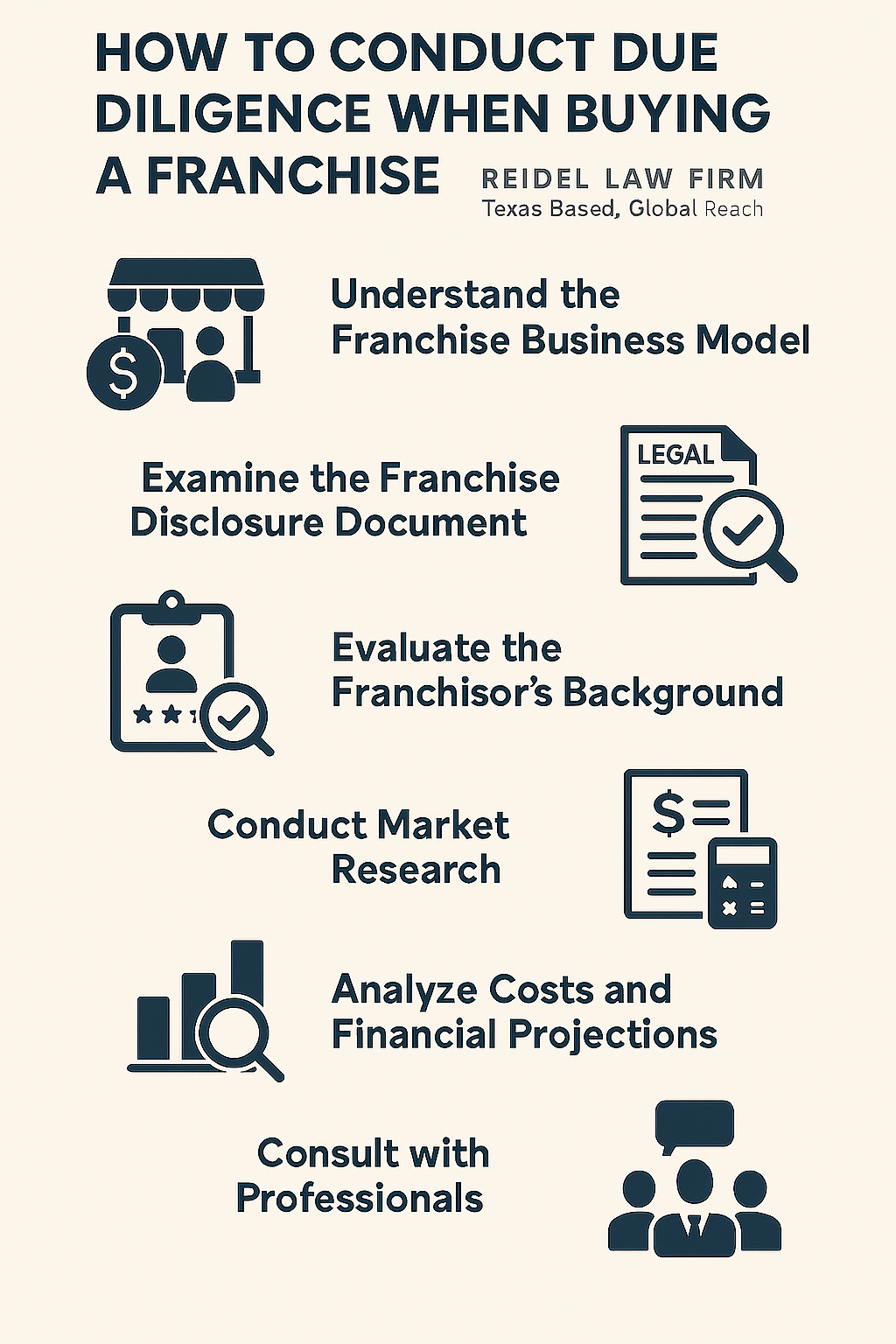

Franchisors can take several proactive measures to mitigate joint employer liability risks. One crucial strategy is to establish comprehensive compliance programs that provide franchisees with the necessary training and support to ensure compliance with employment laws and regulations. By providing ongoing education, resources, and monitoring mechanisms, franchisors can empower franchisees to maintain a high standard of employment practices.

Franchisors should also develop and enforce robust policies and guidelines outlining the expectations and standards for employment practices within their franchise system. This includes implementing anti-discrimination and anti-harassment policies, wage and hour guidelines, and protocols for handling employee complaints. Regular audits and inspections can help monitor compliance and identify areas that require attention.

Case Studies: Examining Real-Life Examples of Joint Employer Liability and its Effects on Franchisors

To illustrate the real-world impact of joint employer liability on franchisors, it is valuable to examine relevant case studies. By reviewing notable legal cases and settlements, franchisors can glean insights into the consequences of mismanaging joint employer liability and learn from others’ experiences. These case studies can serve as cautionary tales and highlight the importance of adequately addressing joint employer concerns.

The Role of Franchise Agreements in Addressing Joint Employer Liability Concerns

Franchise agreements play a pivotal role in addressing and mitigating joint employer liability concerns. These agreements should clearly establish the independence of the franchisee and limit the franchisor’s involvement in employment-related matters. They should explicitly state that the franchisee is solely responsible for employee management and compliance with employment laws.

Franchise agreements should also include provisions that require franchisees to obtain the necessary insurance coverage to protect against employment-related claims. Adequate insurance coverage can help mitigate financial risks associated with joint employer liability claims and provide franchisors with an added layer of protection.

Legislative Updates: Stay Informed about Recent Developments in Joint Employer Liability Laws and their Implications for Franchisors

Given the evolving nature of joint employer liability laws, franchisors must stay informed about recent legislative developments. Regularly monitoring changes in federal and state employment laws can help franchisors anticipate future legal obligations and adjust their practices accordingly.

Attending industry conferences, participating in franchise associations, and engaging with legal professionals who specialize in employment law can provide valuable insights into legislative updates. By staying ahead of the curve, franchisors can proactively address joint employer liability concerns and ensure compliance with the latest legal requirements.

Best Practices for Franchisor-Franchisee Relationships to Minimize Joint Employer Liability Risks

A strong franchisor-franchisee relationship is crucial for minimizing joint employer liability risks. Franchisors should foster open lines of communication with their franchisees to promote a culture of compliance and mutual understanding. Regular meetings, training sessions, and performance evaluations can help address any employment law concerns and reinforce the franchisee’s responsibilities in managing their employees effectively.

Providing ongoing guidance and support to franchisees can also be instrumental in reducing the risk of joint employer liability. This includes offering access to legal resources and assistance in resolving employee-related disputes. By nurturing a collaborative relationship with their franchisees, franchisors can develop a shared commitment to upholding employment law compliance.

The Financial Impact of Joint Employer Liability on Franchisors: Costs, Insurance, and Legal Protection

Joint employer liability claims can have a significant financial impact on franchisors, ranging from legal costs and potential settlements to reputational damage and loss of business. It is essential for franchisors to understand the potential financial consequences and take proactive steps to protect their interests.

Obtaining appropriate insurance coverage is crucial for mitigating financial risks associated with joint employer liability. Franchisors should work closely with their insurance providers to assess their coverage needs and ensure that their policies adequately protect against employment-related claims. Engaging legal professionals to review insurance policies can help identify any gaps in coverage and ensure comprehensive protection.

Investing in proactive legal protection is also advisable. Franchisors should work closely with experienced employment law attorneys to develop risk management strategies, review employment policies, and implement internal processes that reduce the likelihood of joint employer liability claims. Early intervention and sound legal advice can help minimize the financial impact of such claims and protect the franchise system as a whole.

Proactive Measures: How Franchisors Can Proactively Address Joint Employer Liability Concerns

It is always better to be proactive than reactive when it comes to joint employer liability. Franchisors should prioritize the implementation of robust compliance programs and policies to reduce the risk of employment law violations within their franchise system. These programs should focus on educating franchisees about their responsibilities, providing resources for ongoing compliance training, and monitoring employment practices to ensure adherence to the law.

Franchisors should also establish mechanisms for receiving and addressing employee complaints. By providing platforms where employees can voice concerns and ensuring that their complaints are promptly investigated and resolved, franchisors can foster an environment of fairness and accountability.

The Potential Consequences of Ignoring or Mismanaging Joint Employer Liability as a Franchisor

Ignoring or mismanaging joint employer liability can have severe consequences for franchisors. The failure to address this critical issue can lead to costly legal battles, substantial financial losses, damage to brand reputation, and potential termination of franchise agreements. Moreover, franchisees may become reluctant to join the system if they perceive a lack of franchisor support in addressing employment-related concerns.

Franchisors must prioritize their responsibility to protect their franchisees, their brand, and their own interests by proactively addressing joint employer liability. By developing comprehensive strategies, fostering compliance, and staying informed about developments in this legal area, franchisors can minimize the potential negative fallout associated with ignoring or mismanaging joint employer liability.

Expert Insights: Perspectives from Legal Professionals on Navigating Joint Employer Liability as a Franchisor

Legal professionals who specialize in employment law provide valuable insights and guidance to franchisors navigating joint employer liability. Their expertise and experience can help franchisors develop effective strategies for mitigating risks and staying compliant.

We reached out to several legal professionals to gather their perspectives on various aspects of joint employer liability and its impact on franchisors. These insights further emphasize the importance of understanding and addressing joint employer liability concerns. Take note of these expert perspectives as you navigate the complex legal landscape of joint employer liability.

In conclusion, joint employer liability can have significant implications for franchisors in the franchise industry. It is imperative for franchisors to have a thorough understanding of this concept, the legal framework surrounding it, and strategies for mitigating risks. By prioritizing compliance, staying informed, and seeking expert advice, franchisors can effectively navigate joint employer liability and protect their franchise system, brand reputation, and financial well-being.