In today’s globalized economy, import compliance is a crucial aspect of international trade. It ensures that goods entering a country adhere to the specific regulations and standards set forth by the government. One of the key elements of import compliance is correct product classification. Product classification involves determining the appropriate category for a particular product, which is essential for determining the applicable import duties, taxes, and regulations.

Why Product Classification is Crucial for Import Compliance

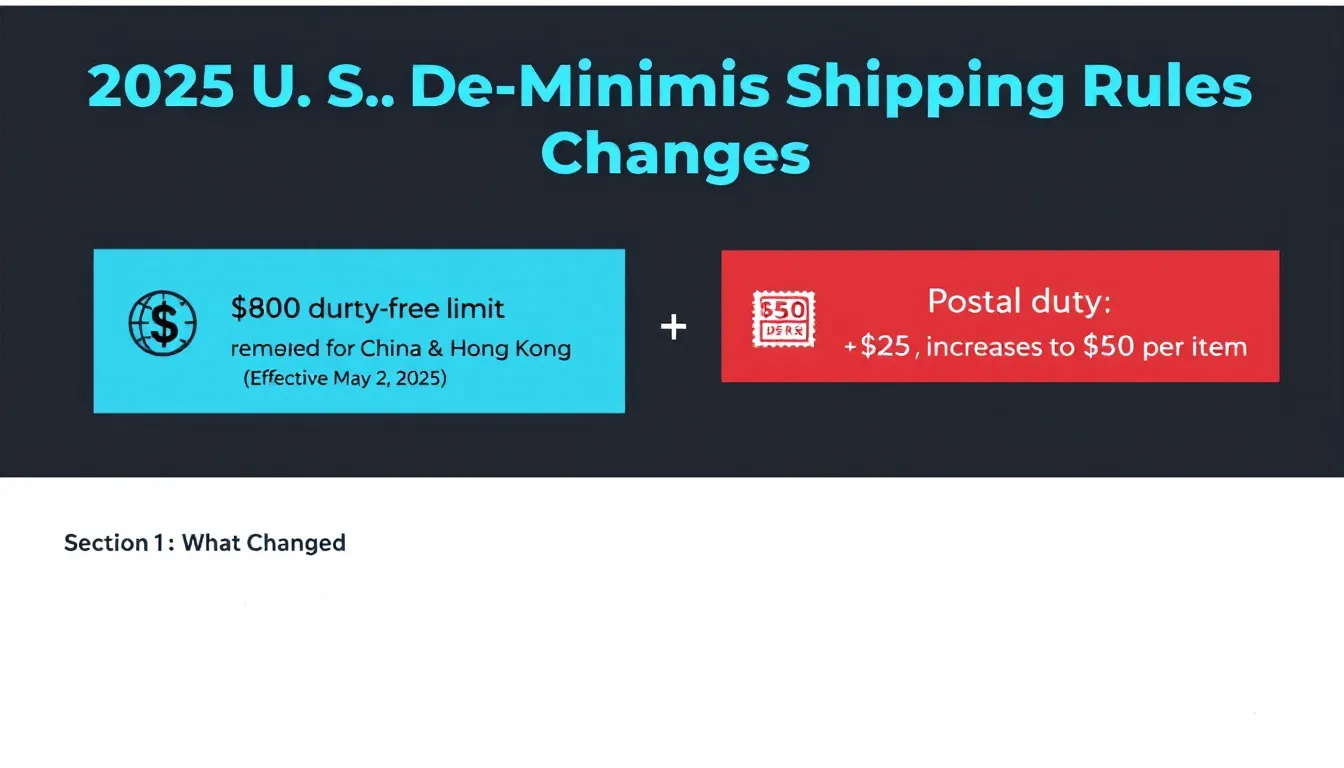

Product classification plays a pivotal role in import compliance for several reasons. First and foremost, it enables customs authorities to accurately assess the appropriate duties and taxes that should be levied on imported goods. This is achieved by utilizing standardized coding systems, such as the Harmonized System (HS) codes, which assign numerical codes to various products based on their characteristics, materials, and intended use. A mistake in product classification can result in underpayment or overpayment of duties, leading to financial implications for both importers and exporters.

Moreover, correct product classification ensures compliance with trade agreements and regulations. Different countries and trade blocs have specific requirements for certain products, such as safety standards or restrictions on certain materials. Accurate classification allows importers to navigate these requirements with ease, avoiding delays in customs clearance and potential penalties for non-compliance.

Understanding the Role of Product Classification in Import Regulations

Product classification serves as the foundation for import regulations. It sets the stage for determining the appropriate licensing, permits, and certifications that may be required for importing specific products. Additionally, it assists customs authorities in identifying and flagging goods that may pose risks to national security, public health, or the environment.

Furthermore, product classification helps customs authorities identify potential infringements on intellectual property rights. By accurately classifying goods based on their description, materials, and intended use, customs officers can better detect counterfeit products and protect the rights of brand owners.

How Accurate Product Classification Ensures Import Compliance

To ensure import compliance, accurate product classification is of paramount importance. It helps importers and exporters navigate the complex web of regulations and standards by providing clarity on the requirements and obligations associated with specific products.

Accurate classification also helps establish transparency and trust between trading partners. When importers provide correct product classification information, it demonstrates their commitment to compliance, which can enhance their reputation and pave the way for smoother transactions in the future.

The Consequences of Incorrect Product Classification in Importing

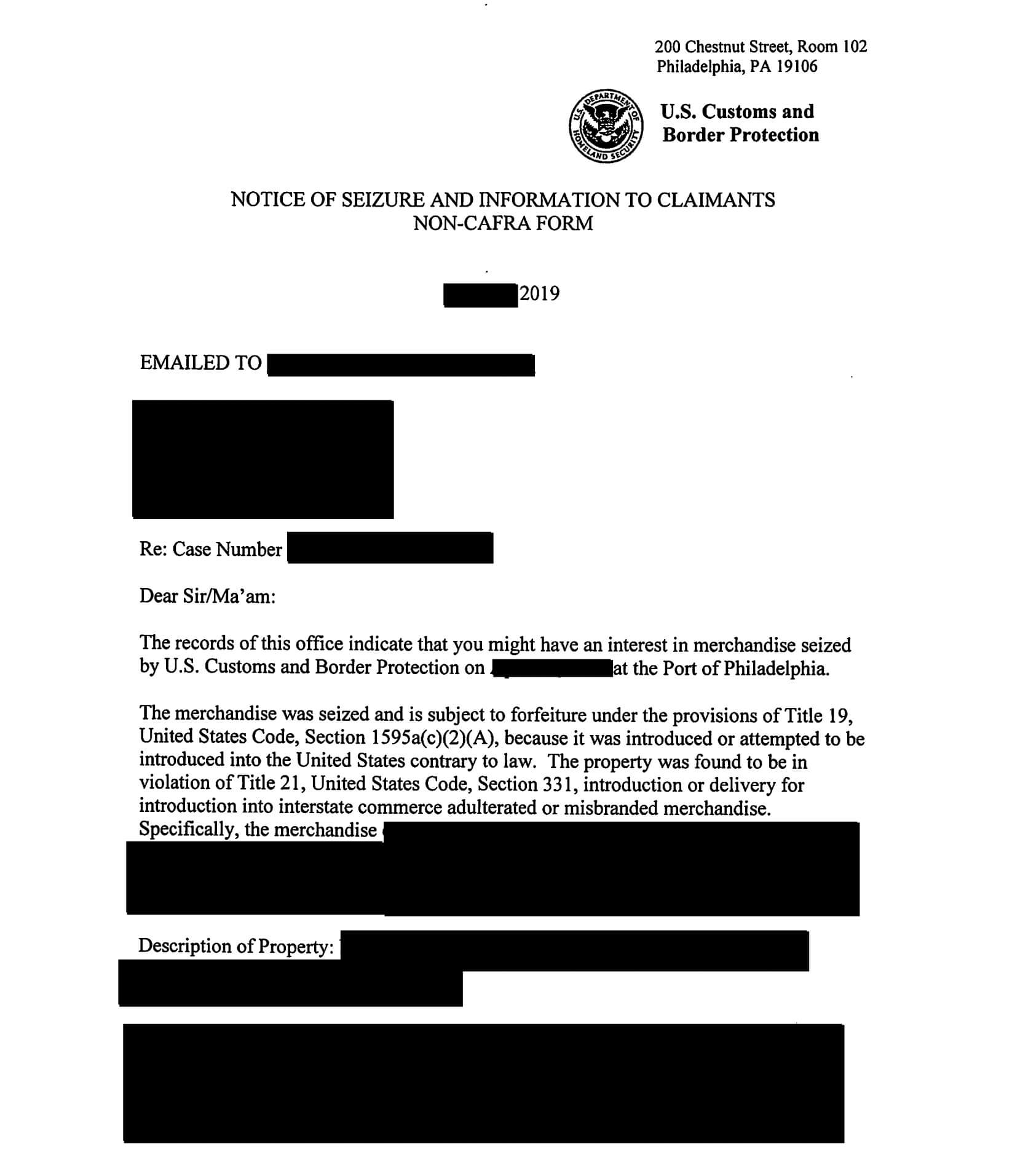

Incorrect product classification can have severe consequences for importers, exporters, and even consumers. These consequences can range from financial penalties and delays in customs clearance to legal actions and damaged reputations.

Firstly, incorrect classification can result in underpayment or overpayment of import duties and taxes. Underpayment may lead to audits, investigations, and additional charges imposed by the customs authorities, straining the financial resources of importers. On the other hand, overpayment can harm businesses’ competitiveness and profitability, as excess costs cannot be easily recovered.

Furthermore, incorrect classification can lead to non-compliance with regulations, resulting in seized goods, fines, and reputational damage. Consumers may also be affected if products do not meet safety standards or quality requirements due to incorrect classification. This poses risks to public health and safety, as well as potential liability issues for importers.

Key Factors to Consider when Classifying Products for Import Compliance

When classifying products for import compliance, several key factors should be taken into consideration. These factors include the product’s composition, materials, intended use, and any specific regulations or standards applicable to its category.

It is crucial to thoroughly analyze the product’s characteristics and consult the appropriate classification resources, such as the customs tariff schedule or industry-specific guidelines, to determine the most accurate classification. In some cases, seeking professional advice from customs brokers or trade consultants may be necessary to ensure compliance.

Overview of Harmonized System (HS) Codes for Product Classification

The Harmonized System (HS) codes are a standardized global coding system used for product classification. Developed and maintained by the World Customs Organization (WCO), the HS codes provide a uniform framework for classifying products across different countries.

The HS codes consist of six digits, with additional digits for more specific classification. Each code corresponds to a particular product category, covering a wide range of goods, from raw materials to finished products. Importers must accurately assign the appropriate HS code to their goods when filing import declarations.

The Benefits of Using HS Codes for Product Classification in Imports

The use of HS codes for product classification in imports offers several benefits. Firstly, HS codes provide a common language for global trade, facilitating communication and understanding between trading partners, customs authorities, and other stakeholders.

Furthermore, HS codes simplify customs processes by standardizing the classification of products. This standardization helps avoid discrepancies, reduces the likelihood of human errors, and promotes consistency in the application of import regulations. As a result, customs clearance procedures become more efficient, enabling faster cargo movement and enhancing overall supply chain performance.

Common Challenges in Product Classification for Import Compliance

Product classification poses various challenges, particularly due to the constantly evolving nature of products and their associated regulations. One common challenge is the complex nature of some products that may fall into multiple categories or have overlapping characteristics.

Another challenge lies in staying up to date with changes in regulations, standards, and trade agreements. It is essential for importers to continuously monitor and update their product classifications to ensure ongoing compliance.

Additionally, language barriers, conflicting interpretations of rules, and the lack of detailed guidance on particular products can further complicate the classification process.

Best Practices for Accurate and Consistent Product Classification in Imports

To achieve accurate and consistent product classification in imports, several best practices should be followed. Firstly, it is crucial to invest in ongoing training and education for employees involved in the classification process. Regular training sessions can enhance their knowledge and understanding of regulations, promote consistent application of classification rules, and reduce the risk of errors.

Secondly, maintaining accurate product descriptions with detailed specifications is essential. Clear documentation aids in the correct identification of characteristics, materials, and intended use, facilitating accurate classification.

Furthermore, developing strong relationships with customs authorities, trade associations, and industry experts can provide valuable insights and guidance on evolving regulations and help address any classification challenges that may arise.

How Technology is Revolutionizing Product Classification for Imports

The advent of advanced technologies, such as artificial intelligence (AI) and machine learning, has revolutionized product classification for imports. These technologies offer automated solutions that can analyze large volumes of data, identify patterns, and make accurate classification recommendations.

By leveraging AI-powered tools, importers can streamline the classification process, minimize human errors, and enhance accuracy and efficiency. These technologies can also facilitate real-time updates on regulatory changes, ensuring compliance with the most up-to-date requirements.

The Role of Customs Authorities in Verifying Product Classification for Imports

Customs authorities play a vital role in verifying the accuracy of product classification for imports. They have the responsibility to review import declarations, examine supporting documentation, and perform physical inspections when necessary.

To ensure compliance, customs authorities may request additional information, samples, or laboratory testing to confirm the correctness of the declared classification. In cases of doubt or suspicion, they may conduct audits or investigations to uncover any potential misclassification or fraudulent activities.

Strategies to Minimize Risks and Errors in Product Classification for Imports

Minimizing risks and errors in product classification requires a comprehensive approach that combines internal controls, robust processes, and continuous improvement measures.

Firstly, having a dedicated team responsible for product classification and compliance can help ensure consistency and accountability. This team should stay up to date with changes in regulations, communicate with relevant stakeholders, and conduct periodic internal audits to identify and rectify any classification errors or gaps.

Additionally, leveraging automated solutions and technologies can significantly reduce the risk of human errors. Advanced product classification software and databases provide access to updated information, streamline classification processes, and offer validation mechanisms to flag potential errors.

Case Studies: Real-life Examples of the Impact of Incorrect Product Classification on Import Compliance

Real-life examples illustrate the severe impact of incorrect product classification on import compliance. One notable case involves a company that misclassified a product as a spare part, resulting in underpayment of duties. The customs authorities discovered the misclassification during an audit and imposed penalties, including additional charges and interest on the underpaid amount.

In another case, an importer failed to correctly classify a chemical substance, leading to non-compliance with safety regulations. The customs authorities seized the shipment and fined the importer, resulting in financial losses and reputational damage.

These examples highlight the importance of accurate product classification and the severe consequences that can arise from errors or intentional misclassification.

Enhancing Supply Chain Efficiency through Correct Product Classification in Imports

Correct product classification in imports contributes to enhancing supply chain efficiency in several ways. Firstly, it ensures the smooth flow of goods through customs, minimizing delays and expediting the clearance process.

Furthermore, accurate classification facilitates effective inventory management and planning. By understanding the specific requirements and regulations associated with each product category, importers can optimize their stock levels, reduce carrying costs, and meet customer demand more efficiently.

Moreover, correct classification allows for better risk management. Importers can identify and address potential compliance risks associated with specific products or trade routes, enhancing supply chain security and minimizing the likelihood of disruptions.

The Link Between Correct Product Classification and Trade Agreements

Correct product classification is closely linked to trade agreements. Trade agreements often include provisions related to product eligibility, preferential treatment, and harmonized standards. By accurately classifying products, importers can determine their eligibility for preferential tariff rates or other benefits available under trade agreements.

Furthermore, correct classification ensures compliance with rules of origin, a critical aspect of trade agreements. Rules of origin ascertain the country of origin of goods and determine whether a product qualifies for preferential treatment based on factors such as the percentage of local content or transformation carried out within a specific country or trade bloc.

Navigating Regional Trade Regulations: Importance of Accurate Product Classification

Regional trade regulations can introduce additional complexities in product classification. Different trade blocs or regions may have specific requirements, standards, or restrictions applicable to certain products.

Accurate product classification becomes even more crucial in these cases, as importers must navigate the unique regulations of each region. Failure to correctly classify products can result in delays, penalties, and potential barriers to market access.

By staying informed about regional trade regulations and diligently classifying their products, importers can avoid non-compliance, capitalize on regional trade preferences, and expand their global market reach.

Ensuring Consumer Safety through Proper Product Classification in Imports

Proper product classification is intrinsically linked to consumer safety. Incorrect classification can lead to the importation of products that do not meet the necessary safety standards or quality requirements, putting consumers at risk.

By accurately classifying products, importers can ensure that the proper inspections, tests, and certifications are obtained to guarantee the safety and integrity of the goods. This is particularly relevant for products such as pharmaceuticals, cosmetics, and electronic devices, where non-compliance can result in serious health and safety hazards.

Industry-specific Guidelines for Accurate and Compliant Product Classification

Various industries have developed industry-specific guidelines to facilitate accurate and compliant product classification. These guidelines provide additional clarity and detailed instructions on how to classify products within specific sectors.

For example, the automotive industry has developed guidelines that take into account the characteristics and components of vehicles, ensuring their correct classification. Likewise, the food and beverage industry provides specific instructions for classifying different types of products, such as processed foods, alcoholic beverages, or agricultural commodities.

Importers should familiarize themselves with these industry-specific guidelines and consult them alongside general classification resources to ensure accurate and compliant product classification.

Steps to Take to Ensure Timely and Accurate Re-Classification of Products

Regular re-classification of products is essential to ensure ongoing compliance with changing regulations and standards. Importers should establish a process for timely and accurate re-classification, especially when modifications or updates occur in the product, its components, or the associated regulations.

When re-classifying products, importers should review all relevant documentation, consider any changes in materials or characteristics, and consult the latest classification resources available. They should also communicate with customs authorities and seek guidance if any uncertainties arise.

Keeping an updated record of re-classified products, along with the reasons for the changes, ensures transparency and provides an audit trail for compliance purposes.

Conclusion

Correct product classification is of utmost importance in import compliance. Accurate classification ensures the proper assessment of import duties, facilitates compliance with regulations, enhances supply chain efficiency, and ensures consumer safety. Importers must prioritize accurate classification, leverage technology, and stay informed about evolving regulations to minimize risks, streamline customs processes, and maintain compliance with international trade requirements.