In the realm of international trade, import classification plays a vital role in ensuring smooth customs procedures and accurate assessment of duties and tariffs. However, this complex process is not without its challenges. To effectively address these challenges and ensure compliance, import classification professionals must possess a deep understanding of the subject matter and employ strategies that promote accuracy and efficiency. In this article, we will explore the intricacies of import classification, discuss the common challenges faced in this field, and provide insights into proven techniques for resolving misclassification issues. By delving into industry-specific considerations, international trade regulations, and emerging trends and technologies, this comprehensive guide aims to equip import classification professionals with the knowledge and tools necessary to navigate this complex terrain effectively.

Understanding Import Classification and Its Importance

Import classification refers to the categorization of goods imported into a country according to a standardized classification system. It is a critical process that ensures proper documentation, facilitates international trade, and enables customs authorities to apply the appropriate duties and tariffs. By accurately classifying goods, businesses can avoid delays in customs clearance, reduce the risk of penalties, and maintain compliance with trade regulations. Understanding the significance of import classification is the first step towards overcoming the challenges associated with it.

Proper import classification is essential for accurate trade statistics and economic analysis. It allows governments to track the types and quantities of goods being imported, which helps in making informed policy decisions and assessing the impact of international trade on the domestic economy. Additionally, import classification plays a crucial role in enforcing trade agreements and regulations, such as those related to product safety, intellectual property rights, and environmental standards. Therefore, businesses must invest time and resources in understanding import classification to ensure smooth and compliant international trade operations.

The Basics of Import Classification: Definition and Purpose

At its core, import classification involves assigning a Harmonized System (HS) code to each product being imported. The HS code, comprising a combination of digits and letters, provides a standardized method for identifying and classifying goods. Its primary purpose is to streamline international trade by ensuring consistent classification across different countries. By assigning the correct HS code, businesses can accurately communicate crucial information about the nature, composition, and intended use of the imported goods.

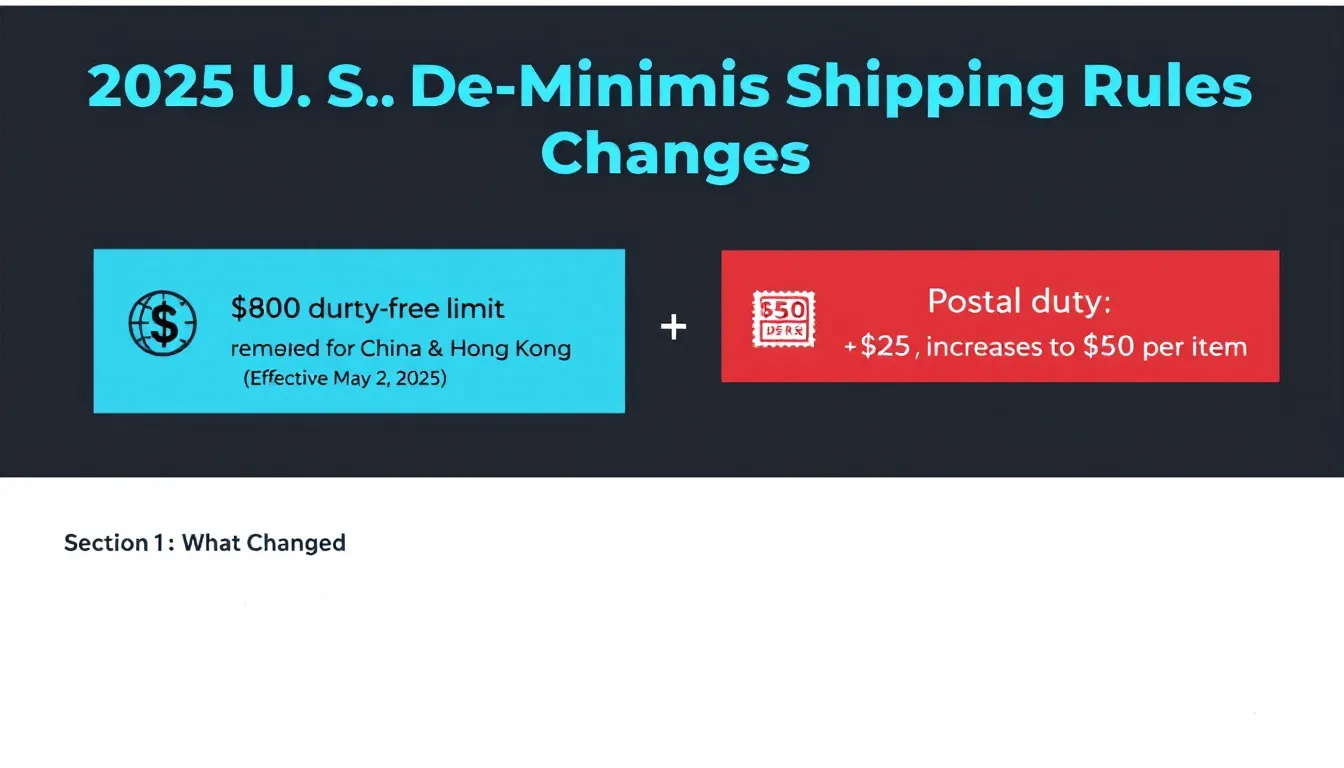

Common Challenges Faced in Import Classification

While import classification is crucial, it is not without its challenges. One of the common obstacles faced by import classification professionals is the complexity of the Harmonized System itself. With thousands of unique codes and numerous sections, chapters, and subheadings, navigating the HS can be daunting. Additionally, the interpretation and application of codes can vary across countries, posing further challenges to achieving uniformity in classification. Other common challenges include identifying the appropriate classification for products with complex compositions or functionalities, staying updated with evolving regulations, and managing large volumes of data efficiently.

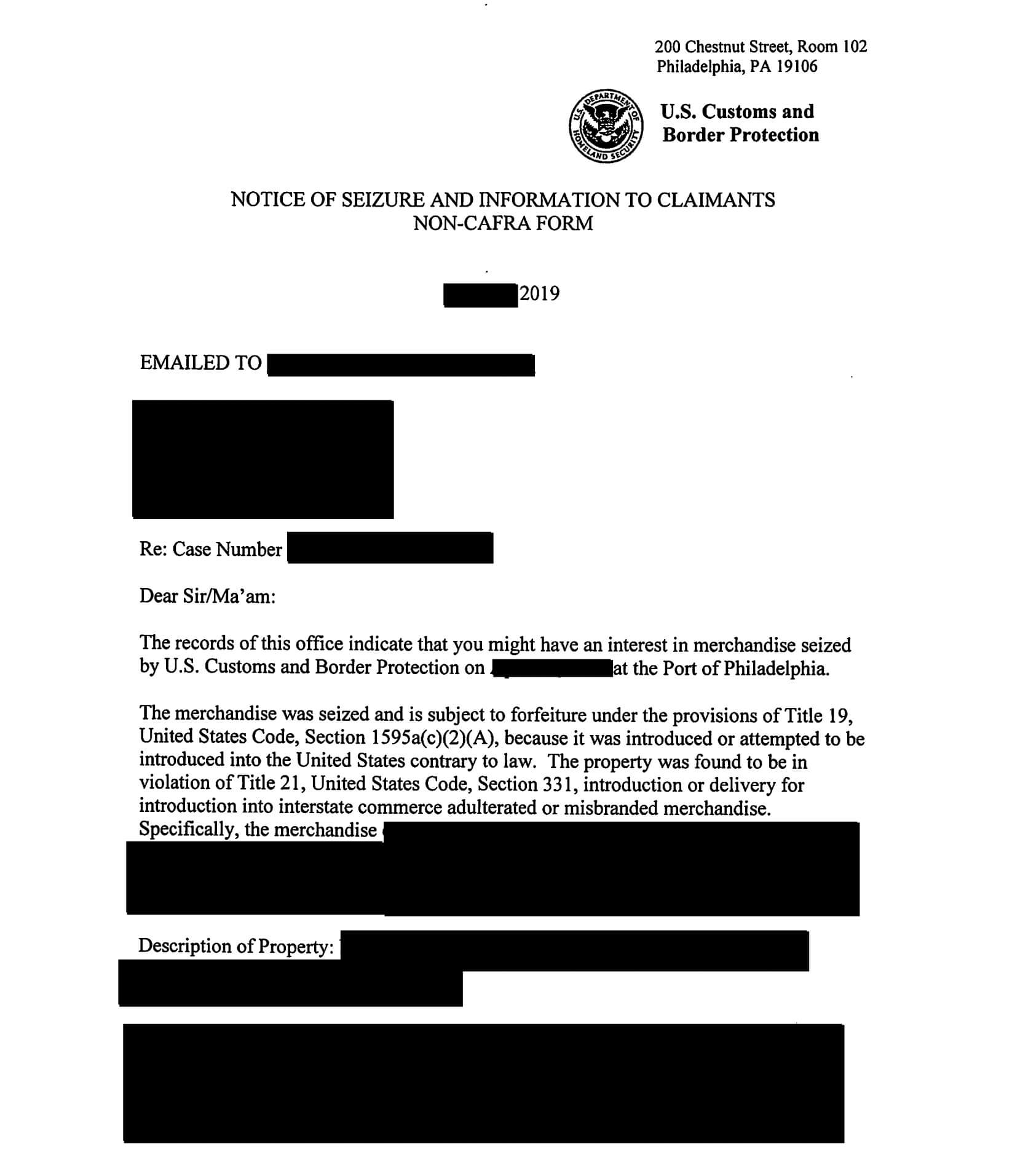

The Impact of Incorrect Import Classification on Businesses

Incorrect import classification can have significant ramifications for businesses. It can result in delays in customs clearance, leading to disruptions in the supply chain and potential financial losses. Moreover, misclassification can lead to overpayment or underpayment of duties and tariffs, exposing businesses to risks such as penalties, fines, and audits. Furthermore, misclassification can hinder effective management of trade preferences or hinder eligibility for free trade agreements and other benefits related to specific product classifications. Therefore, the accurate classification of imports is essential for maintaining compliance and optimizing operational efficiency.

Identifying and Resolving Misclassification Issues in Imports

Identifying and resolving misclassification issues is a critical aspect of import classification management. It requires a systematic approach that involves conducting thorough product analyses, reviewing the relevant chapters and sections of the HS, consulting with experts, and leveraging technology solutions. Resolving misclassification issues often involves reevaluating product characteristics and functionalities, consulting with customs authorities, and making the necessary adjustments in documentation and processes. By proactively detecting and addressing misclassification issues, businesses can avoid potential penalties and maintain a robust compliance framework.

Strategies for Accurate Import Classification

Accurate import classification requires the adoption of effective strategies that enhance consistency, efficiency, and compliance. One key strategy entails establishing clear and comprehensive product knowledge within the organization. This includes providing training to import classification professionals, maintaining up-to-date documentation on product attributes, and fostering collaboration between departments involved in the classification process. Embracing advanced technology solutions, such as automated classification systems and data analytics, can also significantly enhance accuracy and streamline import classification processes. Additionally, maintaining regular communication and cooperation with customs authorities can help address any uncertainties or ambiguities in the classification process.

The Role of Harmonized System (HS) Codes in Import Classification

The Harmonized System (HS) codes are the cornerstone of import classification. They provide a standardized framework for universal classification and enable efficient communication between businesses and customs authorities. By correctly applying HS codes, businesses can ensure accurate duties and tariffs assessment, comply with regulatory requirements, and simplify cross-border transactions. Understanding the structure and content of HS codes and staying updated with changes and amendments are crucial in achieving accuracy and compliance in import classification.

Utilizing Technology to Streamline Import Classification Processes

Given the complexities involved in import classification, leveraging technology solutions can significantly streamline processes and enhance efficiency. Automated classification systems can analyze product attributes and recommend appropriate HS codes, reducing the risk of human error and eliminating time-consuming manual classification efforts. Data analytics can be leveraged to identify trends and patterns in classification data, enabling continuous improvements in accuracy and compliance. Additionally, technological tools can help businesses stay informed about changes in regulations and tariff schedules, facilitating proactive classification management.

Best Practices for Effective Import Classification Management

Adhering to best practices is instrumental in ensuring effective import classification management. Firstly, businesses should establish a centralized and organized system for maintaining accurate product information and documentation. Regular audits should be conducted to identify potential misclassifications and rectify any errors promptly. It is also crucial to invest in ongoing training and education for import classification professionals to enhance their knowledge and stay abreast of regulatory developments. Implementing robust internal controls, such as classification review processes and cross-functional collaboration, can further enhance accuracy and compliance.

Training and Education for Import Classification Professionals

Considering the complexity and significance of import classification, providing proper training and education to professionals in this field is vital. Training programs should cover various aspects, including the fundamentals of the HS, interpretation of classification rules, analyzing product characteristics, and using technology tools effectively. Additionally, professionals should be encouraged to participate in industry conferences, seminars, and webinars to expand their knowledge, network with peers, and stay informed about emerging trends and best practices. Continuous learning and professional development are essential for import classification professionals to excel in their roles and drive compliance within their organizations.

Case Studies: Successful Approaches to Overcoming Import Classification Challenges

Examining real-life case studies can provide valuable insights into successful approaches to overcoming import classification challenges. These case studies can highlight strategies employed by businesses to address complex product compositions, navigate regulatory changes, or resolve disputes with customs authorities. By analyzing these success stories, import classification professionals can learn from practical experiences and adopt innovative techniques, tailored to their specific industry or product landscape, to improve their own classification processes.

Industry-Specific Considerations in Import Classification

Each industry has its unique considerations in import classification. Product characteristics, composition, and intended use can vary significantly across sectors, leading to specific challenges. For instance, the pharmaceutical industry may encounter challenges in classifying complex drug formulations, while the automotive sector may face complexities related to parts and components sourcing. Understanding industry-specific regulations, consulting with industry experts, and fostering continual dialogue with customs authorities can help businesses navigate these unique considerations and achieve accurate classification results.

Navigating International Trade Regulations for Proper Import Classification

Proper import classification is intricately linked to international trade regulations. Businesses must understand and comply with the regulatory frameworks in their country of operation, as well as the regulations governing their import partners’ jurisdictions. Keeping abreast of regulatory changes, maintaining open lines of communication with customs authorities, and seeking professional advice when needed are essential in ensuring accurate classification and compliance. Proactive engagement with trade associations and industry groups can also provide valuable insights into regulatory developments and potential impacts on import classification practices.

Collaborating with Customs Authorities for Improved Import Classification Accuracy

To enhance import classification accuracy, collaboration with customs authorities is crucial. Building strong relationships with customs officials, seeking their guidance on complex or ambiguous products, and fostering open lines of communication can significantly improve classification accuracy. Customs authorities often provide training and guidance materials to businesses to promote compliance and enhance understanding of trade regulations. Moreover, participating in customs outreach programs or joining customs-trade partnership initiatives can facilitate mutual understanding and pave the way for smoother customs processes.

Leveraging Data Analytics to Enhance Import Classification Accuracy

Data analytics can play a pivotal role in enhancing import classification accuracy. By analyzing historical classification data, identifying patterns, and conducting data-driven assessments, businesses can improve the consistency and efficiency of their classification processes. Utilizing advanced analytics tools and algorithms can help identify potential misclassifications, optimize control mechanisms, and facilitate continuous improvement. Moreover, integrating data analytics with other technological solutions, such as automated classification systems, can further streamline import classification and drive accuracy.

Ensuring Compliance with Tariffs and Duties through Proper Import Classification

Proper import classification is essential not only for accurate duties and tariff assessment but also for ensuring compliance with trade policies and agreements. By applying the correct HS codes, businesses can maximize their eligibility for preferential trade agreements, exemptions, or other benefits. Additionally, maintaining accurate records and documentation related to import classification is critical for audits, customs verifications, and dispute resolution. Regular internal audits and review processes can help identify gaps or inconsistencies, enabling businesses to proactively rectify errors and maintain a robust compliance framework.

The Future of Import Classification: Emerging Trends and Technologies

Looking ahead, the field of import classification is poised for significant advancements and transformations driven by emerging trends and technologies. Automation, artificial intelligence, and machine learning are set to revolutionize classification processes, enabling faster, more accurate, and consistent outcomes. The integration of blockchain technology may provide enhanced traceability, transparency, and security in import classification. Furthermore, as global supply chains evolve and new industries emerge, adapting classification practices to meet changing demands and challenges will be crucial for import classification professionals to stay ahead.

In conclusion, import classification presents various challenges that require comprehensive understanding, effective strategies, and a commitment to continuous improvement. By delving into the nuances of import classification, addressing common challenges, leveraging technology, and adhering to best practices, businesses can navigate this complex terrain with confidence. Furthermore, staying informed about industry-specific considerations, international trade regulations, and emerging trends will enable import classification professionals to adapt their processes and remain successful in a constantly evolving global trade landscape.