Franchise businesses have become a popular entrepreneurial opportunity for individuals looking to be their own boss. However, the business model comes with a set of financial assurance obligations that franchisees must understand and address. In this comprehensive article, we will delve into the various aspects of franchise financial assurance obligations, examine their importance, explore the legal framework surrounding them, and provide strategies for effectively managing these responsibilities. By gaining a deeper understanding of franchise financial assurance, franchisees can ensure their financial stability and long-term success.

Understanding Franchise Financial Assurance Obligations

Financial assurance obligations, in the context of franchising, refer to the capital, assets, or guarantees that franchisees are required to provide as a means of demonstrating their financial stability to the franchisor. These obligations serve as a safety net for both the franchisor and the franchisee and help ensure that both parties can fulfill their contractual obligations.

Franchisors typically require financial assurance as a means of protecting their brand and reputation. It provides them with confidence that their franchisees are financially capable of running a successful business and meeting their financial obligations. Franchisees, on the other hand, benefit from financial assurance requirements as they instill discipline and provide a framework for financial management.

The Importance of Financial Assurance in Franchising

Financial assurance plays a crucial role in franchising as it safeguards the interests of both the franchisor and the franchisee. For franchisors, it is essential to ensure that their brand is protected and that franchisees are financially capable of operating their businesses effectively. By requiring financial assurance, franchisors can mitigate the risk of franchisees running into financial difficulties and potentially damaging the brand’s reputation.

For franchisees, financial assurance requirements provide an opportunity to demonstrate their financial stability, credibility, and commitment to the franchise. It acts as a mechanism to assure the franchisor that they have the necessary resources to run a successful business and fulfill their obligations, including paying royalties, marketing fees, and other financial commitments.

Exploring the Legal Framework of Franchise Financial Assurance

The legal framework surrounding franchise financial assurance obligations may vary depending on the jurisdiction and the terms of the franchise agreement. Franchisors and franchisees should consult legal professionals specializing in franchise law to ensure compliance with applicable regulations and to understand the specific financial assurance requirements and obligations.

Franchise regulations often outline the minimum financial resources or assets franchisees must possess to enter into a franchise agreement successfully. These regulations aim to protect franchisees from entering into agreements they may not have the financial means to fulfill and provide a level playing field for all parties involved.

In addition to franchise-specific laws, other applicable laws and regulations, such as securities laws, may come into play, particularly if the financial assurance obligations involve raising capital or issuing securities.

Different Types of Financial Assurance Obligations for Franchisees

Franchisors may impose various types of financial assurance obligations on franchisees, depending on the nature of the business and industry. Some common types of financial assurance obligations include:

1. Cash Deposits: Franchisees may be required to provide a cash deposit as security. This deposit is often held by the franchisor and may be used to cover any potential defaults or damages incurred during the term of the franchise agreement.

2. Letters of Credit: Franchisees may be required to obtain a letter of credit from a financial institution, which guarantees payment to the franchisor in case of default or non-compliance.

3. Personal Guarantees: Franchisees may need to provide personal guarantees, where they pledge their personal assets or income as collateral, ensuring the franchisor’s protection in case of financial difficulties.

4. Insurance Coverage: Franchisors may require franchisees to maintain specific insurance coverage, such as general liability insurance or property insurance, to protect against potential risks or liabilities associated with running the franchise.

Compliance and Reporting Requirements for Franchise Financial Assurance

Compliance with franchise financial assurance obligations is of utmost importance. Franchisees must understand and adhere to the reporting and disclosure requirements outlined in the franchise agreement. These requirements often include regular financial reporting, such as providing audited or reviewed financial statements, tax returns, and other relevant financial information.

Clear communication and transparency between franchisors and franchisees are critical to ensure compliance with financial assurance obligations. Franchisees should maintain accurate financial records, promptly report any material changes in their financial situation, and seek guidance from their franchisor or financial professionals if they encounter any challenges.

Evaluating the Risks and Benefits of Franchise Financial Assurance

Franchise financial assurance obligations come with inherent risks and benefits that franchisees must evaluate before entering into a franchise agreement. On the one hand, financial assurance requirements may increase the initial investment and ongoing costs for franchisees. However, they also provide a level of stability, support, and brand recognition that can help franchisees succeed.

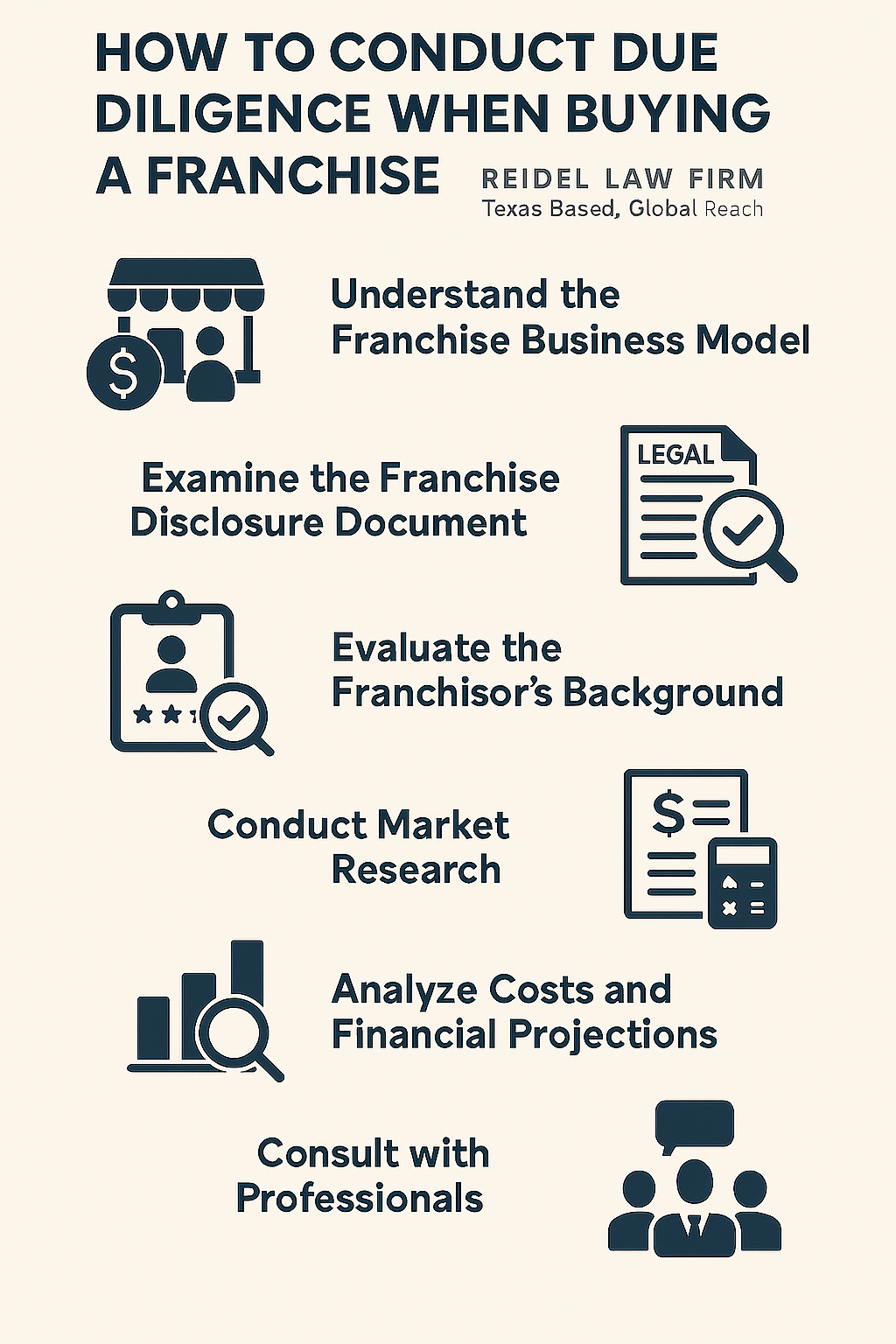

Franchisees should carefully consider the potential advantages and disadvantages of financial assurance obligations and assess their own financial capabilities and risk tolerance before committing to a franchise. Conducting thorough due diligence and seeking advice from franchise consultants and financial professionals can assist franchisees in making informed decisions.

Common Challenges Faced by Franchisees in Meeting Financial Assurance Obligations

Meeting financial assurance obligations can be challenging for franchisees, especially those who are new to business ownership or lack experience in financial management. Some common challenges include:

1. Initial Capital Requirements: The upfront costs associated with meeting financial assurance obligations, such as cash deposits or securing letters of credit, can strain a franchisee’s financial resources.

2. Cash Flow Management: Maintenance of positive cash flow while simultaneously meeting financial obligations, such as royalties and marketing fees, can pose a challenge for franchisees, particularly during the early stages of the business.

3. Economic Factors: Economic downturns or unexpected market conditions can impact a franchisee’s ability to generate revenue and fulfill their financial assurance obligations.

4. Seasonal Fluctuations: Franchisees operating in industries with seasonal fluctuations may face challenges in managing their financial obligations during slow periods.

Strategies for Effectively Managing Franchise Financial Assurance Responsibilities

Successfully managing franchise financial assurance responsibilities requires careful planning and proactive financial management. Here are some strategies that franchisees can adopt:

1. Develop a Comprehensive Business Plan: A well-defined business plan that includes financial projections, cash flow management strategies, and contingency planning can help franchisees navigate the financial challenges they may face.

2. Seek Professional Advice: Engaging competent financial advisors and accountants specializing in franchising can provide valuable guidance and ensure compliance with financial reporting requirements.

3. Maintain Accurate Financial Records: Accurate bookkeeping and diligent record-keeping are essential for monitoring and reporting financial information to the franchisor. This can help franchisees stay on top of their financial obligations and make informed business decisions.

4. Implement Cost Management Strategies: Careful cost management, including negotiating vendor contracts, monitoring expenses, and implementing efficient operational processes, can help franchisees optimize their financial resources and improve profitability.

Tips for Negotiating Financial Assurance Terms in Franchise Agreements

Franchisees should approach the negotiation of financial assurance terms in franchise agreements with careful consideration. Here are some tips to keep in mind during the negotiation process:

1. Understand the Franchisor’s Perspective: Understanding the franchisor’s concerns and reasons behind the financial assurance requirements can help franchisees propose reasonable alternatives or negotiate terms that align with both parties’ interests.

2. Seek Legal Counsel: Consulting a franchise attorney to review the franchise agreement and negotiate financial assurance terms can ensure franchisees have a thorough understanding of their obligations and can advocate for their best interests.

3. Explore Financing Options: Franchisees may consider financing options to meet financial assurance obligations, such as securing loans or seeking financial assistance from third-party lenders. Exploring these options can help ease the financial burden and provide flexibility.

Best Practices for Maintaining Financial Stability as a Franchisee

Maintaining financial stability is crucial for franchisees to effectively meet their financial assurance obligations and ensure the long-term success of their business. Here are some best practices to consider:

1. Budgeting and Cash Flow Planning: Developing a detailed budget and regularly monitoring cash flow can help franchisees anticipate and manage their financial obligations effectively.

2. Building Reserves: Building reserves or contingency funds can provide a buffer in case of unexpected expenses or temporary decreases in revenue.

3. Reviewing and Updating Financial Plans: Regularly reviewing and updating financial plans and projections can help franchisees adapt to changing market conditions and proactively address potential financial challenges.

4. Continuous Learning and Education: Staying informed about financial management best practices and industry-specific trends can empower franchisees to make informed financial decisions and effectively manage their obligations.

Understanding the Role of Audits in Monitoring Franchisee’s Financial Compliance

As part of the financial assurance monitoring process, franchisors may conduct audits to assess franchisees’ financial compliance. Audits serve as a means to verify the accuracy and completeness of franchisees’ financial reporting and ensure compliance with financial assurance obligations and other contractual terms.

During an audit, franchisors may review financial statements, bank records, sales reports, and other relevant financial documentation. Audit findings can provide insights into a franchisee’s financial performance, identify areas for improvement, and help ensure that the franchisee remains in compliance with their financial assurance obligations.

How to Prepare and Present Financial Statements for Franchisee Review

Preparing and presenting accurate and reliable financial statements is vital for franchisees when undergoing financial reviews or audits by the franchisor. Here are some key steps to consider:

1. Engage a Qualified Accountant: Working with a qualified accountant who understands the specific reporting requirements for franchise businesses can ensure the financial statements are prepared correctly.

2. Adhere to Reporting Standards: Follow generally accepted accounting principles (GAAP) or other applicable reporting standards when preparing financial statements. This ensures consistency, comparability, and reliability of the financial information.

3. Include Required Information: Financial statements should include essential components such as balance sheets, income statements, cash flow statements, and footnotes that provide additional information and context.

4. Review and Verify Accuracy: Conduct a thorough review of the financial statements to ensure accuracy, completeness, and adherence to reporting standards. Verify that all supporting documentation is accurate and readily available for further review or audit.

The Impact of Non-Compliance with Financial Assurance Obligations on Franchise Agreements

Non-compliance with financial assurance obligations can have serious consequences for franchisees. Franchisors typically have contractual rights to take corrective actions, impose penalties, or in extreme cases, terminate the franchise agreement.

When franchisees fail to meet their financial obligations, franchisors may exercise their rights to access the financial assurance provided, such as cash deposits or guarantees. Additionally, non-compliance can damage the relationship between the franchisor and the franchisee, making it difficult to resolve disputes and potentially impacting the franchisee’s future prospects in the industry.

Case Studies: Successful Implementation of Franchise Financial Assurance Systems

Examining case studies of successful implementation of franchise financial assurance systems can provide valuable insights into best practices and strategies. Such case studies highlight real-world examples of franchisees effectively managing their financial obligations and achieving financial success.

These case studies often demonstrate the importance of proper financial planning, compliance with reporting requirements, and proactive management of financial obligations. They can serve as a source of inspiration and education for franchisees looking to navigate their own financial assurance journey.

Examining the Relationship Between Franchisors and Lenders in Meeting Financial Obligations

The relationship between franchisors and lenders plays a significant role in meeting financial obligations. Franchisees may often require financing from lenders to fulfill their financial assurance obligations, such as securing loans for cash deposits or obtaining letters of credit.

Franchisors and lenders may establish partnerships or have specific agreements to facilitate franchisees’ access to financing. These relationships are crucial as they provide franchisees with the necessary financial resources to meet their obligations while maintaining a strong financial position.

Assessing the Impact of Economic Factors on Meeting Franchise Financial Assurances

Franchisees must be aware of the potential impact of economic factors on meeting their financial assurance obligations. Economic conditions, such as recessions, market fluctuations, or industry-specific trends, can significantly influence a franchisee’s ability to generate revenue and meet financial obligations.

Understanding the potential impact of economic factors and monitoring industry trends can help franchisees proactively adapt their financial strategies, adjust their operations, and develop contingency plans to navigate through challenging economic times.

The Future of Franchise Financial Assurance: Trends and Innovations

The world of franchising and financial assurance is ever-evolving, driven by technological advancements, regulatory changes, and market demands. Emerging trends and innovations in franchise financial assurance include:

1. Digitization of Financial Reporting: Leveraging technology to streamline financial reporting processes, improve data accuracy, and enhance communication between franchisors and franchisees.

2. Enhanced Risk Management Tools: Utilizing advanced risk management tools to monitor financial performance, identify potential risks, and proactively address financial challenges.

3. Integration of Artificial Intelligence: Harnessing the power of artificial intelligence to analyze financial data, identify trends, and provide actionable insights for franchisees and franchisors.

4. Increased Transparency and Disclosure: Striving for greater transparency in financial reporting, sharing financial information, and promoting open communication between franchisors and franchisees.

Resources and Support for Franchisees in Navigating Financial Assurance Requirements

Franchisees can benefit greatly from utilizing available resources and seeking support to navigate through their financial assurance obligations. Here are essential resources and support networks that can assist franchisees:

1. Franchise Associations: Joining franchise associations and networks can provide access to educational materials, industry-specific resources, and networking opportunities with experienced