In the world of entrepreneurship, there are numerous laws and regulations that govern the establishment and operation of businesses. One such set of laws is known as “Business Opportunity Laws.” These laws are designed to provide a legal framework and protection for both entrepreneurs and consumers in the realm of business opportunities.

Understanding the Basics of Business Opportunity Laws

Business Opportunity Laws encompass a variety of legal requirements and regulations that entrepreneurs must adhere to when offering or selling business opportunities. By definition, a business opportunity exists when there is a sale or lease of any product, equipment, or service that enables the buyer to start their own business. This could include franchises, distributorships, or even network marketing programs.

The aim of Business Opportunity Laws is to ensure transparency and fairness in business transactions by requiring sellers to provide potential buyers with accurate and complete information about the business opportunity being offered. By doing so, these laws help protect individuals from fraudulent or misleading claims, giving them the necessary tools to make informed decisions.

The Importance of Business Opportunity Laws for Entrepreneurs

For aspiring entrepreneurs, understanding and complying with Business Opportunity Laws is vital for several reasons. Firstly, compliance with these laws helps establish credibility and trust with potential customers or investors. By following the legal requirements, entrepreneurs demonstrate that they respect the rights and interests of consumers, which can significantly enhance their business reputation.

Secondly, Business Opportunity Laws provide entrepreneurs with a structured and standardized framework for operating their businesses. By defining what information should be disclosed to potential buyers, these laws help entrepreneurs streamline their sales processes and avoid legal complications in the future.

Furthermore, compliance with Business Opportunity Laws can also offer entrepreneurs protection against legal disputes and potential legal liabilities. By ensuring that all necessary disclosures and registrations are made, entrepreneurs can minimize the risk of facing legal action from dissatisfied customers or business partners.

Key Components of Business Opportunity Laws Explained

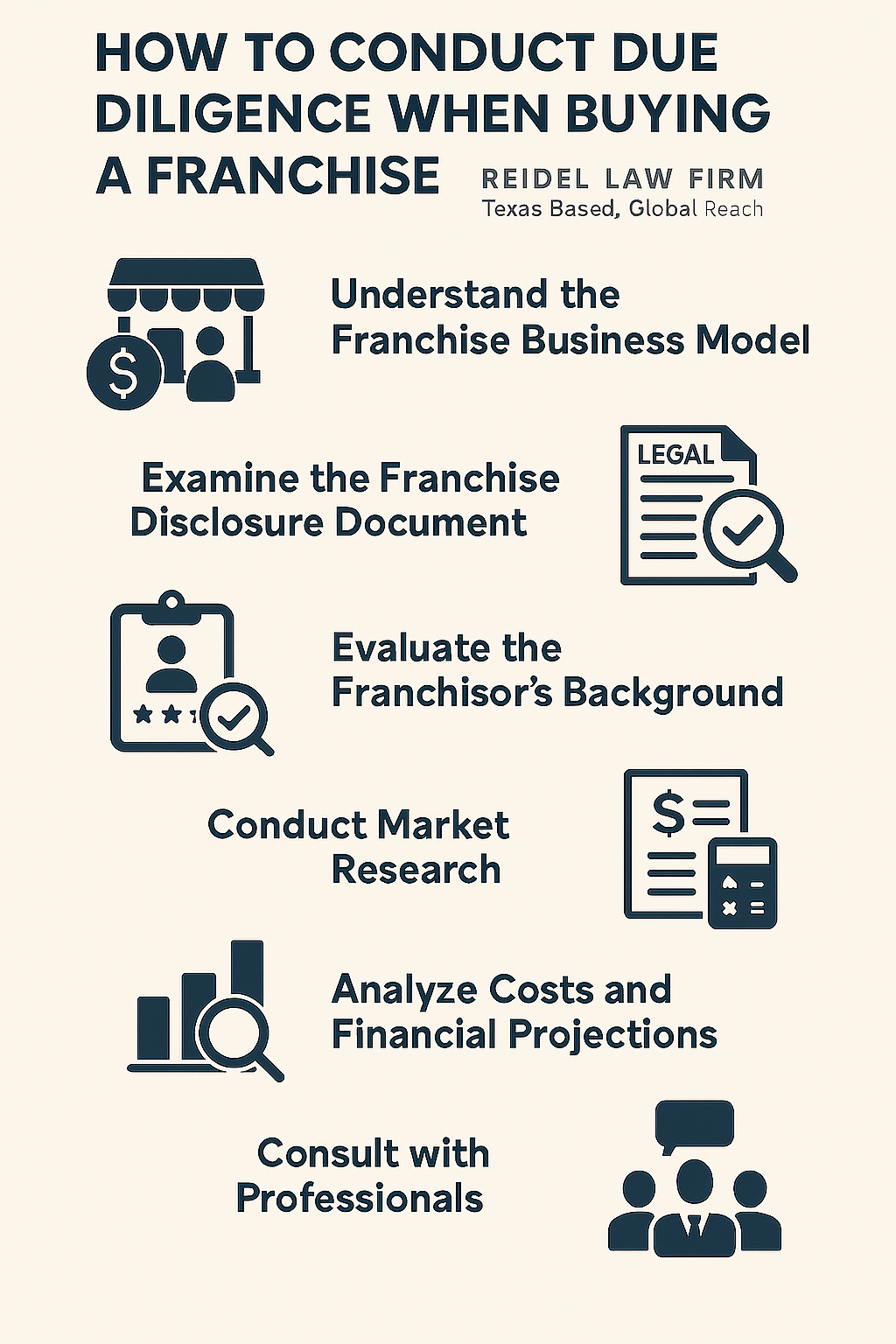

Business Opportunity Laws typically consist of several key components that entrepreneurs need to be aware of. One of the primary requirements is the provision of a comprehensive disclosure document. This document, often referred to as a Franchise Disclosure Document (FDD) in the case of franchises, must be provided to potential buyers before any sales or payments occur. The FDD contains detailed information about the business opportunity, including the company’s financial statements, litigation history, and the obligations of both the buyer and seller. It is essential for entrepreneurs to create and maintain an accurate and up-to-date FDD to ensure compliance with Business Opportunity Laws.

Another crucial component of these laws is the registration process. In many jurisdictions, entrepreneurs offering business opportunities must register with relevant government agencies before they can legally operate. Typically, this involves submitting an application, paying registration fees, and providing the necessary documentation and disclosures. By registering, entrepreneurs demonstrate their commitment to complying with the law and protecting the interests of consumers.

How Business Opportunity Laws Protect Consumers and Investors

Business Opportunity Laws play a vital role in safeguarding consumers and investors from fraudulent or deceptive business practices. By requiring sellers to disclose accurate and complete information about the business opportunity, these laws enable potential buyers to make informed decisions. This transparency helps consumers avoid falling victim to scams or purchasing opportunities that do not align with their goals or expectations.

Furthermore, Business Opportunity Laws often include provisions to protect consumers from unfair or oppressive contractual terms. For example, these laws may restrict the use of non-compete clauses or provide mechanisms for contract termination or refund in case of misrepresentation or fraud. By setting these standards, Business Opportunity Laws help level the playing field between buyers and sellers, ensuring a fair and equitable business environment.

A Comprehensive Guide to Compliance with Business Opportunity Laws

Ensuring compliance with Business Opportunity Laws requires a thorough understanding of the relevant legal requirements and a commitment to upholding the highest ethical standards. Below are some key steps that entrepreneurs can take to comply with these laws:

- Create a comprehensive disclosure document: Develop a detailed disclosure document, such as an FDD, that provides potential buyers with all necessary information about the business opportunity.

- Update and maintain accurate records: Regularly review and update your disclosure document to reflect any changes in the business or legal requirements. Keep meticulous records of all transactions and communications with potential buyers.

- Register with relevant government agencies: Determine the registration requirements in your jurisdiction and complete the necessary applications and submissions.

- Seek legal advice: Consult with a business attorney experienced in Business Opportunity Laws to ensure compliance with all regulations and to address any questions or concerns.

- Educate your team: Train your sales staff and employees on the legal requirements and ethical standards for offering and selling business opportunities. Ensure they understand the importance of transparency and accurate disclosure.

By following these steps and maintaining a commitment to compliance, entrepreneurs can navigate the complexities of Business Opportunity Laws successfully.

Common Misconceptions about Business Opportunity Laws Debunked

There are several misconceptions when it comes to Business Opportunity Laws that can lead to misunderstandings and confusion. Let’s debunk some of these common misconceptions:

Misconception 1: Compliance with Business Opportunity Laws is optional: In reality, compliance with these laws is mandatory in many jurisdictions. Failure to comply can result in legal consequences, fines, or the closure of your business.

Misconception 2: Business Opportunity Laws only apply to franchises: While franchises are a significant component of Business Opportunity Laws, these laws often extend beyond franchises to cover other business models such as distributorships and network marketing programs. It is important to understand which laws apply to your specific business opportunity.

Misconception 3: Disclosure documents are one-size-fits-all: Disclosure documents need to be tailored to the specific business opportunity being offered. An FDD for a franchise, for example, will differ from a disclosure document for a distributorship. Customization is essential to ensure accuracy and compliance.

Misconception 4: Compliance is a one-time obligation: Business Opportunity Laws require ongoing compliance. Entrepreneurs must regularly review and update their disclosure documents, register with government agencies as required, and stay informed about changes in the law.

By dispelling these misconceptions, entrepreneurs can better understand the importance and intricacies of Business Opportunity Laws.

Factors to Consider Before Starting a Business Under Business Opportunity Laws

Before embarking on a business venture under the umbrella of Business Opportunity Laws, entrepreneurs should carefully consider several key factors to ensure their success:

Market Analysis: Evaluate the potential demand for your product or service in the target market. Consider competition, market saturation, and consumer trends.

Financial Feasibility: Determine the initial investment required, ongoing expenses, and potential revenue streams. Conduct thorough financial projections to assess the profitability and sustainability of the business opportunity.

Industry Research: Familiarize yourself with the industry your business opportunity falls within. Understand the market dynamics, growth potential, and potential risks or challenges that may arise.

Legal Compliance: Research and understand the laws and regulations specific to your business opportunity. Seek guidance from legal professionals to ensure compliance with all relevant requirements.

Training and Support: Assess the training and support provided by the business opportunity seller. Determine if they offer comprehensive training programs, ongoing support, and resources to help you succeed.

Navigating Legal Requirements: Registering and Disclosing Under Business Opportunity Laws

One of the most critical aspects of compliance with Business Opportunity Laws is the requirement to register with relevant government agencies and provide accurate disclosures to potential buyers. The specific registration and disclosure obligations vary by jurisdiction, but generally involve the following:

Registration: Determine the registration requirements in your jurisdiction. This may involve submitting an application, paying registration fees, and providing specific documentation such as financial statements or proof of insurance.

Disclosure Documents: Develop a comprehensive disclosure document, such as an FDD, that provides potential buyers with all necessary information about the business opportunity. Ensure the document includes all required disclosures and is kept up to date.

Timing of Disclosures: Understand when and how the disclosure document should be provided to potential buyers. In many cases, it must be given sufficiently in advance of any sale or payment to allow the buyer ample time to review and consider the information.

Penalties for Non-compliance: Familiarize yourself with the potential penalties for non-compliance with Business Opportunity Laws in your jurisdiction. These may include fines, legal action from dissatisfied buyers, or even criminal charges in severe cases of fraud or deception.

By navigating the legal requirements of registration and disclosure, entrepreneurs can ensure compliance with Business Opportunity Laws and build a solid foundation for their business.

The Role of Government Agencies in Enforcing Business Opportunity Laws

Government agencies play a crucial role in enforcing Business Opportunity Laws and protecting consumers and entrepreneurs. These agencies are responsible for monitoring and regulating the business opportunity industry to ensure compliance with the law. Some common tasks performed by government agencies include:

Registration and Oversight: Government agencies oversee the registration process for business opportunities, ensuring that sellers meet the necessary requirements before legally operating. This may involve conducting background checks, reviewing disclosure documents, and verifying financial information.

Education and Information: Government agencies often provide educational resources and guidance to entrepreneurs and consumers regarding Business Opportunity Laws. This may include workshops, seminars, or online materials that help individuals understand their rights and obligations.

Investigations and Complaint Resolution: Government agencies investigate complaints filed by consumers against business opportunity sellers. They may mediate disputes, conduct audits, or take legal action against sellers who violate the law or fail to meet their obligations.

Policy Development and Updates: Government agencies work to develop and update policies, regulations, and safeguards to adapt to changing business practices and protect the interests of consumers. They collaborate with stakeholders to ensure that laws are effective, fair, and enforceable.

By collaborating with government agencies and proactively engaging in compliance, entrepreneurs can contribute to a thriving business opportunity industry that benefits all stakeholders.

Case Studies: Examining Successful Businesses Operating Under Business Opportunity Laws

Examining case studies of successful businesses operating under Business Opportunity Laws can provide valuable insights into best practices and strategies for entrepreneurial success. By understanding their approaches and lessons learned, entrepreneurs can gain inspiration and apply these principles to their own ventures.

One example of a successful business operating under Business Opportunity Laws is XYZ Franchise. XYZ Franchise is a fast-casual restaurant chain that offers franchise opportunities to aspiring entrepreneurs. The company has thrived by prioritizing transparency and support for its franchisees.

One key factor in the success of XYZ Franchise is their commitment to providing meticulous training and ongoing support to their franchisees. They offer comprehensive training programs covering all aspects of operating the business, from food preparation to marketing strategies. This support helps ensure that new franchisees feel confident and prepared to manage their business effectively.

Additionally, XYZ Franchise places a strong emphasis on open communication and transparency with their franchisees. They maintain regular channels of communication, allowing franchisees to provide feedback and share best practices. This collaborative approach fosters a sense of community and encourages continuous improvement across the franchise network.

By examining success stories like XYZ Franchise, entrepreneurs can gain valuable insights into the strategies and practices that contribute to thriving businesses operating under Business Opportunity Laws. These case studies offer practical examples of how to navigate challenges, establish strong foundations, and foster success in the dynamic business landscape.

Best Practices for Entrepreneurs to Maximize Success within the Framework of Business Opportunity Laws

Maximizing success within the framework of Business Opportunity Laws requires entrepreneurs to adopt several best practices. By following these guidelines, entrepreneurs can enhance their chances of building a successful and ethical business:

Transparency and Honesty: Be transparent and honest in all dealings with potential buyers. Disclose all relevant information about the business opportunity and avoid making false or misleading claims.

Invest in Education and Training: Continuously invest in your own education and skills development related to your business opportunity. Stay up to date with industry trends, regulations, and best practices to remain competitive and responsive to market demands.

Build Strong Relationships: Cultivate strong relationships with your customers, partners, and employees. Prioritize open communication, responsive customer service, and fair business practices.

Ethical Marketing and Advertising: Adhere to ethical standards in your marketing and advertising efforts. Avoid deceptive or misleading advertising tactics that could jeopardize your reputation or attract legal scrutiny.

Stay Informed: Stay informed about changes in Business Opportunity Laws and regulatory requirements. Regularly review and update your disclosure documents, registrations, and any other legal obligations.

Seek Professional Guidance: Work with legal professionals who have expertise in Business Opportunity Laws. They can provide valuable guidance and ensure that you meet all legal requirements.

By adopting these best practices, entrepreneurs can position themselves for long-term success while operating within the bounds of Business Opportunity Laws.

Current Trends and Developments in Business Opportunity Laws

Business Opportunity Laws are constantly evolving to keep pace with emerging business models and consumer protection needs. Several current trends and developments are shaping the landscape of Business Opportunity Laws:

Rise of Online Business Opportunities: With the growth of the internet and e-commerce, online business opportunities have become increasingly prevalent. Business Opportunity Laws are adapting to regulate these online ventures and ensure consumer protections are in place.

Increased Focus on Cybersecurity: As cybersecurity threats continue to rise, Business Opportunity Laws are incorporating provisions to protect consumers’ personal and financial information. Regulations may require sellers to implement data protection measures and provide information regarding data handling practices.

Expansion of International Business Opportunities: Business Opportunity Laws are expanding to address international business opportunities, considering the unique challenges that arise in cross-border business ventures. This includes harmonizing laws