Franchising can be a mutually beneficial business arrangement for both franchisors and franchisees. However, when it comes to setting franchise fees and royalties, franchisors must navigate a complex legal landscape to ensure compliance and fairness. In this article, we will explore the various legal considerations that franchisors need to keep in mind when determining franchise fees and royalties.

Understanding the legal framework for franchise fees and royalties

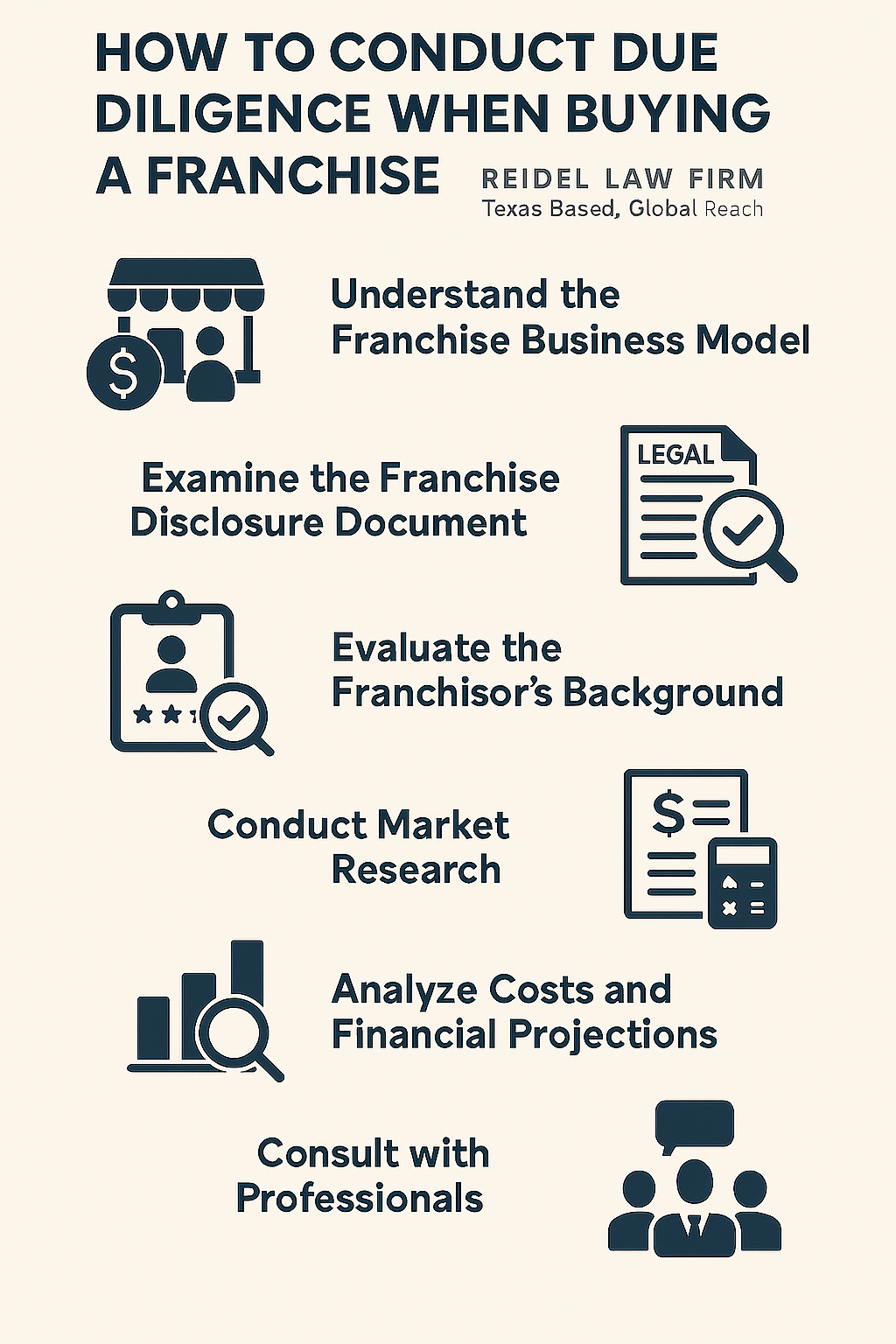

Franchisors must have a solid understanding of the legal framework surrounding franchise fees and royalties. This includes familiarizing themselves with relevant federal and state laws, such as the Federal Trade Commission’s Franchise Rule, which requires franchisors to provide prospective franchisees with a detailed Franchise Disclosure Document (FDD). The FDD should include information on franchise fees and royalties, ensuring transparency and informed decision-making for prospective franchisees.

In addition to federal regulations, franchisors must also comply with state-specific franchise laws that may impose additional disclosure requirements and restrictions on fee structures. Therefore, franchisors must carefully review and adhere to the legal requirements of each jurisdiction in which they operate to avoid potential legal challenges or penalties.

The importance of transparency in setting franchise fees and royalties

Transparency is key when it comes to setting franchise fees and royalties. Franchisors should provide prospective franchisees with clear and comprehensive information about the fees and royalties they will be required to pay. This includes a breakdown of all costs associated with operating the franchise, such as initial franchise fees, ongoing royalties, advertising fees, and any other applicable charges.

By providing transparent information, franchisors can help prospective franchisees make informed financial decisions and build trust in the franchisor-franchisee relationship. Moreover, transparency can reduce the risk of disputes or legal challenges related to undisclosed or hidden fees.

Compliance with franchise disclosure laws and regulations

Franchisors must ensure compliance with franchise disclosure laws and regulations. These laws require franchisors to provide prospective franchisees with the FDD, which contains crucial information about the franchise opportunity. The FDD typically includes details on the franchisor’s financial performance, litigation history, and, importantly, information on franchise fees and royalties.

Franchisors should ensure that the information provided in the FDD is accurate and up-to-date. Failure to comply with franchise disclosure laws can result in serious legal consequences, including rescission rights for franchisees or even lawsuits for misrepresentation.

Balancing profitability and fairness in setting franchise fees and royalties

Setting franchise fees and royalties requires a delicate balance between profitability and fairness. While franchisors aim to generate profits, it is crucial to avoid imposing excessive or unfair fees on franchisees. Imposing fees that do not align with the value provided by the franchisor can lead to strained relationships and potential legal disputes.

Franchisors should consider various factors when determining the appropriate fee structure, such as the nature of the business, industry standards, and the support and resources provided to franchisees. By striking a balance between profitability and fairness, franchisors can foster a positive franchisee-franchisor relationship and enhance overall system success.

Factors to consider when determining the appropriate franchise fee structure

When establishing a franchise fee structure, franchisors should take into account several factors to ensure fairness and profitability. Firstly, they should evaluate the initial investment required from franchisees, including costs for training, equipment, and real estate. This assessment helps determine an appropriate initial franchise fee.

Secondly, franchisors should consider ongoing support and services provided to franchisees. If a franchisor offers robust support, including marketing assistance and back-end systems, higher ongoing royalty fees may be justified. However, these fees must be reasonable and commensurate with the value received by franchisees.

Furthermore, franchisors should review industry benchmarks and conduct market research to gauge the typical range of franchise fees and royalties in their sector. This analysis can help ensure that the fees charged are competitive and reflective of industry standards.

The impact of franchise fees and royalties on franchisee profitability

Franchise fees and royalties directly impact franchisee profitability. Excessive or unreasonably high fees can erode a franchisee’s bottom line and hinder their ability to succeed. Therefore, franchisors should carefully assess the financial impact of their fee structure on franchisee profitability, especially when determining ongoing royalties.

Franchisees rely on their ability to generate revenue and achieve a reasonable return on investment. It is essential for franchisors to strike a balance between collecting fees that uphold their business model and supporting their franchisees in building profitable operations. Ongoing collaboration, regular financial performance reviews, and open lines of communication between franchisors and franchisees can help address any concerns regarding profitability.

Ensuring compliance with antitrust laws when setting franchise fees and royalties

Franchisors must also consider antitrust laws when determining and implementing franchise fees and royalties. Antitrust laws aim to promote fair competition and prevent anti-competitive behavior that may harm consumers or limit market competition.

Franchisors should avoid engaging in price-fixing or setting fees and royalties in a manner that could be construed as anti-competitive. Collaborating with legal counsel and conducting antitrust compliance reviews can help franchisors navigate the complexities of antitrust laws and ensure their fee structures comply with relevant regulations.

The role of market research in determining competitive franchise fees and royalties

Market research plays a vital role in setting competitive franchise fees and royalties. Franchisors should conduct thorough market analysis to gain insights into competitor fee structures within their industry. Understanding the pricing landscape allows franchisors to position their fees competitively while maintaining profitability.

Market research helps franchisors answer critical questions such as the average initial franchise fee charged by competitors, the industry standard for ongoing royalties, and any additional fees or charges commonly imposed. Armed with this information, franchisors can make informed decisions when setting their fee structure, ensuring they remain competitive within their market niche.

Protecting intellectual property rights through franchise fees and royalties

Franchise fees and royalties enable franchisors to protect their intellectual property (IP) rights. Intellectual property includes trademarks, trade secrets, copyrights, and patented technologies that form the foundation of a successful franchise system.

By charging franchise fees and royalties, franchisors can invest in maintaining and protecting their IP. This may involve ongoing brand management, marketing initiatives, and research and development to enhance the franchise system. Franchise fees and royalties help fund these essential activities, ensuring the continued relevance and strength of the franchisor’s IP.

Addressing potential legal challenges related to excessive or unfair fees

Even with the best intentions, franchisors may face legal challenges related to their fee structures. These challenges can arise if franchisees perceive the fees to be excessive or unfair, or if there is a breach of contractual obligations by either party.

To mitigate legal risks, franchisors should ensure that their fee structures are reasonable, transparent, and clearly articulated in the franchise agreement. Engaging in open and honest communication with franchisees can help address concerns early on and potentially prevent legal disputes from escalating.

Negotiating fair terms for franchise fees and royalty payments

Negotiating fair terms for franchise fees and royalty payments is crucial for both franchisors and prospective franchisees. Franchise agreements should clearly outline the fee structure, payment terms, and any circumstances that may warrant fee adjustments.

During the negotiation process, franchisors should consider factors such as the franchisee’s financial capacity, projected revenue, and the value provided by the franchisor. Employing a collaborative and fair approach to fee negotiations fosters a positive relationship and sets the foundation for a successful long-term partnership between the franchisor and franchisee.

Legal considerations for international franchisors when setting cross-border fees and royalties

International franchisors face unique legal considerations when setting cross-border franchise fees and royalties. Operating in different jurisdictions means they must navigate varying legal requirements, tax regulations, and currency exchange fluctuations.

Franchisors expanding globally should seek legal counsel knowledgeable in international franchising to help ensure compliance with local laws. Seeking guidance will help address issues such as foreign exchange risk, cross-border tax implications, and local market dynamics that may affect fee structures. Complying with applicable laws is essential for international franchisors to establish a strong international presence while maintaining legal and financial security.

Understanding the legal implications of changing or adjusting franchise fees and royalties

Franchisors occasionally need to consider changing or adjusting their franchise fees and royalties to remain competitive, respond to evolving market conditions, or adapt to changes in their business model.

However, franchisors must understand the legal implications of such changes. Depending on the franchise agreement and applicable laws, certain modifications may require franchisee consent or adequate notice periods. Violating contractual obligations or failing to comply with legal requirements can expose franchisors to legal risks, including breach of contract claims and potential damages.

Maintaining compliance with state-specific regulations on franchise fees and royalties

Franchise fees and royalties are subject to state-specific regulations. Franchisors must ensure compliance with these regulations, which can vary significantly from one state to another.

For example, certain states may impose caps on the maximum percentage of ongoing royalties that can be charged. Others may require specific fee disclosures or restrict the ability to modify fees without franchisee consent. Franchisors must thoroughly research and understand the regulations in each state they operate to avoid potential legal disputes or penalties.

Evaluating the potential impact of future legal developments on franchise fee structures

Legal developments can have a significant impact on franchise fee structures. Franchisors need to stay informed about potential legislative or regulatory changes that may affect the legality or enforceability of their fee arrangements.

Franchisors can draw on industry associations, legal counsel, or trade publications to stay abreast of any proposed or enacted legislation that may impact franchise fee structures. Being proactive and prepared allows franchisors to adapt their fee arrangements in compliance with new legal requirements.

Ensuring adequate disclosure of fee breakdowns in the Franchise Disclosure Document (FDD)

The FDD plays a crucial role in disclosure of fees and royalties to prospective franchisees. Franchisors should provide adequate and detailed information on fee calculations and breakdowns in the FDD to ensure clarity and transparency.

The fee breakdown should delineate the various components of the franchise fees and royalties, such as initial franchise fees, ongoing royalty percentages, advertising contributions, and any other relevant charges. This level of disclosure helps franchisees understand their financial obligations and make informed investment decisions.

Navigating the legal complexities of multi-unit franchising when determining fees and royalties

Multi-unit franchising introduces unique legal considerations when determining fees and royalties. Franchisors must carefully evaluate the financial arrangements for franchisees operating multiple locations.

Factors such as economies of scale, shared resources, and overall system support come into play when calculating fees and royalties for multi-unit franchisees. Ensuring fairness and aligning fees with the value provided to multi-unit franchisees is vital to maintain a healthy franchisor-franchisee relationship.

Mitigating legal risks through clear contractual agreements regarding fee adjustments

Franchisors can mitigate legal risks by incorporating clear contractual agreements regarding fee adjustments into their franchise agreements. These agreements should address the circumstances under which fees may be adjusted, the notice periods required, and any other relevant terms and conditions.

Providing ample transparency and clarity in contractual agreements helps minimize misunderstandings and potential legal disputes. Additionally, franchisors should maintain open lines of communication and engage in collaborative discussions with franchisees to address any concerns related to fee adjustments.

The role of legal counsel in reviewing, negotiating, and documenting franchise fee arrangements

Legal counsel plays a crucial role in ensuring franchisors navigate the legal complexities of franchise fee arrangements. Engaging qualified legal professionals who specialize in franchise law helps franchisors review, negotiate, and document fee arrangements accurately and in compliance with applicable laws.

Legal counsel can provide invaluable guidance in drafting franchise agreements, reviewing disclosure documents, and ensuring that fee structures meet legal requirements. Their expertise helps minimize legal risks and ensures that franchisors adhere to best practices in setting franchise fees and royalties.

It is important to note that while this article provides an extensive overview of legal considerations for franchisors when setting franchise fees and royalties, it is not a substitute for legal advice. Franchisors should consult with their legal counsel to obtain specific guidance based on their unique circumstances and local regulations.