Franchising a business can be an appealing option for entrepreneurs who want to start their own venture while benefiting from an established brand and proven business model. However, it’s crucial to have a clear understanding of the costs involved in franchising before making a financial commitment. In this article, we will delve into the various aspects of costs associated with franchising, from franchise fees and initial investment to hidden expenses and long-term financial planning.

Understanding Franchise Fees: What You Need to Know

Franchise fees are typically the upfront costs that a franchisee pays to the franchisor for the right to operate under their brand name. These fees can vary widely depending on the franchisor, the industry, and the level of support and training provided. It’s vital for aspiring franchisees to thoroughly review the franchise disclosure document to understand what the franchise fees cover and whether they are reasonable considering the value provided by the franchisor.

Franchise fees often include the initial training and support provided by the franchisor, such as assistance with site selection, marketing materials, and operational guidance. It’s essential to consider these factors when evaluating the franchise fee as they can significantly impact the success and profitability of your business. Additionally, some franchisors may require ongoing royalty fees or advertising fees, which we will discuss in more detail later in this article.

Initial Investment: Breaking Down the Cost of Franchising

Aside from the upfront franchise fee, franchisees must also budget for various other costs associated with starting a franchise. These costs can include leasehold improvements, equipment and inventory purchases, signage, licenses and permits, and initial marketing expenses. It’s important to thoroughly research and estimate all potential initial investment costs to avoid any surprises and ensure you have sufficient capital to launch your franchise successfully.

One crucial aspect of the initial investment is understanding the working capital requirements. Opening a franchise business often requires funds to cover operational expenses, such as rent, utilities, staffing, and marketing, until the business becomes profitable. Franchisees should factor in a sufficient amount of working capital to sustain their business during the initial months or even years of operation.

Exploring Royalty and Advertising Fees in Franchising

In addition to the initial franchise fee, many franchisors require ongoing royalty fees. These fees are typically a percentage of the franchisee’s gross sales and are paid to the franchisor on a regular basis. Royalty fees are intended to compensate the franchisor for ongoing support, brand promotion, and the use of intellectual property.

Advertising fees are another common expense in franchising. Franchise systems often pool advertising contributions from franchisees to fund national or regional marketing campaigns to enhance brand awareness and drive customer traffic. Franchisees should carefully review the franchisor’s advertising policies and ensure transparency in how these funds are utilized and allocated.

Hidden Costs: Uncovering Additional Expenses in Franchising

When evaluating the costs involved in franchising, it’s crucial to consider potential hidden or unforeseen expenses. These costs can include rent escalations, leasehold maintenance and repairs, equipment replacement, technology upgrades, insurance premiums, and legal fees. Conducting thorough due diligence and seeking professional advice can help identify and estimate these hidden costs accurately.

Another often overlooked cost is the potential for additional expenses required by the franchisor, such as mandatory training programs, software licensing fees, or ongoing certification requirements. These expenses can significantly impact the overall financial commitment of a franchisee and should be carefully assessed and budgeted for.

Financial Projections: Estimating Your Return on Investment (ROI)

Before committing to a franchise, it’s essential to create comprehensive financial projections to estimate the potential return on investment (ROI). This involves determining the expected sales volume, gross profit margin, and operating expenses. Franchisees should consider factors such as market demand, local competition, and the franchisor’s track record when crafting their financial projections.

Financial projections should also account for contingencies, such as economic downturns or unexpected expenses. By estimating the ROI, franchisees can assess the feasibility of the investment and make informed decisions about whether the potential financial returns align with their personal goals and expectations.

Financing Options for Franchisees: How to Fund Your Business Venture

Franchising a business often requires significant upfront capital, and many prospective franchisees seek financing options to fund their venture. There are several avenues to explore, including traditional bank loans, Small Business Administration (SBA) loans, financing through the franchisor, or even private investors.

When considering financing options, it’s essential to assess the interest rates, repayment terms, and collateral requirements. Working closely with a financial advisor or securing pre-approved financing can help streamline the process and increase the chances of obtaining the necessary funds to launch the franchise successfully.

Negotiating Terms and Conditions: Finding the Best Deal for Your Franchise

While most franchisors have set franchise fees and royalty rates, there may be room for negotiation on certain terms and conditions. Franchisees should thoroughly review the franchise agreement and seek legal counsel to identify clauses that may be negotiable or require clarification.

Common areas for negotiation include the duration of the agreement, renewal options, territorial rights, non-compete clauses, and supplier arrangements. By engaging in open and constructive discussions with the franchisor, franchisees can work towards a mutually beneficial agreement that aligns with their goals and expectations.

Legal Costs and Documentation: Navigating the Franchise Agreement Process

Franchising involves legal contracts and documentation, and franchisees should anticipate associated legal costs. It’s essential to engage a qualified franchise attorney to review and negotiate the franchise agreement, disclosure document, and any other contractual documentation involved.

Legal fees can vary depending on the complexity of the negotiation and the scope of legal services required. It’s crucial not to cut corners in this area, as a thorough legal review can help protect your interests and ensure compliance with franchising regulations.

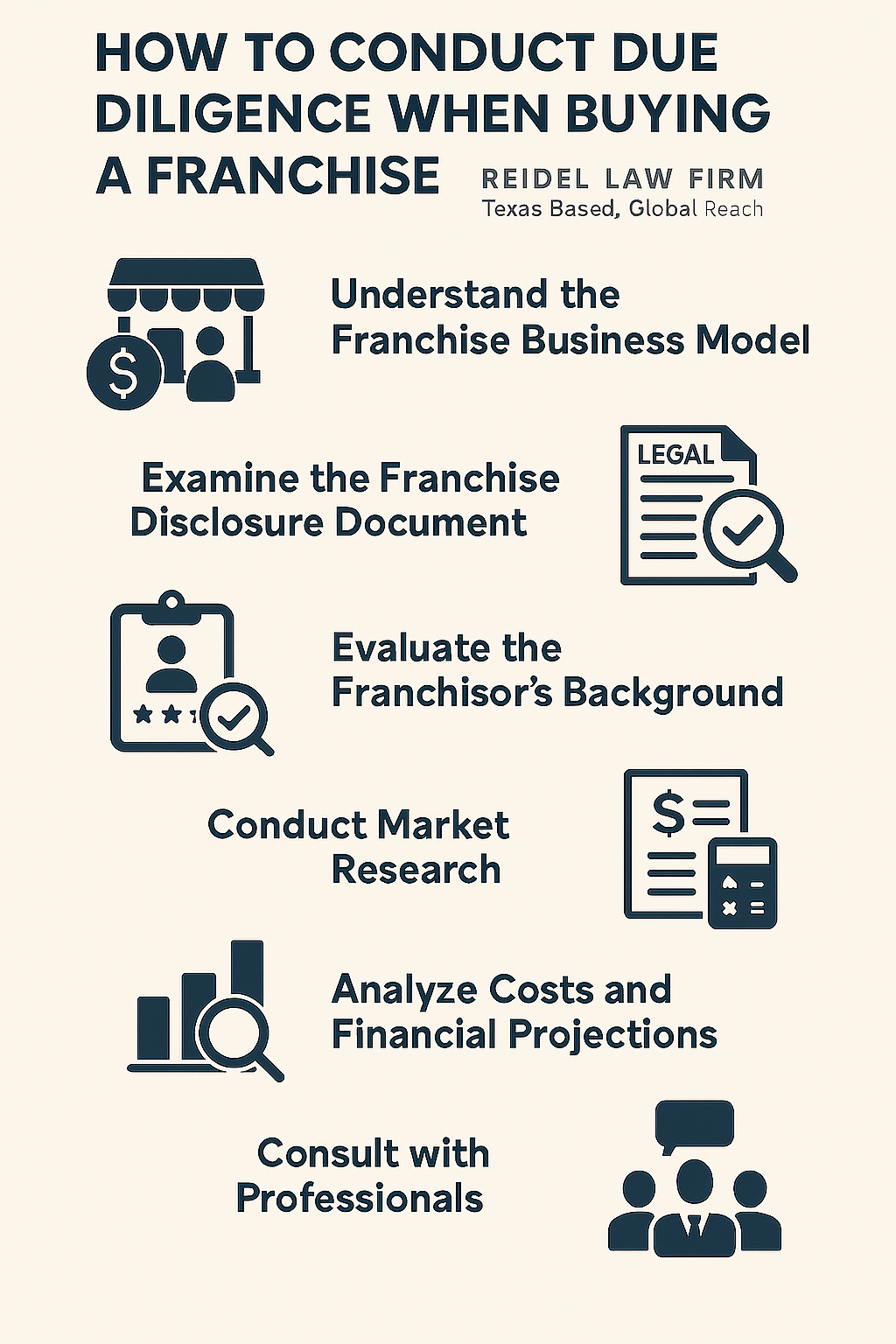

The Importance of Due Diligence: Avoiding Costly Mistakes in Franchising

Performing due diligence is a critical step before committing to a franchise opportunity. Thoroughly researching the franchisor, its financial health, and the success of its existing franchisees is crucial to gain insights into the potential risks and rewards of the investment.

Franchisees should consider speaking with current and former franchisees to understand their experiences and satisfaction with the franchisor. Additionally, reviewing the franchisor’s financial statements and required disclosures, such as the Franchise Disclosure Document (FDD), can provide valuable insights into the company’s track record and future prospects.

Calculating the Total Cost of Ownership in a Franchise Business

Calculating the total cost of ownership involves looking beyond the initial investment and considering all ongoing expenses involved in running a franchise business. This includes regular expenses such as rent, utilities, payroll, inventory, marketing, insurance, and taxes.

By understanding the total cost of ownership, franchisees can make informed decisions regarding pricing, profit margins, and cost-saving measures while ensuring long-term financial viability.

Budgeting for Operations and Working Capital in a Franchise Model

Effective budgeting is crucial to ensure the smooth operation of a franchise business. Developing an operational budget involves estimating all regular expenses and allocating resources accordingly. This includes fixed costs such as rent and utilities, variable expenses like inventory and marketing, and potential contingencies.

Franchisees should also allocate sufficient working capital to cover unexpected circumstances, such as equipment breakdowns or market fluctuations. Establishing an emergency fund can provide peace of mind and help navigate any financial hurdles that may arise.

Understanding the Impact of Location Costs on Franchise Success

The location of a franchise can significantly impact its success. Franchisees must consider the costs associated with securing a prime location, such as lease or purchase costs, tenant improvements, and ongoing rent or mortgage payments. Additionally, franchisees should assess factors such as visibility, foot traffic, and competition when selecting a location.

While desirable locations may come with higher upfront costs, they can also provide a higher customer base and revenue potential. Thorough market research and demographic analysis can help identify optimal locations and justify the associated expenses.

Marketing and Branding Expenses: Promoting Your Franchise to Customers

Marketing and branding are crucial components of running a successful franchise. Franchisees are typically responsible for local marketing efforts to attract customers and promote their business within their designated territory.

Marketing expenses can include digital marketing campaigns, print advertisements, social media management, signage, and promotional materials. Allocating a reasonable budget for marketing activities and adopting effective marketing strategies can help increase brand awareness and drive customer traffic, ultimately contributing to the franchise’s success.

Training and Support Costs: Investing in Success for You and Your Team

Most franchisors provide training and support to help franchisees understand and implement their business model successfully. Franchisees should consider the costs associated with initial and ongoing training programs, which can include travel expenses, training materials, and potentially lost revenue during training periods.

Investing in continuous education and training for both yourself and your team members is essential to maintain the high standards set by the franchisor and provide exceptional customer service. Budgeting for these costs and evaluating the value they bring to your business is crucial for long-term success.

Insurance and Risk Management Expenses in a Franchise Business Model

Insurance is an essential aspect of risk management for any business, including franchises. Franchisees should carefully review the franchisor’s insurance requirements and consider additional coverage based on their specific business needs.

The cost of insurance can vary depending on factors such as the type of franchise, location, industry risks, and coverage limits. However, adequate insurance coverage is crucial to protect the franchisee’s investment and mitigate potential liabilities.

Tax Implications of Owning a Franchise: What You Need to Consider

Running a franchise business has various tax implications, and franchisees should familiarize themselves with their tax obligations. It’s highly recommended to work with an experienced tax advisor or accountant who specializes in franchise businesses to ensure compliance with tax laws and optimize tax planning strategies.

Franchisees should consider factors such as income tax, payroll tax, sales tax, and any applicable franchise or local taxes. By proactively managing tax obligations, franchisees can potentially minimize their tax liability and optimize their financial performance.

Evaluating the Potential Return on Investment for Different Franchise Opportunities

When considering various franchise opportunities, it’s crucial to evaluate the potential return on investment (ROI). Evaluating factors such as initial investment costs, ongoing expenses, and market potential can help assess the financial viability of each opportunity.

Franchisees should conduct extensive research and perform detailed financial analysis for each opportunity, comparing estimated revenues, expenses, and required investment. Understanding the potential ROI is crucial for making an informed decision that aligns with your financial goals and expectations.

Comparing Start-Up Costs for Different Types of Franchises

Start-up costs can vary significantly depending on the type of franchise and industry. Franchisees should carefully evaluate and compare start-up costs among different franchise opportunities, considering factors such as the initial franchise fee, equipment and inventory expenses, lease or purchase costs, marketing requirements, and ongoing royalty or advertising fees.

By comparing start-up costs, franchisees can gain insights into the level of investment required for each franchise opportunity and determine which opportunity aligns best with their available capital and financial resources.

Long-Term Financial Planning for Sustainable Growth in a Franchise Business

Achieving sustainable financial growth is a crucial objective for any franchise business. Long-term financial planning involves setting realistic revenue and profitability targets, managing costs and expenses, and continuously evaluating market conditions and potential growth opportunities.

Franchisees should regularly review and adjust their financial plans to adapt to evolving market trends or changing circumstances. Seeking advice from financial professionals can provide valuable insights and help navigate the complexities of long-term financial planning in the franchising industry.

In conclusion, franchising a business entails various costs that aspiring franchisees should carefully consider. From the initial franchise fees to ongoing expenses, it’s essential to conduct thorough research, perform financial projections, and seek professional advice to make a well-informed decision. Understanding the costs involved in franchising a business can help set realistic expectations, ensure sufficient funding, and pave the way for long-term success.