In today’s complex and ever-changing world of taxation, the demand for professional tax preparation services continues to soar. With the tax code becoming increasingly intricate, individuals and businesses alike are seeking assistance to navigate through the complicated web of rules and regulations. This growing demand has sparked a significant opportunity for entrepreneurs to enter the tax preparation industry and make a substantial impact. Franchising tax preparation services can provide individuals with the resources and support needed to establish and grow a successful business in this thriving industry.

The Benefits of Franchising Tax Preparation Services

Franchising offers a range of benefits to those looking to venture into the tax preparation industry. One of the key advantages is the access to an established brand and proven business model. Franchisees can leverage the reputation and expertise of an established tax preparation brand, allowing them to enter the market with a recognizable name and a built-in customer base.

Additionally, franchisors often provide comprehensive support, including initial training, ongoing education, and marketing assistance. This support can be invaluable, especially for individuals who may be new to the industry or entrepreneurship as a whole.

Another benefit of franchising is the potential for economies of scale. By joining a franchise network, tax preparation service providers can benefit from bulk purchasing power, streamlined operational systems, and shared resources. This can result in cost savings and increased efficiency, ultimately contributing to the franchisee’s profitability.

Furthermore, franchising presents a lower risk compared to starting an independent business. Franchisors have already faced many of the challenges and hurdles associated with launching a new venture, allowing franchisees to learn from their experiences and minimize the chances of making costly mistakes.

Moreover, franchising offers a built-in support network of fellow franchisees. Franchisees can connect with other individuals in the same industry, sharing best practices, insights, and advice. This network can provide a sense of community and collaboration, allowing franchisees to learn from each other’s successes and challenges.

Lastly, franchising provides access to ongoing research and development. Franchisors continuously invest in improving their products, services, and operational systems. As a franchisee, you can benefit from these ongoing advancements, ensuring that your tax preparation services stay up-to-date and competitive in the market.

How to Start a Franchise in the Tax Preparation Industry

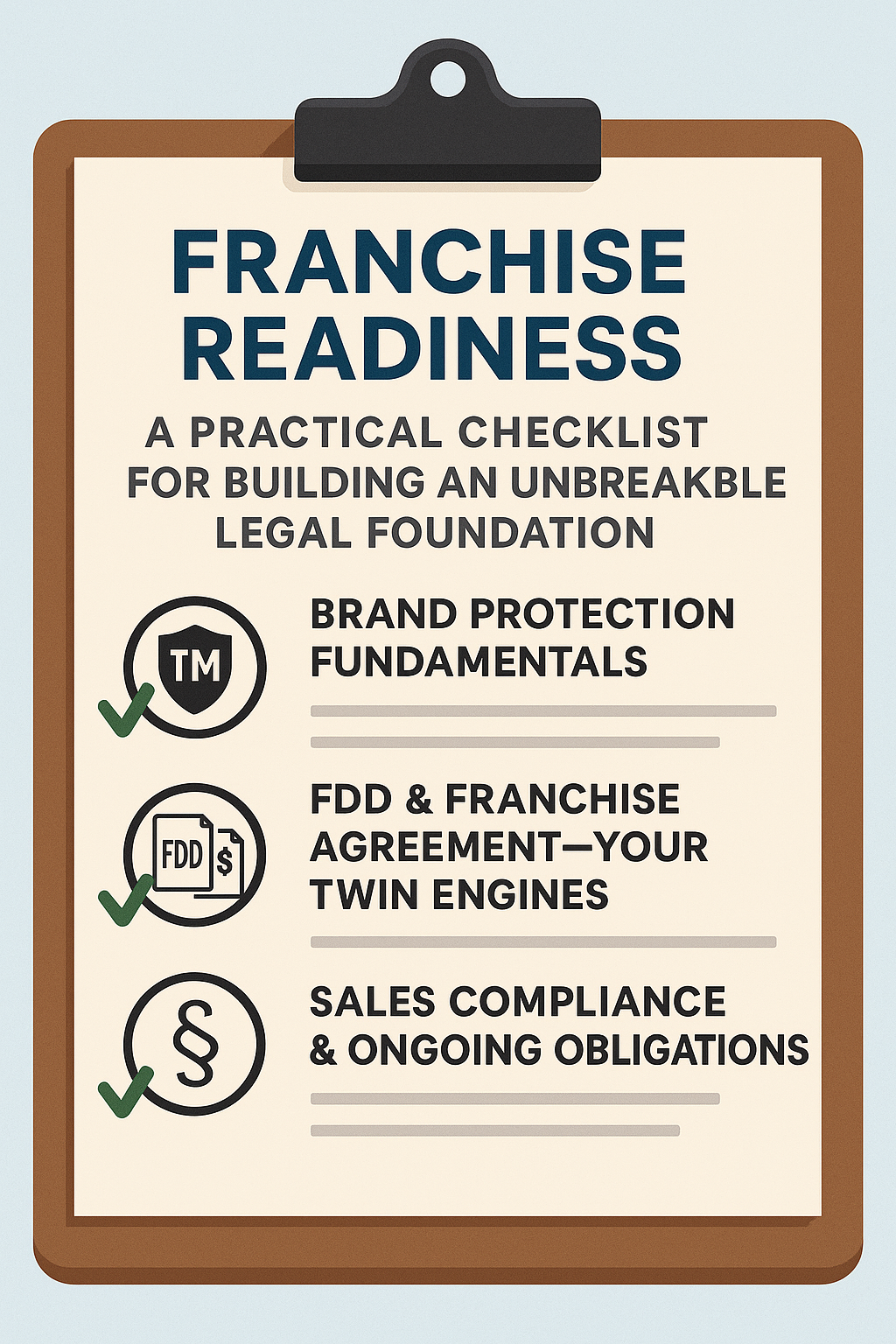

If you’ve decided that franchising a tax preparation service is the right path for you, there are several steps you should take to ensure a successful launch. The first step is to thoroughly research the various tax preparation franchises available in the market. Assess the reputation and track record of different franchisors, as well as the support they provide to their franchisees.

Once you’ve selected a franchise that aligns with your goals and values, it’s crucial to review the franchise agreement and disclosure document carefully. Seek legal advice if necessary to ensure you understand the terms and obligations associated with becoming a franchisee.

After signing the franchise agreement, you will typically be required to attend a comprehensive training program provided by the franchisor. This training will equip you with the necessary skills and knowledge to effectively operate a tax preparation service franchise. It may cover topics such as tax law updates, software training, customer service, and marketing strategies.

In addition to training, you’ll need to secure a suitable location for your franchise. Consider factors such as accessibility, visibility, and proximity to your target market. Depending on the franchisor, you may have the option to operate through a brick-and-mortar office or offer virtual tax preparation services.

Once you have secured a location for your franchise, it’s important to set up the necessary infrastructure and systems to efficiently run your tax preparation service. This includes acquiring the required software and hardware, setting up a reliable internet connection, and establishing a secure data storage and backup system.

Choosing the Right Tax Preparation Franchise for You

The success of your franchise largely depends on selecting the right tax preparation brand. Consider your own strengths, interests, and values when evaluating potential franchises. Look for a franchisor that aligns with your professional goals and offers a support system that matches your needs.

It’s also essential to research the financial viability of the franchise opportunity. Evaluate the initial investment required, ongoing fees, and potential revenue-generating opportunities. Review the financial statements and disclosures provided by the franchisor to assess the profitability and potential return on investment of the franchise.

Customer satisfaction and brand recognition are critical factors to consider as well. Look for franchises that have a strong reputation and positive customer reviews. A well-known brand can help attract and retain clients, giving you a head start in building your customer base.

Furthermore, consider the level of support provided by the franchisor. Look for a franchise that offers comprehensive training programs, ongoing education, and marketing assistance. Additionally, assess the level of ongoing support you will receive, such as operational guidance, technology support, and access to a network of fellow franchisees for advice and mentorship.

Another important aspect to consider when choosing a tax preparation franchise is the target market. Evaluate the demographics and needs of the local community where you plan to operate your franchise. Understanding the specific tax requirements and preferences of your target market will help you tailor your services and marketing strategies to attract and retain clients.

In addition, it’s crucial to assess the competition in the area. Research other tax preparation businesses in the vicinity and analyze their strengths and weaknesses. Identify any gaps or opportunities in the market that you can capitalize on with your franchise. Differentiating yourself from the competition will be key to attracting clients and establishing a strong presence in the local market.