Franchising can be an excellent option for financing the expansion of your business. It allows you to replicate your successful business model and leverage the resources of franchisees to fuel growth. However, before diving into franchising, it is essential to have a solid understanding of the basics and explore the various benefits and factors to consider.

Understanding the Basics of Franchising for Business Expansion

Franchising is a business model where the franchisor grants the rights to operate a business under their established brand, systems, and processes to a franchisee. In exchange, the franchisee pays initial franchise fees and ongoing royalties. By franchising your business, you can rapidly expand your brand’s footprint without incurring significant upfront costs or assuming the operating responsibilities of each location.

Franchising offers several advantages, including access to capital, a motivated and invested pool of franchisees, and the ability to tap into the local knowledge and expertise of franchisees. However, franchising is not suitable for every business. It is crucial to evaluate whether your business is highly scalable, has a proven track record, and possesses a unique value proposition that can be replicated by franchisees.

Exploring the Benefits of Franchising as a Financing Option

Franchising offers numerous benefits for financing business expansion. By franchising, you can access the capital required to open new locations without bearing the entire financial burden. Franchisees typically invest their own capital into the business, which reduces your financial risk. Additionally, franchisees are motivated to succeed as they have a vested interest in the success of their individual franchise units.

Franchising also allows you to leverage the local knowledge and connections of franchisees. They bring valuable insights about the local market, customer preferences, and cultural nuances, which can enhance your brand’s growth potential. The scalability of franchising enables you to expand rapidly, reaching a broader customer base and increasing your market penetration.

Factors to Consider Before Choosing Franchising as a Funding Method

Before opting for franchising as a financing method, it is crucial to consider several factors. Firstly, assess whether your business model is easily replicable and can be successfully operated by franchisees. Conduct market research to determine the demand for your products or services in potential franchise locations.

Another critical factor is the availability of resources to support franchisees. This includes creating a comprehensive training program, developing operational manuals, and establishing ongoing support systems. You must also ensure that your brand has a strong reputation and a recognizable identity to attract franchisees.

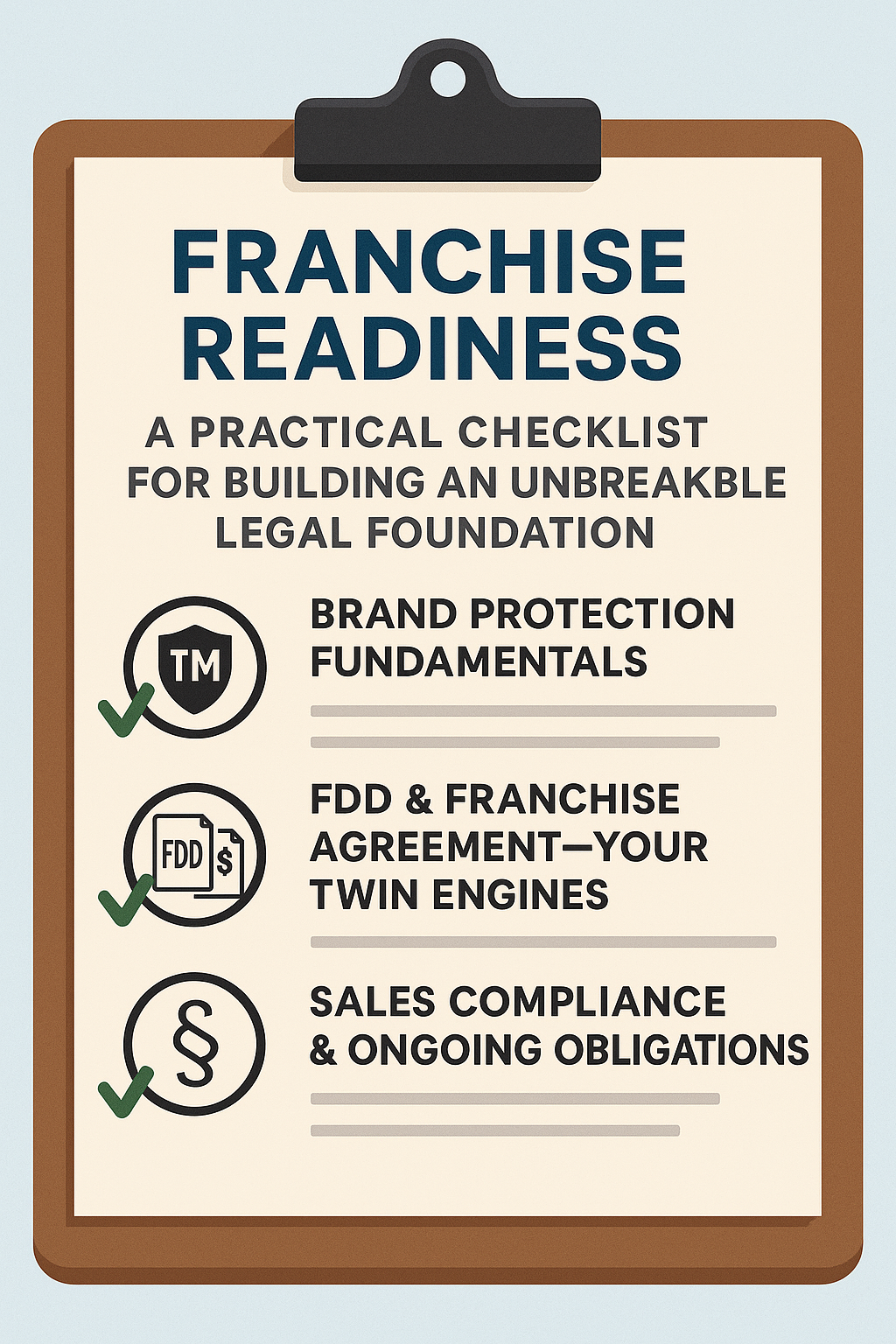

Furthermore, franchising requires legal and regulatory considerations. It is essential to consult with franchise attorneys to understand the legal requirements and obligations associated with franchising your business. Compliance with franchise laws and regulations will help protect your business and prevent potential legal issues in the future.

Evaluating the Financial Viability of Franchise Expansion for Your Business

Before embarking on franchise expansion, it is crucial to conduct a thorough financial analysis. Evaluate the financial performance of your existing business and determine if it is profitable and sustainable. Consider the costs associated with franchise development, including legal fees, training expenses, and marketing support.

Assess the potential return on investment (ROI) from franchising by estimating the initial franchise fees, ongoing royalties, and the potential revenue generated by franchisees. Analyzing the financial viability will help you determine if franchising is a viable option to finance your business expansion.

Creating a Solid Business Plan to Attract Franchise Investors

To attract potential franchise investors, it is crucial to have a solid business plan in place. A well-crafted business plan provides detailed information about your franchise concept, market analysis, financial projections, and marketing strategies. It should showcase the uniqueness and profitability of your business model to entice potential franchisees.

Include information about the training and ongoing support you will provide to franchisees, as well as your track record and success stories. The business plan is your opportunity to demonstrate the potential return on investment and persuade investors to join your franchise network.

Securing Funding Through Franchise Financing Options

There are various options to secure funding for franchise expansion. Traditional bank loans, Small Business Administration (SBA) loans, and alternative financing options are some avenues to explore.

Traditional bank loans are an established method of financing and may offer competitive interest rates. However, they often require collateral and have strict eligibility criteria. SBA loans, on the other hand, are government-backed loans designed to support small businesses, including franchises. They offer more flexible terms and lower down payments, making them an attractive option for franchisees.

Understanding Small Business Administration (SBA) Loans for Franchising

The Small Business Administration (SBA) offers multiple loan programs specifically tailored to support franchise financing. The 7(a) Loan Program and the 504 Loan Program are popular options for franchisees.

The 7(a) Loan Program provides general-purpose financing, including funds for working capital, equipment purchases, and expansion. The program guarantees a portion of the loan, making it more accessible for franchisees who may not meet traditional lending requirements.

The 504 Loan Program focuses on financing long-term fixed assets, such as land, buildings, and equipment. It offers lower down payments and long repayment terms, making it ideal for franchisees investing in real estate.

Alternative Financing Options for Expanding Your Business through Franchises

In addition to traditional bank loans and SBA loans, alternative financing options are becoming increasingly popular for franchise expansion. Crowdfunding, for instance, allows you to raise funds from a large number of individuals who believe in your franchise concept. This approach can provide not only financing but also valuable brand exposure and support from a community of individuals passionate about your business.

Other alternative financing options include equipment financing, merchant cash advances, and business lines of credit. These options offer flexibility and tailored solutions to meet your specific financial needs.

Crowdfunding: A Modern Approach to Financing Franchise Expansion

Crowdfunding has revolutionized the way businesses can raise capital for expansion. Through crowdfunding platforms, you can pitch your franchise concept to potential investors worldwide. By offering rewards or equity in your franchise, you can attract funds from individuals who believe in your business and want to be part of its growth.

Crowdfunding requires a compelling and well-executed marketing strategy to effectively communicate your franchise concept and attract potential investors. It offers an opportunity to leverage social media and online networks to reach a wide audience, generate excitement, and secure the funding needed for your franchise expansion.

Attracting Potential Investors with a Compelling Franchise Offering

To attract potential investors and franchisees, it is crucial to create a compelling franchise offering. Clearly articulate the benefits of joining your franchise network, such as proven systems, ongoing support, and a well-known brand. Highlight the potential return on investment, market demand for your products or services, and the competitive advantage your franchise brings.

Investors are looking for a lucrative opportunity, so demonstrate how your franchise can provide them with a profitable business venture. Use market data, success stories, and testimonials to bolster your claims and build credibility.

Navigating the Legal and Regulatory Aspects of Financing Your Franchise Expansion

Franchising is subject to legal and regulatory requirements to protect both franchisors and franchisees. It is essential to navigate these aspects carefully to ensure compliance and mitigate potential risks.

Consulting with franchise attorneys is crucial to understand the legal obligations associated with franchising your business. They can assist with drafting franchise agreements, disclosure documents, and complying with federal and state laws. A solid legal foundation will protect your brand, prevent legal disputes, and ensure a smooth franchise expansion process.

Conducting Due Diligence on Potential Franchisees to Ensure Financial Success

Choosing the right franchisees is vital for the long-term success of your franchise network. Conducting thorough due diligence on potential franchisees is essential to minimize financial risks and protect your brand’s reputation.

Screening potential franchisees involves evaluating their financial stability, business acumen, and alignment with your brand’s values and vision. Review their credit history, conduct interviews, and assess their understanding of the franchise business model. Tools like background checks and financial assessments can provide valuable insights into their ability to operate a successful franchise unit.

Building Strong Relationships with Lenders and Investors for Future Growth

Maintaining strong relationships with lenders and investors is crucial for future growth and expansion. Communicate proactively with lenders to keep them informed about your franchise’s progress and financial performance. Provide them with regular updates and reports, demonstrating your commitment to transparency and open communication.

Similarly, nurture relationships with franchise investors. Provide ongoing support and training to ensure their success, as it will reflect positively on your franchise network as a whole. Create a culture of collaboration and open dialogue to foster long-term partnerships with investors and position your franchise for continued growth.

Analyzing the Risks and Rewards of Financing Your Business through Franchising

Financing your business through franchising brings both rewards and risks. It is essential to conduct a comprehensive analysis to weigh the potential benefits against the potential challenges.

Rewards include increased market reach, diversified revenue streams, and minimal upfront investment. With the right franchisees, your brand can expand rapidly, generating significant profits. However, risks include maintaining consistent brand standards across locations, handling disputes with franchisees, and potential brand reputation damage caused by poorly performing franchise units.

By carefully analyzing the risks and rewards, you can make an informed decision about whether franchising is the right financing method for your business expansion.

Implementing Effective Marketing Strategies to Attract Potential Franchisees

Marketing plays a crucial role in attracting potential franchisees to your brand. Develop a comprehensive marketing strategy that showcases the unique value proposition of your franchise and differentiates it from competitors.

Utilize a mix of online and offline marketing tactics, including digital advertising, social media campaigns, trade shows, and industry events. Highlight success stories, testimonials, and media coverage to build credibility and generate interest in your franchise offering. Invest in professional branding materials, including brochures, websites, and videos, to convey your brand’s professionalism and appeal to potential franchisees.

Leveraging Technology to Streamline Operations and Increase Profits in Your Franchise

Technology can play a significant role in streamlining operations and increasing profits in your franchise. Implementing a robust franchise management software can centralize operations, facilitate communication between franchisor and franchisees, and ensure consistency across locations.

Explore technology solutions that optimize various aspects of your franchise, such as point-of-sale systems, inventory management software, and customer relationship management (CRM) tools. These tools can streamline processes, enhance efficiency, and provide valuable insights to drive growth and profitability.

Measuring and Tracking Key Performance Indicators (KPIs) for Successful Expansion

Measuring and tracking key performance indicators (KPIs) is crucial for successful franchise expansion. Identify metrics that align with your franchise goals and track them regularly to monitor progress and make informed decisions.

Important KPIs may include revenue growth, customer satisfaction, average unit volume (AUV), franchisee profitability, and brand recognition. Analyzing these metrics can provide insights into the health and performance of your franchise network, enabling you to identify areas of improvement and devise strategies for sustained growth.

Case Studies: Real-Life Examples of Businesses Successfully Financed through Franchising

Examining real-life case studies can provide valuable insights into how businesses have successfully financed their expansion through franchising. These examples offer practical lessons and inspiration for aspiring franchisors.

Case studies may highlight franchise success stories in various industries, such as food and beverage, retail, and service-based businesses. They can showcase the challenges overcome, strategies implemented, and financial outcomes achieved through franchising.

By studying these case studies, you can gain an in-depth understanding of how franchising can be a viable financing option for your business expansion.

In conclusion, financing the expansion of your business through franchising can open doors to growth and success. Understanding the basics, exploring the benefits, and considering the various factors involved are critical. By creating a solid business plan, securing funding through various options, and navigating the legal aspects, you can lay the foundation for a successful franchising journey. Leveraging marketing strategies, technology, and measuring KPIs will fuel expansion and drive profitability. Ultimately, analyzing real-life case studies will inspire and guide you towards financing your business through franchising.