Import classification codes play a crucial role in the world of international trade. By properly categorizing goods for import, businesses can ensure compliance with customs regulations and accurately determine the applicable duties and taxes. However, import classification codes are not static; they undergo changes and updates on a regular basis. Staying informed about these changes and understanding their implications is essential for importers and customs professionals alike.

Understanding the Basics of Import Classification Codes

At the core of import classification codes is the Harmonized System (HS), a globally recognized system developed by the World Customs Organization (WCO). The HS assigns unique codes to products based on their characteristics, such as their composition, intended use, and manufacturing process. Importers use these codes to identify the correct tariff rates and regulatory requirements for their goods.

To navigate the HS successfully, importers must have a solid understanding of its structure. The HS is organized into chapters, with each chapter addressing a specific product category. These chapters are further divided into headings, subheadings, and statistical codes, offering increasingly detailed classifications for different products.

The Importance of Accurate Import Classification Codes

Accurate import classification codes are crucial for several reasons. First and foremost, they determine the customs duties and taxes that businesses have to pay when importing their goods. Incorrect classification can lead to overpaying or underpaying duties, jeopardizing a company’s bottom line. Moreover, customs authorities conduct audits and verifications based on classification codes, and discrepancies can result in penalties, fines, or even legal issues.

Beyond financial implications, accurate classification codes enable customs authorities to monitor and control the flow of goods across borders. By properly classifying imports, governments can identify and regulate certain products, such as controlled substances or hazardous materials, ensuring public safety and compliance with relevant regulations.

How Import Classification Codes Impact Customs Duties and Taxes

Import classification codes directly impact the amount of customs duties and taxes businesses have to pay. Each classification code is associated with a specific tariff rate, which determines the percentage of the customs value that must be paid in duties. Therefore, assigning the correct classification code is essential to avoid overpaying or underpaying duties.

Moreover, import classification codes also influence the application of other trade measures, such as antidumping or countervailing duties, which protect domestic industries from unfair trade practices. Incorrectly classifying imports can lead to unintended consequences, such as the imposition of additional duties or delays in customs clearance.

Common Challenges in Import Classification Code Management

Managing import classification codes effectively can be a daunting task for businesses. One common challenge is the complexity of the HS, which contains thousands of codes spanning a wide range of products. Accurately identifying the correct classification code for a specific product requires in-depth knowledge, research, and interpretation.

Additionally, as global trade and technology evolve, new products and industries emerge, making it necessary to update and adapt import classification codes accordingly. Monitoring and staying up to date with these changes can be overwhelming, especially for companies with a high volume of imports or those operating in multiple markets.

Recent Updates to Import Classification Codes: What You Need to Know

Keeping up with recent updates to import classification codes is crucial for importers and customs professionals. Regular updates ensure that the HS remains current and aligns with industry changes and technological advancements.

Recent updates to the HS have introduced new codes and modified existing ones to reflect emerging product categories and evolving trade practices. For example, advancements in technology have led to the creation of new electronic devices that require unique classification codes. Additionally, changes in manufacturing processes or materials used may result in modifications to existing codes.

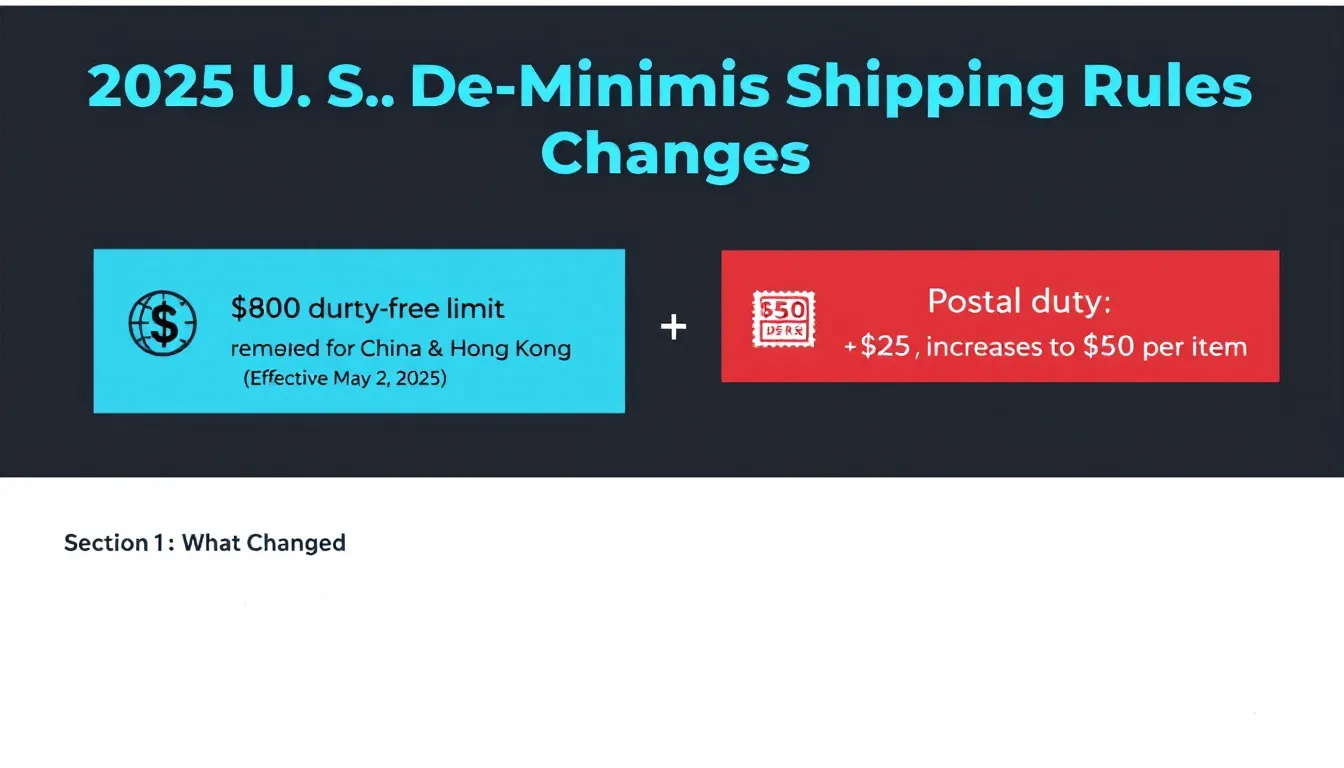

Key Changes in Import Classification Codes and Their Implications

Understanding the key changes in import classification codes and their implications is vital for importers seeking to maintain compliance and optimize their operations. Some key changes include the introduction of new tariff lines, revisions to product descriptions, and realignments of subheadings or statistical codes.

For importers, these changes can impact the determination of the correct duty rates, customs documentation requirements, and the eligibility for preferential trade agreements. Being aware of these changes helps businesses adjust their classification practices, ensure accurate duty calculations, and avoid potential non-compliance issues.

Navigating the Harmonized System (HS) for Import Classification Codes

Navigating the HS effectively requires a systematic approach that combines knowledge, resources, and technology. Importers can start by understanding the structure of the HS and familiarizing themselves with its chapters, headings, and subheadings. This foundational knowledge serves as a basis for accurate classification.

Additionally, businesses can leverage various tools and resources to simplify the classification process. Automated customs management software, online databases, and expert advice can provide valuable assistance in finding the correct classification codes. Collaborating with customs authorities and seeking their guidance can also help resolve any uncertainties or disputes regarding classification.

Best Practices for Ensuring Compliance with Import Classification Codes

Ensuring compliance with import classification codes requires establishing robust procedures and following best practices. Here are some key recommendations:

- Invest in training and education: Regular training and education programs for employees involved in import classification are essential. Knowledgeable staff can make informed decisions and mitigate compliance risks.

- Develop an internal classification guide: Create a comprehensive guide that outlines the classification methodology, provides examples, and references relevant resources. This guide can serve as a reference for consistent and accurate classification across the organization.

- Conduct periodic self-audits: Regularly review and audit the accuracy of classification codes assigned to imports. Identify any discrepancies or errors and take corrective measures promptly.

- Leverage technology: Consider implementing customs management software or classification tools that automate and streamline the classification process. These solutions can help reduce errors and enhance efficiency.

Strategies for Efficiently Updating and Managing Import Classification Codes

Managing import classification codes efficiently requires implementing proactive strategies that enable timely updates and accurate classification. Here are some strategies to consider:

- Establish a centralized system: Create a centralized repository or database to store and organize import classification codes. This system should allow easy access and facilitate updates whenever changes occur.

- Monitor regulatory updates: Stay informed about regulatory updates, trade policy changes, and modifications to the HS. Regularly review official publications, subscribe to relevant newsletters or alerts, and participate in industry forums or conferences to stay up to date.

- Collaborate with industry partners: Exchange information and best practices with other importers, customs professionals, and industry associations. Collaborative efforts can help identify and address common challenges in import classification code management.

- Assign dedicated personnel: Designate specific individuals or teams responsible for monitoring changes, updating classification codes, and ensuring compliance. Allocate resources to support these personnel in their role.

Leveraging Technology to Streamline Import Classification Code Processes

Technology plays a significant role in streamlining import classification code processes. Customs management software and automation solutions can greatly enhance efficiency, accuracy, and compliance.

These technologies often include features such as databases of classification codes, product description libraries, and rule-based engines that facilitate the identification of the correct code. Automation can also reduce manual data entry, improve data integrity, and enhance overall processing speed.

The Role of Automation in Maintaining Up-to-Date Import Classification Codes

Automation plays a crucial role in maintaining up-to-date import classification codes. By leveraging automation tools, businesses can reduce the reliance on manual processes and ensure real-time updates.

Automated systems can monitor and pull updates from official sources, automate code assignments based on predefined rules, and provide alerts or notifications when changes occur. This proactive approach significantly reduces the risk of using outdated codes and streamlines the overall management of classification codes.

Industry-Specific Considerations for Import Classification Code Updates

When it comes to import classification code updates, different industries may face unique considerations. Certain sectors, such as pharmaceuticals, electronics, or textiles, often deal with rapidly evolving products or complex regulatory frameworks. Staying informed about industry-specific changes and requirements is essential for accurate classification.

Industry associations, specialized consultants, and government agencies can provide valuable insights and guidance regarding industry-specific considerations. Engaging in industry forums or attending sector-specific training sessions can also enhance understanding and facilitate discussions with peers facing similar challenges.

Case Studies: Lessons Learned from Errors in Import Classification Codes

Case studies showcasing errors in import classification codes can offer valuable lessons for importers seeking to improve their classification processes. Examining real-world scenarios and their consequences helps highlight the importance of accuracy and staying informed.

Common errors include assigning incorrect codes due to misinterpretation of product characteristics, inadequate research, or reliance on outdated information. These errors often result in unexpected duties, shipment delays, and compliance issues. Learning from such case studies can help implement preventive measures and enhance classification accuracy.

Collaborating with Customs Authorities for Accurate Import Classification Codes

Collaboration with customs authorities plays a significant role in ensuring accurate import classification codes. Customs officials possess in-depth knowledge and insights into regulatory requirements, making them valuable resources for importers.

Establishing relationships with customs authorities can help address classification-related queries, confirm correct code assignments, and seek advice on challenging cases. Regular communication and cooperation strengthen compliance, foster better understanding of regulatory expectations, and mitigate issues arising from misinterpretation or disputes.

Training and Education for Effective Management of Import Classification Codes

Training and education are vital for effective management of import classification codes. Businesses should invest in comprehensive training programs that cover the fundamentals of classification, regulatory updates, and best practices.

Training can include workshops, seminars, e-learning modules, and hands-on exercises to enhance knowledge and practical skills. Continuous education ensures that employees remain current with changing regulations and new industry developments.

Expert Tips for Staying Informed about Changes in Import Classification Codes

Staying informed about changes in import classification codes requires proactive efforts and awareness. Here are some expert tips to consider:

- Monitor official sources: Regularly review updates from customs authorities, such as notices, circulars, or official publications. These sources often provide information about changes, clarifications, or interpretations of import classification codes.

- Subscribe to industry newsletters: Subscribe to newsletters or publications from industry associations, trade organizations, or customs brokers. These resources provide timely insights into trade policy changes, regulatory updates, and emerging trends.

- Engage in industry forums: Participate in industry forums or online communities where professionals discuss import classification challenges and share knowledge. Learning from peers and engaging in discussions can help identify trends and potential upcoming changes.

- Network with customs professionals: Establish connections with customs professionals, trade compliance specialists, or consultants who possess expertise in import classification. Networking events, conferences, or industry seminars offer opportunities for knowledge exchange and staying up to date.

The Future of Import Classification Codes: Emerging Trends and Technologies

The future of import classification codes holds various emerging trends and technologies that will shape the way businesses manage and stay informed about changes. Some key developments include:

- Artificial intelligence and machine learning: These technologies can automate the identification of classification codes by extracting information from product descriptions, images, or technical specifications. AI algorithms can learn from patterns and continuously improve accuracy.

- Data sharing and collaboration: Enhanced digital collaboration between importers, customs authorities, and industry stakeholders can facilitate real-time information sharing, leading to better classification practices and regulatory compliance.

- Blockchain technology: Blockchain’s decentralized ledger can provide increased transparency and traceability in import classification processes. Immutable records can enhance the accuracy of code assignments and simplify data exchange among supply chain participants.

- Predictive analytics: Leveraging data analytics and historical import data can assist in predicting future changes or updates to import classification codes. This enables businesses to proactively prepare for regulatory adjustments and minimize disruptions.

In conclusion, staying informed about changes and updates to import classification codes is imperative for importers and customs professionals. Accurate classification ensures compliance, minimizes financial risk, and promotes smooth customs clearance. By understanding the basics of import classification codes, their implications, and employing best practices, businesses can navigate the HS effectively, leverage technology, and adapt to industry-specific considerations. Regular training, collaboration with customs authorities, and staying informed about emerging trends contribute to effective management of import classification codes to drive operational efficiency and compliance.