In the world of franchising, choosing the right legal structure for your franchise is a critical decision that can have long-lasting implications for your business. The legal structure you select will determine how your franchise is operated, taxed, and protected. It is important to understand the various legal structures available for franchises and carefully consider the advantages and disadvantages of each option before making a decision.

Understanding the Importance of Legal Structure in Franchising

Legal structure plays a pivotal role in the success and sustainability of your franchise. The legal structure you choose will determine the extent of your personal liability, the tax obligations of your franchise, and the flexibility you have in managing your business. By selecting the appropriate legal structure, you can minimize risks, protect your personal assets, and create a solid foundation for growth and expansion.

Exploring the Different Legal Structures for Franchises

When it comes to franchising, there are several legal structures to consider. The most common options include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has its own distinct characteristics and implications.

A sole proprietorship is the simplest form of legal structure, offering full control and ownership to a single individual. However, it also exposes the owner to unlimited personal liability for the debts and obligations of the franchise.

A partnership involves two or more individuals who share ownership and responsibility for the franchise. While partnerships can provide a way to pool resources and skills, they also carry the risk of shared liability.

An LLC combines the flexibility of a partnership with the limited liability protection of a corporation. This allows franchise owners to protect their personal assets while still benefiting from pass-through taxation.

Corporations, on the other hand, offer the highest level of limited liability protection but are subject to more complex legal requirements and formalities.

Key Factors to Consider When Choosing a Legal Structure for Your Franchise

When evaluating legal structures for your franchise, it’s crucial to consider several key factors. First, assess your personal liability risk. If you want to shield your personal assets from potential lawsuits or debts, a structure that offers limited liability protection, such as an LLC or corporation, may be the most suitable option.

Another important consideration is taxation. Different legal structures have varying tax implications. Sole proprietorships and partnerships, for instance, are subject to pass-through taxation, meaning the franchise’s profits and losses are reported on the owner’s personal tax return. Corporations, on the other hand, are subject to double taxation, where both the business and the owners are taxed separately.

Furthermore, consider the level of control you desire over your franchise. Some legal structures, like sole proprietorships and partnerships, offer more flexibility and autonomy. In contrast, corporations may require a board of directors and shareholders, limiting your decision-making authority.

Lastly, take into account the potential for growth and expansion. If you plan to bring in investors or seek financing in the future, a legal structure like a corporation may be more attractive to potential stakeholders.

Pros and Cons of Each Legal Structure for Franchise Businesses

It is essential to weigh the pros and cons of each legal structure before committing to one for your franchise business.

Sole proprietorships offer simplicity and full control over the business, but they expose the owner to unlimited personal liability. Partnerships provide shared responsibility and resources, but also shared liability. LLCs combine the advantages of limited liability and pass-through taxation, but require more paperwork and have additional legal requirements. Corporations offer the highest level of liability protection and are attractive to investors, but they involve more complex regulations and formalities.

By carefully considering these factors, you can make an informed decision that aligns with your goals and minimizes potential risks.

Analyzing the Liability and Tax Implications of Different Legal Structures for Franchises

When choosing a legal structure for your franchise, it is crucial to analyze the liability and tax implications associated with each option.

Sole proprietorships and partnerships expose the owners to unlimited personal liability, meaning their personal assets are at risk if the franchise faces legal or financial challenges. On the other hand, an LLC or corporation provides limited liability protection, safeguarding the owner’s personal assets from business-related liabilities.

In terms of taxation, sole proprietorships and partnerships are subject to pass-through taxation, which means the owners report the franchise’s profits and losses on their personal tax returns. LLCs also offer pass-through taxation, but corporations are subject to double taxation, as both the business and its owners are taxed separately on their respective incomes.

By understanding these liability and tax implications, franchise owners can make an informed decision that aligns with their risk tolerance and financial objectives.

How to Determine the Ideal Legal Structure for Your Franchise Based on Your Business Goals

Choosing the ideal legal structure for your franchise requires careful consideration of your business goals and objectives.

Start by evaluating your personal and financial liability tolerance. If protecting your personal assets is paramount, consider a legal structure that provides limited liability, such as an LLC or corporation.

Next, assess your long-term growth plans. If you intend to bring in investors or seek external financing, a corporation may be the most attractive option, as it offers the ability to issue shares and aligns well with traditional investment models.

Additionally, consider the level of control and decision-making authority you desire. If you value complete autonomy, a sole proprietorship or partnership may be the best fit. On the other hand, if you are open to sharing ownership and decision-making, an LLC or corporation could provide a suitable framework.

Ultimately, it is important to consult with legal and financial professionals who specialize in franchise law and taxation to determine the best legal structure for your specific franchise and goals.

Comparing Sole Proprietorships, Partnerships, and Corporations for Franchise Ownership

When evaluating legal structures for franchise ownership, it can be helpful to compare and contrast the three common options: sole proprietorships, partnerships, and corporations.

A sole proprietorship offers simplicity and complete control, making it an attractive choice for individuals starting small franchises on their own. However, it exposes the owner to unlimited personal liability.

A partnership, on the other hand, allows for shared resources and responsibilities but also shares liability. It can be a suitable option for franchises operated by multiple individuals who want to collaborate and pool their skills and capital.

Corporations provide the highest level of limited liability protection but come with more complex legal requirements and formalities. They are often the preferred choice for large franchises or those seeking external investors.

By comparing these options, franchise owners can identify the legal structure that aligns best with their ownership goals and risk tolerance.

Navigating the Complexities of Legal Structures in Franchise Agreements

Legal structures play a vital role in franchise agreements, which outline the rights and responsibilities of both the franchisor and the franchisee. The chosen legal structure for a franchise has a direct impact on the terms and obligations established in the agreement.

Franchise agreements typically define the roles and responsibilities of the franchisor, such as providing support, training, and trademark licensing. The legal structure will determine the extent of liability and financial obligations the franchisor bears.

For franchisees, the legal structure affects the level of control and autonomy they have over their business operations. It also determines the personal liability they face.

It is crucial for both parties to carefully review and negotiate the franchise agreement, ensuring the legal structure is accurately reflected and aligns with the goals and expectations of all parties involved.

Legal Protection: Ensuring Your Personal Assets are Shielded in the Right Legal Structure for Your Franchise

One of the primary reasons for choosing the right legal structure for your franchise is to protect your personal assets. Personal liability exposure can pose a significant risk to your financial well-being if your business faces legal or financial challenges.

By opting for a legal structure that offers limited liability protection, such as an LLC or corporation, you can create a legal separation between your personal assets and those of the franchise. This means that if your franchise incurs debts or lawsuits, your personal assets, such as your home or savings, are generally shielded from being used to satisfy those obligations.

However, it is important to note that while these legal structures provide limited liability protection, they do not completely absolve you from all personal liability. If you personally guarantee any debts or obligations, you may still be held responsible.

To ensure your personal assets are adequately shielded, consult with a qualified attorney who specializes in franchise law to guide you through the process of selecting the appropriate legal structure for your franchise.

How to Avoid Common Mistakes When Selecting a Legal Structure for Your Franchise Business

Selecting the right legal structure for your franchise is a complex decision that should not be taken lightly. To avoid common mistakes and make an informed choice, there are several key considerations to keep in mind.

First, thoroughly understand the implications of each legal structure and how they align with your goals and risk tolerance.

Second, seek professional guidance from attorneys and accountants who specialize in franchise law and taxation. They can provide invaluable insights and ensure you are considering all relevant factors.

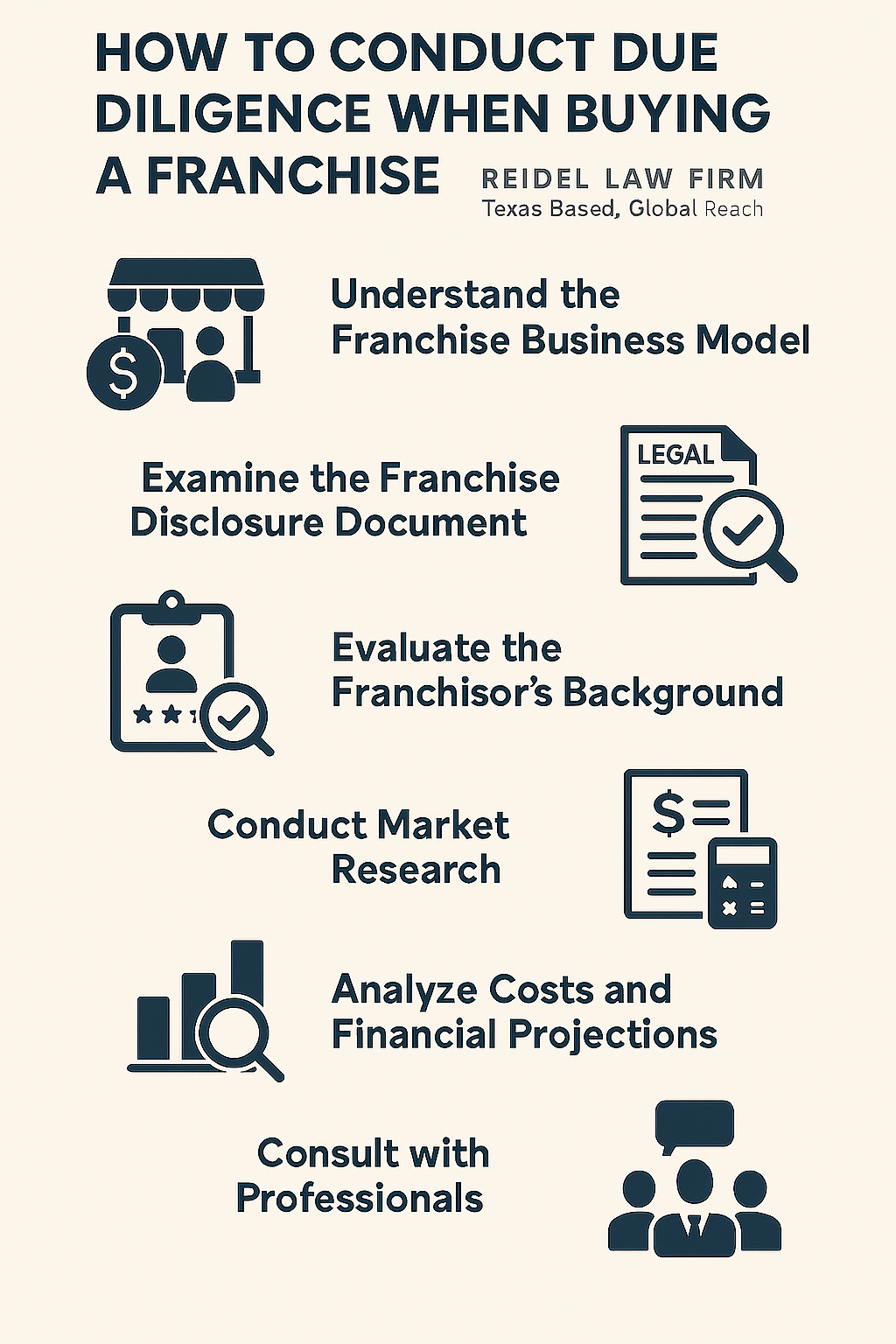

Additionally, do comprehensive research and due diligence. Review case studies and speak with other franchise owners who have chosen different legal structures. Their experiences can offer valuable insights and identify potential challenges or benefits that you may not have considered.

Lastly, be proactive in reviewing and reassessing your legal structure as your franchise grows and evolves. The legal structure that suits your needs in the early stages may not be ideal as your franchise expands or undergoes significant changes.

By avoiding common mistakes and taking a thoughtful and strategic approach, you can select a legal structure for your franchise that sets you up for long-term success.

The Role of Legal Structure in Attracting Investors to Your Franchise Venture

Choosing the right legal structure for your franchise can have a significant impact on your ability to attract investors and secure financing for your venture.

Investors, whether they are individuals or institutions, seek opportunities that align with their risk appetite and investment goals. A legal structure like a corporation, with its clear ownership structure and ability to issue shares, is often perceived as more attractive to investors.

Additionally, some investors may feel more comfortable investing in franchises that have limited personal liability for the owners. Legal structures such as LLCs and corporations can provide this level of liability protection, which may increase investor confidence in your franchise.

By choosing a legal structure that aligns with the expectations and preferences of potential investors, you can enhance your franchise’s appeal and increase the likelihood of securing the necessary funds to fuel growth and expansion.

Compliance and Regulatory Considerations: Choosing a Legal Structure that Aligns with Industry Standards in Franchising

Compliance with industry standards and regulations is a crucial aspect of running a successful franchise. Selecting the right legal structure can help ensure that your franchise meets the necessary compliance requirements.

Different legal structures have varying reporting, record-keeping, and governance obligations. It’s essential to choose a structure that aligns with your industry’s regulatory requirements and facilitates compliance.

For example, corporations are subject to more stringent regulatory oversight and reporting obligations, making them a suitable choice for franchises operating in highly regulated industries. On the other hand, sole proprietorships and partnerships may be less ideal in such industries due to the lack of formal corporate governance and reporting structures.

By selecting a legal structure that aligns with your industry’s compliance standards, you can ensure that your franchise meets its legal obligations and operates within the parameters set by regulatory authorities.

Balancing Flexibility and Stability: Finding the Optimal Legal Structure for Your Growing Franchise Network

As your franchise network grows, finding the optimal legal structure becomes even more critical. The legal structure you initially select may not be the most suitable as your franchise expands and evolves.

With growth comes the need for flexibility in decision-making, financing, and operational control. A legal structure that provides room for expansion, such as a corporation with its ability to issue shares and attract investors, may be more appropriate for a growing franchise network.

On the other hand, if you prioritize flexibility and autonomy, an LLC can accommodate the changing needs of your franchise while still providing limited liability protection.

It is essential to reassess your legal structure periodically as your franchise expands to ensure it aligns with your growth objectives and provides the necessary framework for continued success.

Case Studies: Successful Franchises and their Chosen Legal Structures

Examining case studies of successful franchises and their chosen legal structures can provide valuable insights and inspiration when choosing the right legal structure for your own franchise.

For example, many well-known fast-food franchises, such as McDonald’s and Subway, operate as corporations. This legal structure allows for easy expansion and attracting investors.

Other franchises, like consulting firms or individual service providers, may opt for the simplicity of a sole proprietorship or partnership to maintain control and minimize administrative burden.

By studying successful franchises and understanding the reasoning behind their chosen legal structures, you can gain valuable knowledge and make more informed decisions for your own franchise.

In conclusion, choosing the right legal structure for your franchise is a pivotal decision that requires careful consideration of factors such as liability, taxation, control, and growth potential. By comparing and weighing the pros and cons of each option, consulting with professionals, and learning from case studies, you can make an informed choice that aligns with your specific franchise and long-term goals. Choosing the right legal structure sets the foundation for success and creates a solid framework for your franchise to flourish.