Customs clearance is your top focus once a shipment has departed from a particular country.

Your professional reputation and bottom line are depending on you. But rather than be a source of stress, it should be an exciting time.

Because the overall importing process is nearing its final stage. Take a second to pre-celebrate now if you’d like.

Read on for steps and tips to grow your business bank account through a successful shipment.

What is the Customs Clearance Process?

Customs regulations are ultimately in place for border protection. And you can clear this hurdle by following a specific process.

Steps:

- Paperwork examined by customs authorities

- Customs duties and taxes are assessed

- Customs officials request payment on fees due

- Payment is made on customs fees

- Your shipment can now clear customs

Additional Information About the Required Steps

The most important documents to a customs officer are commercial invoices. They contain detailed information of all parties involved. Plus, the export transaction date and air waybill.

Next most important is the shipping label. Your international shipments will have an easier time if both documents are accurate and complete.

Taxes and duties depend on:

- Country specific requirements for imports

- Value of your shipment

- Type of imports being brought into the country

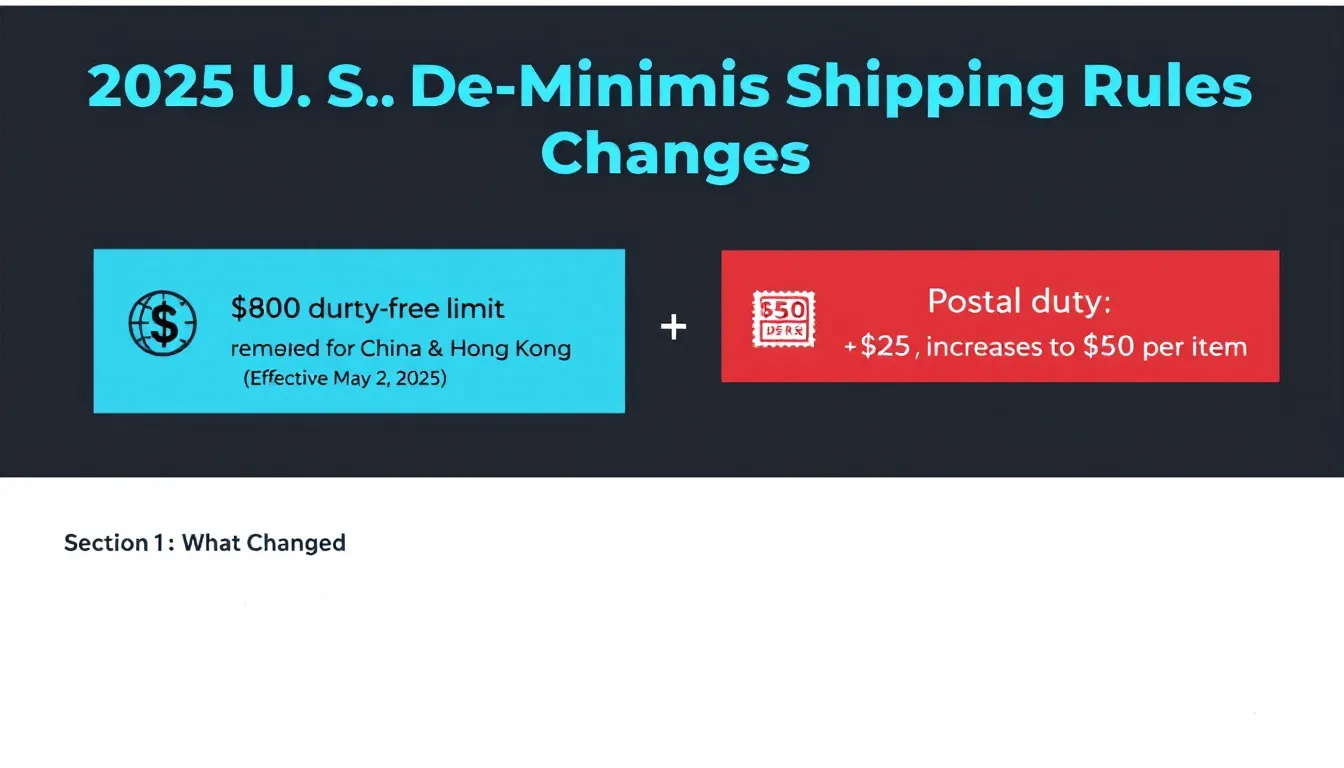

Goods subject to duties and taxes must be above the minimum taxable threshold. Here in the United States, it’s $800.

After that, all the costs will be relayed to you. The customs authority will provide a deadline for payment.

The customs office will then see if fees on the shipment have been paid.

One tip for clearing customs at this point. Use Deliver Duty Paid (DDP) through FedEx or a similar company to save time. The shipping company will include any necessary import duty in the original cost of shipping.

If border protection determines that you have a Deliver Duty Unpaid (DDU), independent customs brokers will receive your shipment. And request payment so it can reach its final destination.

The final step involves imported goods shipping via a cargo transportation company to the end customer.

In the following section, we’ll share how long the customs clearance process usually takes.

How Long Does It Take for Customs Clearance?

Time is money.

Which means that any delay from missing documents or a late payment affects your importing business.

Customs clearance takes less than 24 hours. Normally. However, if you don’t have all the required documents, it’ll be a couple of days.

On rare occasions it may be longer. But that’s typically because a brand-new importer does it on their own. And decides to take shortcuts.

But that doesn’t describe you. This is evidenced by the fact that you’re here reading all about it.

Now, let’s address the documents you’ll want to put together.

Documents Required for Import-Export Customs Clearance

Being prepared with proper documentation speeds up customs clearance.

Spend the extra time by creating a checklist with all the information domestic and foreign customs officials will need. Making their job easier will translate to a satisfied end-user and money in your business account.

Don’t let a single missing document prevent your shipment from arriving on time.

Most important:

- Commercial invoice

- Shipping label

Others:

- Purchase order

- Bill of lading

- Export packing list

- Air waybill

- Letter of credit

- Dock/Warehouse receipt

- Certificate of origin

- Insurance certificate

- Export license

There’s a common question we often hear which we’ll address next.

Are Customs Clearance Documents Compulsory for Every Shipment?

Yes, they are non-negotiable and a requirement when your goods cross international borders. Import duties and paying taxes are necessary in every customs clearance process.

Applies to:

- Commercial shipments

- Goods that are re-exported

- Imports from other countries

Involving an experienced trade lawyer helps you assemble the correct documents ahead of time.

Moving on, we want to address a potential issue that could arise while importing goods.

What Does It Mean When a Package Has Been Declared at Customs?

Sometimes the customs clearance process will be held up. Reasons vary, but all you care about is saving the customer experience and lowering delay costs.

Your goal at this point is to please the government agency holding on to your shipment. And it starts with discovering what they need.

How to move along your imported goods:

- Reach out to the seller for an update

- Contact the freight forwarder

- Ensure that all taxes and duties are paid

-

Check if additional paperwork is required

Whether the problem is unpaid customs duties or missing documents, a solution is out there. Just be patient and keep asking until you find it.

Before wrapping up, we want to cover your best chance for satisfying a customs officer.

How Do I Get a Customs Release?

Although mistakes may happen that are outside of your control, customs clearance is likely with an internal process in place.

Make sure all staff involved in the importing of goods have a copy. And double check they are using it 100% of the time.

Besides internal checks, we want to further increase your chances of a smooth operation.

Tips:

- Only work with the most respected carrier companies

- Be aware that every country your import passes through will need customs clearance

- Know that laws and regulations around international trade fluctuate

- Pack your shipment properly

-

Attach important documents to your shipment for easy access

Seeking the advice of an international trade lawyer is your best bet.

Beyond facilitating customs clearance, they deliver extra value:

- Tariff classification assistance

- Customs valuation

- Regulatory compliance

- Customs entry review

- Post-entry audit services

- Risk management and assessment

- Representation in customs detentions and seizures

The idea of researching for hours to find the ideal fit may be overwhelming.

As such, we’ll make it easier on you.

Keep reading to meet an ally in resolving your customs issues.

Reidel Law Firm Assisting Customs Compliance

You probably don’t have time to decipher the “legalese” around bringing imports across the border.

Naturally, this is an assumption. But it’s based on discussions with our customers.

We can help you handle the legal aspects of any import issues. It is our specialty after all.

Plus, it removes the need for any sort of course on these topics.

Our international trade law division also supports:

- Export Compliance

- Litigation before the Court of International Trade (Section 337, anti-dumping/countervailing, and other trade-related cases)

- Trade Compliance Audits and Training

Reach out to see how we can help your supply chain run smoothly!