Franchise businesses provide a lucrative opportunity for entrepreneurs to own and operate their own businesses while benefiting from an established brand and support system. However, managing franchise royalty fees and legal obligations is a critical aspect of ensuring the success and compliance of both franchisors and franchisees. In this comprehensive guide, we will explore the various aspects of franchise royalty fees and legal obligations, providing key insights and strategies for effective management.

Understanding Franchise Royalty Fees: A Comprehensive Guide

Franchise royalty fees are recurring payments that franchisees make to franchisors as a part of the franchise agreement. These fees typically represent a percentage of the franchisee’s gross sales and are essential for the franchisor’s ongoing support and maintenance of the brand. It is crucial for franchisees to have a clear understanding of the royalty fee structure and its implications before entering into a franchise agreement.

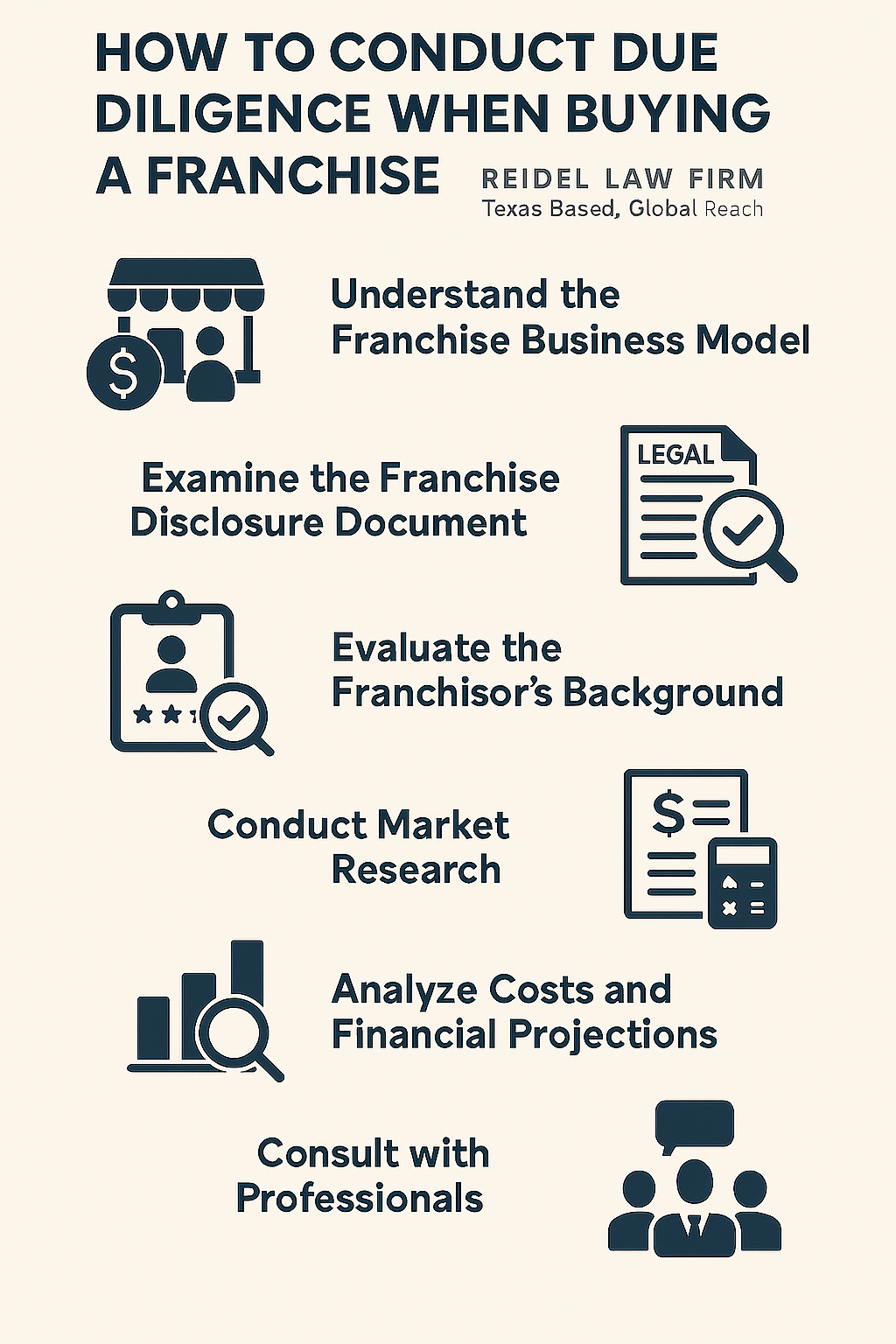

In order to effectively manage franchise royalty fees, franchisees should consider various factors such as the franchisor’s track record, the level of support provided, and the potential return on investment. Conducting thorough due diligence and consulting with legal and financial professionals can help franchisees make informed decisions regarding royalty fees.

The Importance of Managing Franchise Royalty Fees and Legal Obligations

Managing franchise royalty fees and legal obligations is of paramount importance for both franchisors and franchisees. For franchisors, ensuring fair and reasonable royalty fee structures establishes a sustainable financial model, strengthens the brand, and promotes healthy franchisee relationships.

Franchisees, on the other hand, must manage royalty fees to maintain profitability and meet their financial obligations. Failing to manage royalty fees adequately can result in strained relationships with franchisors, financial difficulties, and even legal disputes.

Key Factors to Consider When Managing Franchise Royalty Fees and Legal Obligations

When managing franchise royalty fees and legal obligations, franchisees should consider several key factors. Firstly, understanding the components included in the royalty fee structure is essential. These components may include advertising fees, technology support, training, and ongoing support.

Franchisees should also assess the franchisor’s financial stability and track record. A franchisor with a strong financial standing is more likely to invest in the ongoing support and development of the franchise system. Additionally, reviewing comparable industry standards and benchmarks can help franchisees to ensure that the royalty fees they are paying are fair and reasonable.

Another crucial factor to consider is the impact of royalty fees on profitability. Franchisees should analyze their financial projections and ensure that they can maintain profitability while meeting their royalty fee obligations. Seeking guidance from financial professionals can help franchisees assess the financial impact of royalty fees.

Lastly, franchisees must be aware of any potential changes to royalty fee structures or legal obligations. Ongoing communication with the franchisor and actively staying informed about industry updates and legal changes will allow franchisees to adapt and plan accordingly.

Exploring the Different Types of Franchise Royalty Fees

Franchise royalty fees can vary in structure depending on the franchise system and industry. Understanding the different types of royalty fees is crucial for effective management. The most common types of royalty fees include:

- Flat Fee: Franchisees pay a fixed amount as a royalty fee, regardless of their gross sales.

- Percentage Fee: Franchisees pay a percentage of their gross sales as a royalty fee. This is the most common type of royalty fee structure.

- Tiered Fee: Royalty fees are structured in tiers, with the percentage increasing as the franchisee’s gross sales increase.

- Minimum Fee: Franchisees pay a minimum predetermined amount as a royalty fee, regardless of their gross sales. If the percentage fee exceeds the minimum fee, the higher amount will be charged.

Legal Obligations in Franchise Agreements: What You Need to Know

Franchise agreements outline the legal obligations and responsibilities of both the franchisor and the franchisee. It is crucial for both parties to have a clear understanding of these obligations in order to maintain compliance and avoid potential legal disputes.

Common legal obligations in franchise agreements include payment of royalty fees, adherence to quality standards, use of proprietary systems and trademarks, and compliance with marketing and advertising guidelines. Understanding these obligations, seeking legal advice, and maintaining open lines of communication with the franchisor will help franchisees ensure compliance and mitigate legal risks.

Navigating the Legal Landscape: Compliance with Franchise Laws and Regulations

In addition to the legal obligations outlined in franchise agreements, franchisors and franchisees must also comply with applicable franchise laws and regulations. Franchise laws vary by jurisdiction and cover aspects such as disclosure requirements, registration, termination and renewal rights, and dispute resolution processes.

Franchisees must familiarize themselves with these laws and regulations and incorporate compliance into their franchise operations. Engaging legal professionals who specialize in franchise law can provide invaluable guidance and ensure adherence to legal requirements.

Tips for Negotiating Favorable Franchise Royalty Fees and Legal Terms

Franchise agreements are open to negotiation, and franchisees should approach these negotiations with careful consideration. Here are some tips for negotiating favorable franchise royalty fees and legal terms:

- Research and understand industry standards and benchmarks for royalty fees.

- Seek legal advice to review and negotiate the franchise agreement.

- Consider engaging a franchise consultant to provide insights and guidance throughout the negotiation process.

- Outline specific performance targets and milestones that could lead to royalty fee reductions or incentives.

- Request transparency and regular reporting on how royalty fees are used and allocated by the franchisor.

Strategies for Effectively Tracking and Reporting Franchise Royalty Fees

Accurate tracking and reporting of franchise royalty fees are essential for both franchisors and franchisees. Implementing effective strategies for tracking and reporting ensures transparency, minimizes disputes, and aids in financial management and forecasting.

Franchisors should implement robust accounting systems that can accurately track royalty fee collections and provide clear and detailed reports to franchisees. Franchisees, on the other hand, should maintain meticulous records of their sales and royalty fee payments to verify the accuracy of the reports received from the franchisor.

Utilizing software and technology solutions specifically designed for franchise royalty fee management can streamline the tracking and reporting process, reducing manual errors and improving efficiency.

How to Optimize Franchise Royalty Fee Structure for Maximum Profitability

Franchise royalty fee structure plays a significant role in determining the profitability of franchisees. Optimizing the fee structure requires careful analysis, negotiation, and strategic decision-making.

One approach to optimizing the royalty fee structure is negotiating performance-based fee reductions or incentives tied to reaching specific targets. This promotes franchisee motivation and aligns their interests with the franchisor’s success.

Another strategy is to consider multiple revenue streams beyond traditional royalties. These may include licensing fees, product sales, or franchisee equity investments. Diversifying revenue streams can enhance profitability and reduce reliance on royalty fees.

Additionally, franchisees should regularly review their operational costs and assess opportunities to reduce expenses, improve efficiency, and boost profitability while still meeting their royalty fee obligations.

Balancing Financial Responsibilities: Managing Franchise Royalty Fees and Operational Costs

Managing franchise royalty fees alongside operational costs is a delicate balancing act that franchisees must navigate. While royalty fees contribute to the franchisor’s ongoing support and brand development, operational costs are directly associated with the day-to-day running of the franchise business.

Franchisees should focus on effective cost management strategies, such as negotiating favorable supplier contracts, optimizing staffing levels, implementing efficient inventory management systems, and monitoring key financial metrics such as gross profit margin and break-even point. It is essential to strike a balance to maintain profitability and meet financial obligations.

Mitigating Risk: Ensuring Compliance with Legal Obligations in Franchising

Mitigating legal risks associated with franchise royalty fees and legal obligations is critical for both franchisors and franchisees. Non-compliance can result in financial penalties, damaged brand reputation, and even termination of the franchise agreement.

Franchisees should establish robust internal processes to ensure ongoing compliance with legal obligations. Regular audits, training programs, and maintaining open lines of communication with the franchisor can help identify and address any compliance gaps in a timely manner.

Franchisors, on the other hand, should provide comprehensive training and support to franchisees, develop clear policies and guidelines, and conduct periodic reviews and inspections to ensure compliance with legal obligations.

The Role of Technology in Streamlining Franchise Royalty Fee Management and Legal Compliance

Technology plays a vital role in streamlining franchise royalty fee management and legal compliance. Software solutions specifically designed for franchise management offer a range of benefits, including:

- Automating royalty fee calculations and collections, reducing manual errors.

- Generating detailed reports and financial statements for increased transparency.

- Providing secure online portals for franchisees to access their financial information and track royalty fee payments.

- Facilitating communication and collaboration between franchisors and franchisees.

- Simplifying compliance with legal requirements by storing and organizing necessary documentation.

Implementing technology solutions tailored to franchise royalty fee management can enhance efficiency, accuracy, and overall compliance, freeing up time and resources to focus on business growth and success.

Best Practices for Handling Disputes Related to Franchise Royalty Fees and Legal Obligations

Disputes related to franchise royalty fees and legal obligations can arise from misunderstandings, differing interpretations of agreements, or external factors. However, having a proactive approach and following best practices can help resolve disputes effectively and preserve the franchisor-franchisee relationship.

Communication is key when disputes arise. Open and honest dialogue between both parties can often lead to a resolution. Timely identification of issues, documentation of the dispute, and seeking legal guidance are important steps to take when disputes cannot be resolved through direct communication.

Franchise mediation or arbitration may be recommended in cases where a resolution cannot be reached through direct negotiations. Engaging neutral third-party mediators or arbitrators can help facilitate a fair and unbiased dispute resolution process.

Case Studies: Successful Approaches to Managing Franchise Royalty Fees and Legal Requirements

Examining case studies can provide valuable insights into successful approaches to managing franchise royalty fees and legal requirements. These case studies highlight different strategies implemented by franchisors and franchisees to optimize profitability, ensure compliance, and foster a mutually beneficial relationship.

Case studies may include real-life examples of franchise systems that have implemented innovative royalty fee structures, leveraged technology solutions for streamlined management, and successfully navigated legal challenges.

Maximizing ROI: Strategies for Monitoring and Improving the Performance of Franchise Royalty Fee Investments.

Maximizing return on investment (ROI) is a primary goal for franchisees. Monitoring and improving the performance of franchise royalty fee investments is essential to achieve this goal.

Establishing key performance indicators (KPIs) specific to royalty fee payments allows franchisees to track the impact of these fees on their bottom line. By analyzing KPIs such as gross profit margin, customer acquisition cost, and lifetime customer value, franchisees can identify areas for improvement and implement strategies to increase ROI.

Additionally, regularly reviewing the franchise system’s overall performance and franchisee satisfaction levels can provide insights into the effectiveness of royalty fee investments. Franchisees should maintain open lines of communication with the franchisor, actively participating in discussions on royalty fee utilization and potential adjustments.

Staying Ahead of Changes: Adapting to Evolving Laws and Regulations in the Franchising Industry.

The franchising industry is subject to evolving laws and regulations. Franchisors and franchisees must stay ahead of these changes to ensure ongoing compliance and mitigate legal risks.

Franchisees should allocate time and resources to staying informed about industry updates and legal changes. Monitoring industry publications, attending franchise association events and seminars, and subscribing to newsletters or legal updates are effective ways to keep abreast of changes.

Franchisors should proactively communicate any changes in franchise laws and regulations to their franchisees, providing guidance on how to comply with the amendments. Establishing a process for regular compliance audits can help ensure ongoing adherence to legal requirements.

The Pros and Cons of Different Approaches to Structuring Franchise Royalty Fees.

There are various approaches to structuring franchise royalty fees, each with its own pros and cons. Franchisors and franchisees should carefully consider these factors in order to determine the most suitable royalty fee structure for their specific circumstances.

The key pros and cons of different approaches to structuring franchise royalty fees include:

- Flat Fee:

- Pros: Offers predictability and stability for franchisees, regardless of sales fluctuations.

- Cons: May not incentivize franchisees to increase sales and profitability as the fee remains fixed.

- Percentage Fee:

- Pros: Aligns the franchisor’s interests with the franchisee’s success, as the fee is directly tied to sales.

- Cons: Higher sales volumes can result in higher royalty fee payments, potentially impacting profitability.

- Tiered Fee:

- Pros: Rewards high-performing franchisees with lower royalty fees, incentivizing growth.

- Cons: Complex to administer and calculate, potentially leading to confusion or disputes.

- Minimum Fee:

- Pros: Provides a safety net for franchisees during periods of lower sales.

- Cons: Can lead to higher royalty fee payments if the percentage fee exceeds the minimum fee.