In the fast-paced world of franchising, it is crucial for franchisors to stay informed and proactive when it comes to their Franchise Disclosure Document (FDD) renewal process. FDD renewal is not simply a routine procedure; it carries significant legal implications that can have a profound impact on the franchisor’s business.

Understanding the Importance of FDD Renewal

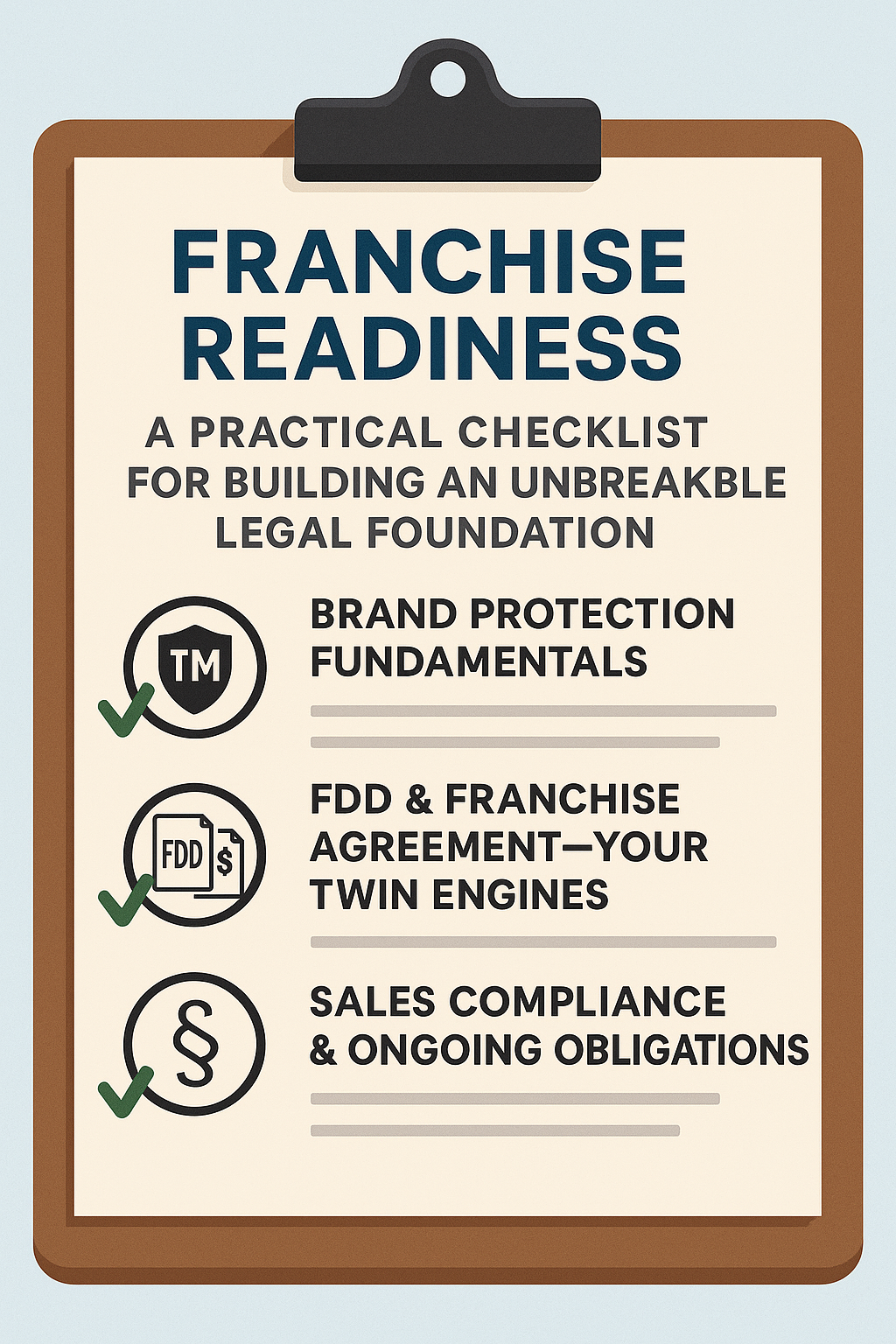

First and foremost, let’s establish the importance of FDD renewal. The FDD is a comprehensive document that provides potential franchisees with crucial information about the franchisor and the franchise opportunity. It is a legal requirement under the Federal Trade Commission’s Franchise Rule, and failure to comply with FDD renewal obligations can result in severe consequences, including the suspension or termination of the franchisor’s ability to sell franchises.

Renewing the FDD allows franchisors to ensure that the information provided to prospective franchisees is accurate and up-to-date. It is an opportunity to review and revise any outdated or misleading content in the document, ensuring compliance with state and federal laws and regulations.

The Potential Risks Associated with FDD Renewal

While FDD renewal is essential, it also carries potential risks that franchisors need to be aware of. One key risk is the failure to identify and address legal blind spots during the renewal process. Legal blind spots refer to areas in the FDD that may be incomplete, inaccurate, or non-compliant with the law. These blind spots can expose franchisors to litigation, regulatory fines, and reputational damage.

Another risk is the failure to adapt to regulatory changes. Laws and regulations surrounding franchising are constantly evolving, and failure to stay up-to-date can result in non-compliance and legal complications. Franchisors must have a thorough understanding of any regulatory changes impacting FDD renewals and ensure their documents and practices align with these changes.

Common Legal Blind Spots in the FDD Renewal Process

Many franchisors unknowingly overlook common legal blind spots during the FDD renewal process. These blind spots can include inadequate disclosure of litigation involving the franchisor, outdated financial performance representations, failure to disclose material changes to the franchise system, and inaccuracies in the franchise agreement.

Another blind spot is the failure to include state-specific disclosures. Franchisors must be aware that certain states have their own franchise registration and disclosure requirements, and failure to include these state-specific disclosures can lead to legal complications. Franchisors must review their FDD for compliance with every state in which they offer franchises.

How to Identify and Address Legal Blind Spots in FDD Renewal

To identify and address legal blind spots in the FDD renewal process, franchisors should consider seeking guidance from experienced franchise attorneys. These attorneys have the expertise to review the FDD, identify potential blind spots, and provide practical solutions to ensure compliance with all legal requirements.

Franchisors should also conduct a thorough review of their existing FDD, paying attention to areas that are commonly missed or overlooked. This review should include a careful examination of the financial performance representations, franchise agreement, and any state-specific requirements. Franchisors must also assess any recent changes to laws and regulations and make necessary updates to their FDD.

Key Elements to Review During the FDD Renewal Process

During the FDD renewal process, franchisors should pay close attention to several key elements. One critical element is the Item 19 – Financial Performance Representations. Franchisors must ensure that any representations regarding potential profits or earnings are accurate and supported by reliable data. It is important to review and update this section to reflect the most current and relevant information.

Another crucial element is the franchise agreement. Franchisors should carefully review this document to ensure its accuracy, clarity, and compliance with applicable laws. Any changes to the franchise agreement should be properly disclosed in the FDD.

Ensuring Compliance with State and Federal Laws in FDD Renewals

Compliance with both state and federal laws is paramount in FDD renewals. Franchisors must be aware of the specific requirements of each state where they offer franchises and ensure their FDD meets those requirements. This includes understanding state-specific disclosures, registration requirements, and any unique regulations that may apply.

At the federal level, franchisors must comply with the FTC’s Franchise Rule. This rule outlines specific disclosure requirements and mandates that franchisors provide accurate and complete information to potential franchisees in the FDD. Failure to comply with these requirements can result in serious legal consequences.

The Role of Franchise Attorneys in Mitigating Legal Blind Spots in FDD Renewals

Franchise attorneys play a crucial role in mitigating legal blind spots in FDD renewals. These legal professionals have in-depth knowledge of franchise laws and regulations, as well as experience in conducting thorough FDD reviews. They can identify potential blind spots, provide guidance on compliance matters, and ensure all necessary documentation and disclosures are in place.

Franchise attorneys also serve as valuable partners during any adversarial procedures resulting from FDD renewals. Their expertise in franchise law allows them to represent franchisors in negotiations, mediations, or litigation, protecting the franchisor’s interests and minimizing legal risks.

Best Practices for Managing Legal Risks in the FDD Renewal Process

Managing legal risks in the FDD renewal process requires a proactive and diligent approach. Here are some best practices to help franchisors effectively navigate potential legal blind spots:

1. Seek the advice of experienced franchise attorneys who specialize in FDD renewals.

2. Conduct a thorough review of your existing FDD, paying attention to common blind spots.

3. Stay informed about regulatory changes impacting the franchising industry.

4. Update your FDD to reflect any material changes to your franchise system.

5. Comply with state-specific requirements. Review each state’s filing and disclosure requirements and make necessary updates to your FDD.

6. Ensure accuracy and clarity in your financial performance representations.

7. Provide adequate disclosure of any litigation involving the franchisor.

8. Regularly communicate with franchise attorneys to stay informed of legal updates and changes.

Proactive Steps to Minimize Legal Exposure During FDD Renewals

To minimize legal exposure during FDD renewals, franchisors can take proactive steps to ensure compliance and mitigate risks. One proactive step is to establish a strong internal review process. This includes designating key personnel responsible for managing the FDD renewal process and creating a detailed checklist to ensure all necessary elements are addressed.

Franchisors should also implement ongoing training programs to educate their internal team about franchise laws, regulations, and best practices. Regular training sessions can help minimize human error and ensure continued compliance with legal requirements.

Avoiding Costly Mistakes: Legal Considerations for Franchisors during FDD Renewals

Costly mistakes can have a significant impact on a franchisor’s business and reputation. By being aware of potential legal blind spots and implementing the best practices mentioned above, franchisors can avoid costly mistakes during the FDD renewal process.

One critical consideration is to be transparent and provide full and accurate disclosures within the FDD. Transparency builds trust with potential franchisees and reduces the risk of legal disputes down the line. Franchisors should work closely with attorneys to ensure all required disclosures are properly included in the FDD.

Additionally, franchisors should maintain open lines of communication with existing and prospective franchisees. Clear and frequent communication helps establish a collaborative and cooperative relationship, minimizing the likelihood of future legal disputes and fostering a positive franchise system.

Understanding Regulatory Changes Impacting FDD Renewals

Regulatory changes can significantly impact the FDD renewal process. It is crucial for franchisors to stay informed about any updates or amendments to franchise laws and regulations at both the federal and state levels.

Franchisors should regularly review the FTC’s Franchise Rule and update their practices and disclosures to align with any recent changes. They should also stay aware of any state-specific requirements as laws can differ from state to state. By understanding and adapting to regulatory changes, franchisors can mitigate legal risks and ensure ongoing compliance.

Navigating Complex Legal Requirements in the FDD Renewal Process

Navigating the complex legal requirements in the FDD renewal process can be a daunting task. Franchisors must have a solid grasp of franchise laws, regulations, and disclosure requirements. This includes understanding the specific information that must be disclosed in the FDD, such as the franchisors’ financial condition, fees and expenses, and territory rights.

In addition, franchisors must comply with state-specific rules and regulations, which can vary widely. Some states require franchisors to register their FDD with the relevant regulatory agencies before offering franchises in those states, while others have specific disclosure requirements that must be met.

To successfully navigate these complex legal requirements, franchisors should consider engaging the services of experienced franchise attorneys who can guide them through the process and ensure compliance with all legal obligations.

Potential Consequences of Ignoring Legal Blind Spots in FDD Renewals

Ignoring legal blind spots in FDD renewals can have severe consequences for franchisors. Failure to address these blind spots can lead to legal disputes, regulatory investigations, and reputational damage. Franchisors may face lawsuits from disgruntled franchisees, fines from regulatory agencies, and even the revocation of their ability to sell franchises.

By ignoring legal blind spots, franchisors put their entire franchise system at risk. Franchisees may lose confidence in the franchisor’s ability to support and protect their investment, leading to a decline in the overall success and growth of the franchise network.

Essential Documentation and Disclosures for a Comprehensive FDD Renewal Process

A comprehensive FDD renewal process requires essential documentation and disclosures. Franchisors must ensure all necessary elements are included in their FDD to provide potential franchisees with accurate and complete information about the franchise opportunity.

Some essential documentation and disclosures for a comprehensive FDD renewal process include:

– The franchisor’s audited financial statements

– The franchise agreement

– The franchisor’s litigation history, including any pending or resolved lawsuits

– A list of all current franchisees and their contact information

– Any material changes to the franchise system or operating procedures

By including these essential elements in the FDD, franchisors demonstrate transparency and provide potential franchisees with the necessary information to make an informed decision about joining the franchise system.

Case Studies: Lessons Learned from Franchisors’ Experiences with Legal Blind Spots in FDD Renewals

Looking at case studies can provide valuable insights into the consequences of ignoring legal blind spots in FDD renewals. These real-life examples highlight the importance of thorough FDD reviews and compliance with all legal requirements.

In one case, a franchisor failed to update its FDD to reflect material changes to its franchise system. This led to litigation from franchisees who felt misled by outdated information. The franchisor faced reputational damage and had to pay significant legal fees and settlements as a result.

In another case, a franchisor omitted disclosure of pending litigation in its FDD renewal. This oversight resulted in a costly lawsuit and damage to the franchisor’s brand reputation. Had the franchisor addressed this legal blind spot during the renewal process, the consequences could have been avoided.

These case studies serve as cautionary tales for franchisors and emphasize the importance of thorough and comprehensive FDD renewals.

Tips for Conducting a Thorough Legal Review during the FDD Renewal Period

Conducting a thorough legal review during the FDD renewal period is essential for franchisors. Here are some tips to ensure a comprehensive and effective review:

1. Seek the assistance of experienced franchise attorneys who specialize in FDD renewals.

2. Create a checklist of all critical elements that need to be reviewed, such as financial performance representations, disclosure of litigation, and state-specific requirements.

3. Review the franchise agreement to ensure accuracy and compliance with applicable laws.

4. Stay up-to-date with regulatory changes impacting the franchising industry.

5. Engage in open communication with internal stakeholders and franchise attorneys throughout the review process.

By following these tips, franchisors can conduct a thorough legal review and minimize the chances of overlooking critical blind spots during the FDD renewal period.

In conclusion, franchisors must be aware of the legal blind spots that can arise during the FDD renewal process. By understanding the importance of FDD renewal, identifying potential risks, and taking proactive measures, franchisors can mitigate legal exposure, ensure compliance with state and federal laws, and safeguard the long-term success of their franchise system.