Franchise businesses have become increasingly popular in recent years, offering individuals the opportunity to own and operate their own business while benefiting from the support and credibility of an established brand. While starting a franchise business can be a thrilling and rewarding venture, it’s essential to consider the long-term aspects of your investment. One crucial aspect that often gets overlooked is developing an exit strategy.

Understanding the Importance of an Exit Strategy for Franchise Businesses

When starting a franchise business, it’s easy to focus solely on its immediate success and growth. However, having a well-thought-out exit strategy is equally important. An exit strategy refers to a predetermined plan that outlines how and when an entrepreneur will sell, transfer, or close their franchise business. While it may seem counterintuitive to think about the end before you even begin, having a clear exit strategy can provide numerous benefits and protect your investment.

One of the key benefits of having an exit strategy is that it allows franchise owners to have a clear vision for the future of their business. By considering potential exit scenarios, such as selling the franchise or passing it on to a family member, owners can make strategic decisions that align with their long-term goals. Additionally, an exit strategy can help franchise owners navigate unexpected circumstances, such as changes in the market or personal circumstances, by providing a roadmap for how to handle these situations.

Factors to Consider When Developing an Exit Strategy for your Franchise Business

Developing an exit strategy requires careful consideration of various factors that can influence the decision-making process. First and foremost, you should evaluate your personal goals and objectives. Are you looking for a long-term investment or a short-term opportunity? Knowing your long-term plans can help shape your exit strategy and determine the most appropriate timing.

Market conditions and industry dynamics are also critical considerations. Is the market saturated with similar franchise businesses? How is the industry evolving? Understanding these factors can help you gauge the potential demand and value of your franchise business down the road.

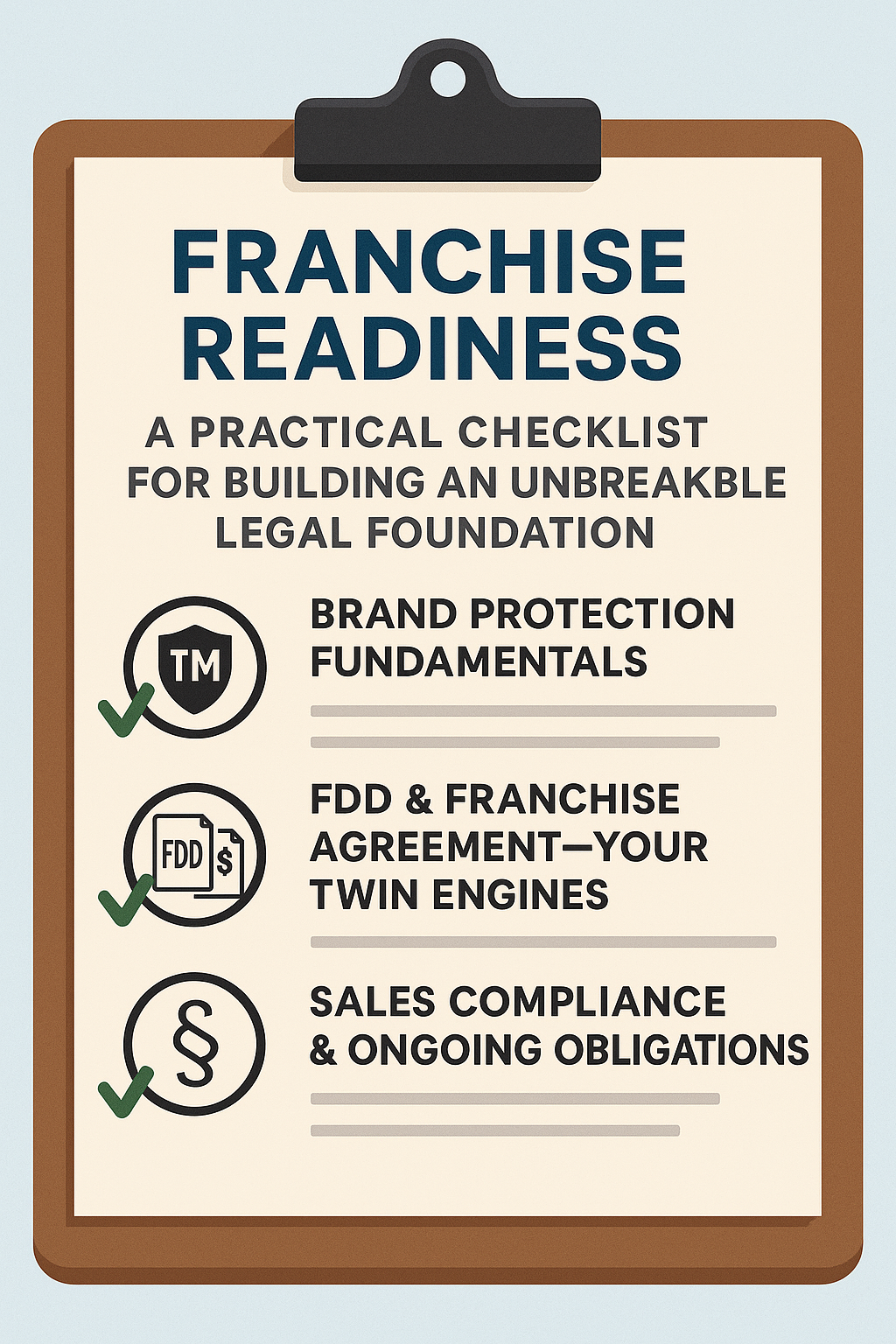

In addition, legal and regulatory factors should not be overlooked. Familiarize yourself with the legal requirements and obligations related to selling or transferring a franchise business. Certain franchisors may have specific guidelines or restrictions that need to be followed, so it’s essential to have a thorough understanding of any contractual obligations.

Furthermore, financial considerations play a significant role in developing an exit strategy. Assess the financial health of your franchise business and determine its profitability and growth potential. Consider factors such as revenue, expenses, cash flow, and potential return on investment. Understanding the financial aspects of your business can help you make informed decisions about the timing and method of your exit.

Key Benefits of Having a Well-Thought-Out Exit Strategy in Place for your Franchise Business

Having a well-defined exit strategy can provide numerous benefits for franchise business owners. Firstly, it offers peace of mind and a sense of control over your investment. By having a clear plan, you can navigate any unexpected circumstances and make informed decisions based on your long-term goals.

An exit strategy also serves as a guide for succession planning. If you intend to pass the business down to family members or a trusted employee, having a predetermined plan can facilitate a seamless transition and ensure the continued success of the franchise.

Additionally, having an established exit strategy can enhance the value of your franchise business. Potential buyers or investors will view your business positively if they see that you have considered the long-term prospects and have a comprehensive plan in place.

Another benefit of having a well-thought-out exit strategy is the ability to maximize your financial returns. By planning ahead, you can strategically time your exit to take advantage of market conditions and optimize the value of your franchise business. This can result in a higher sale price or a more favorable deal structure, ultimately increasing your profits.

Furthermore, an exit strategy can also protect your personal and professional reputation. By having a clear plan in place, you can ensure a smooth transition and minimize any negative impact on your brand or relationships with stakeholders. This can help maintain your credibility in the industry and preserve your standing as a successful franchise business owner.

Examining the Different Types of Exit Strategies for Franchise Businesses

There are several types of exit strategies that franchise business owners can consider:

- Sale of the Business: This is perhaps the most common exit strategy, where the franchise owner sells their business to a buyer or investor. The sale can include the transfer of assets, intellectual property rights, and goodwill.

- Transferring Ownership: In this case, the franchise owner transfers ownership of the business to a family member, partner, or trusted employee. This type of exit strategy is particularly relevant for those who wish to keep their legacy intact.

- Initial Public Offering (IPO): For franchise businesses with significant growth potential, going public through an IPO can be a lucrative exit strategy. However, this option requires careful planning, substantial growth, and adherence to regulatory requirements.

- Liquidation: If the franchise business is no longer viable or profitable, liquidation may be the only option. This involves selling off assets and paying off debts, leading to the closure of the business.

Choosing the most suitable exit strategy depends on various factors such as personal goals, market conditions, and the nature of the franchise business itself.

Merger or Acquisition: Another exit strategy for franchise businesses is to merge with or be acquired by another company. This can provide opportunities for growth, increased market share, and access to new resources. However, it requires careful negotiation and due diligence to ensure a successful merger or acquisition.

Succession Planning: Franchise owners can also consider succession planning as an exit strategy. This involves identifying and grooming a successor who will take over the business when the current owner retires or steps down. Succession planning ensures a smooth transition and continuity of operations for the franchise business.