When it comes to running a franchise, compliance is key to your brand’s integrity and success. This concise guide cuts straight to the chase. We’ll show you how to craft a franchise compliance program that not only adheres to legal requirements but also supports a strong, consistent brand across all locations. Expect practical steps and straightforward advice designed to uphold quality standards and strengthen your business presence. Let’s get started on the pathway to building a compliance foundation that fortifies your franchise against risks while maintaining the trust of your customers and franchisees.

Key Takeaways

Franchise compliance involves aligning business operations with legal requirements and maintaining brand integrity, establishing a culture of excellence that fosters customer trust and franchisee loyalty.

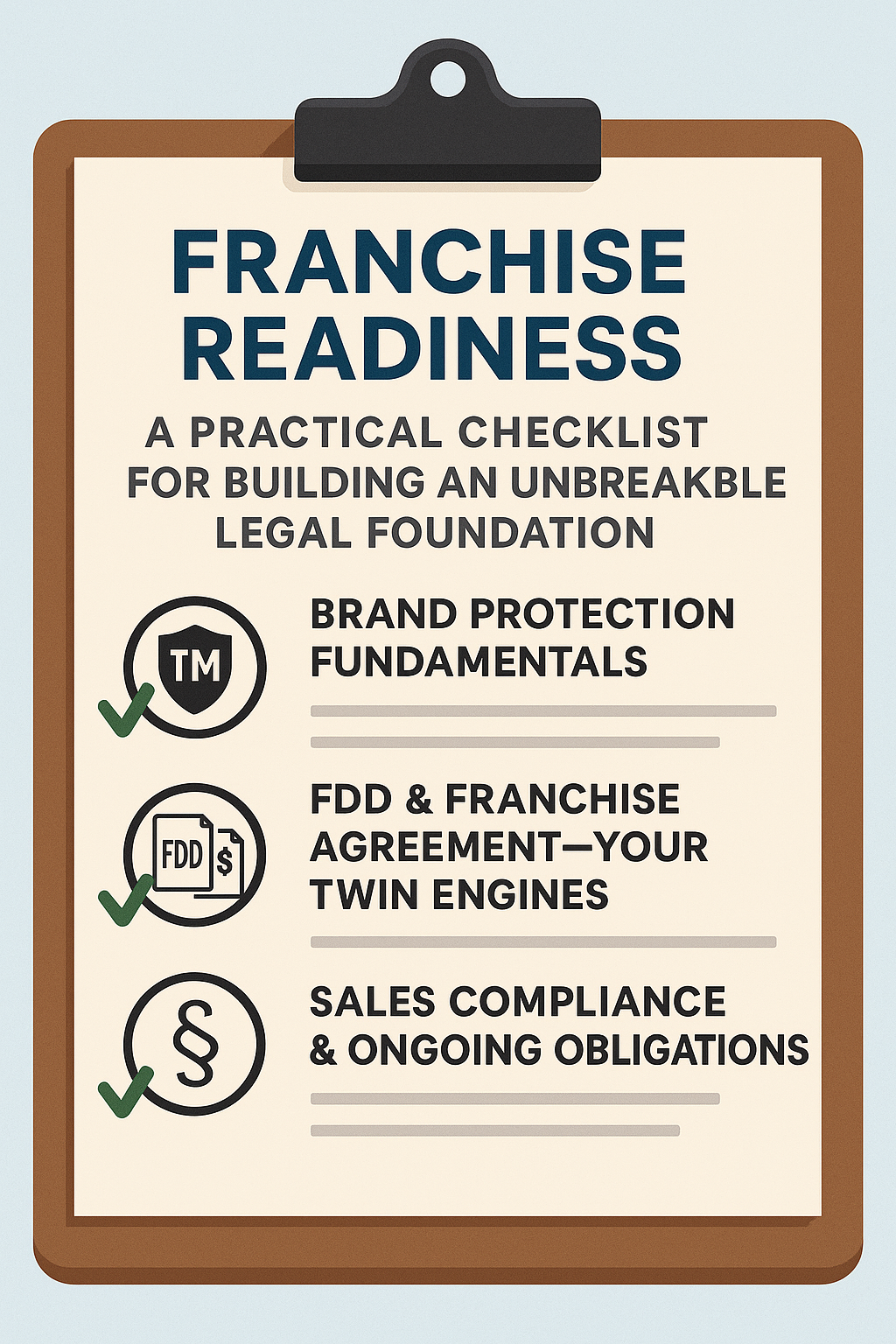

Implementation of a franchise compliance program entails conducting thorough compliance assessments, developing tailored policies and procedures, and providing franchisee training, underpinning the franchise’s operational success and legal standing.

Continuous monitoring and enforcement of compliance standards through regular audits and technology, alongside strong legal support from franchise attorneys and regulatory compliance experts, are essential to a franchise’s adaptability and sustained growth.

Understanding Franchise Compliance

The concept of ‘franchise compliance’ goes beyond mere paperwork and regulatory demands. It is essentially about ensuring that your business meets certain standards which safeguard the reputation of your brand as well as consumer safety. This task involves skilfully managing through a complex array of legal requirements, all while preserving what makes your franchise stand out. The aim of franchise compliance isn’t simply to fulfill obligations by rote, but to maintain and deliver on the values and excellence that consumers have come to expect from you. It serves as a shield, guaranteeing that every individual franchise unit mirrors the core principles and superior operational performance characteristic of your brand, thus promoting consistency in customer experience throughout.

Cultivating a culture of compliance within a franchise system can be likened to tending to a garden—it requires ongoing dedication and vigilance. But this process transcends basic law adherence. It’s also about establishing an esteemed image that draws in both potential franchisees and patrons. Achieving optimal compliance not only fortifies the franchise’s standing legally and morally, but paves the way for prosperous growth underpinned by consumer confidence and allegiance.

Legal Obligations

Navigating the legal intricacies of the franchise sector, one is met with a host of sophisticated rules that govern this industry. The Amended Franchise Rule by the Federal Trade Commission requires at federal level adherence to a specific timeframe for presenting the Franchise Disclosure Document (FDD) and imposes stringent penalties for non compliance. State laws add another layer of complexity with their own set of statutes related to health, safety, and financial disclosures that franchises must adhere to.

Within this complex network of regulations, enlisting a seasoned franchise attorney proves crucial. Their specialized knowledge ensures your franchise begins on firm grounding and maintains operations within legal boundaries. They serve as vigilant watchmen who keep you abreast of legislative updates, astute advisors for strategic adjustment plans, and staunch defenders who help preserve your brand’s reputation.

Brand Consistency

Maintaining brand consistency is at the core of a franchise’s operations, essential to every marketing effort, product introduction, and interaction with customers. It provides assurance to patrons that they can expect the same reliable experience whether visiting a store in a lively metropolis or a serene town. This uniformity is preserved through thorough compliance audits within the franchise system. Such evaluations meticulously examine all aspects of how franchises conduct business and engage in promotional activities— all aimed at keeping their commitment to deliver an impeccable brand promise intact.

The aim is for such uniformity across the franchise that apart from each location’s distinctive local charm, customers should perceive no difference between one site and another. Constant surveillance followed by improvements ensures not only intellectual property protection but also promotes an environment where outstanding performance becomes standard practice across the board.

Franchisor-Franchisee Relationship

Every flourishing franchise is anchored by a robust bond between the franchisor and its franchisees, characterized by mutual respect, open dialogue, and alignment in goals. This collaborative relationship encourages a fertile ground for innovative ideas to flourish and propels business growth. It’s through this partnership that compliance gains traction. It sets the expectations clearly, ensures necessary support is available, and brings the brand’s vision into reality.

Astute leaders within the franchise realm are aware that their network’s strength comes from embracing diversity as well as fostering adaptability to local market idiosyncrasies without compromising brand integrity. They recognize that prosperity across different markets hinges on empowering their franchisee counterparts with direction while allowing them sufficient independence to establish a strong local footprint that engages effectively with their particular community. Such equilibrium paves way for a harmonious functioning of each entity within the system in pursuit of collective objectives under an efficiently structured franchise model.

Crafting Your Franchise Compliance Program

Transitioning from understanding to action requires establishing a compliance program that not only reflects the ethos of your franchise but also fortifies it in the face of potential compliance issues. This is an adaptable and dynamic plan, designed to navigate both legal changes and the changing needs of franchisees. Starting with a well-articulated business model, you inform franchisees about their responsibilities and create standards for measuring their adherence to these expectations. Construct upon this foundation a sturdy, all-encompassing sales compliance program that protects your entire franchise system.

Implementing the process for maintaining franchise compliance involves several key stages.

Conducting a comprehensive evaluation of your current level of compliance.

Crafting customized policies and procedures relevant to your operation.

Rolling out training programs specifically tailored for franchisors.

This ongoing enhancement journey ensures both uprightness as well as prosperity within your enterprise’s framework.

The objective remains steadfast—to build resilience through continual development. Ensuring each step enhances overall integrity while promoting success throughout every aspect of managing franchises under one brand umbrella—a robust commitment reflective across every layer involved in carrying forward such rigorous operational mandates wherein lies its foundational strength—the ability never just exist but evolve ahead alongside prevailing market dynamics at any given time-frame pointing towards ultimate growth-oriented endpoints—securing positioning par excellence amongst peers around the globe subsequently!

Assessing Your Current Compliance Status

Establishing an effective compliance program for your franchise entails:

Conducting a frank evaluation of where you currently stand regarding compliance

Remaining alert to legislative changes that could affect your business operations

Taking initiative in revising your strategies to remain at the forefront of regulatory adherence

Predictively responding to evolving legal conditions, thus ensuring a consistent trajectory toward full compliance

Embracing these shifts is not merely about navigating difficulties. It presents opportunities for development and strengthens the resilience of your franchise against impending unpredictability. It involves an ongoing cycle of scrutiny and modification, guaranteeing that your measures are not only adequate in present terms but also durable enough for what lies ahead.

Developing Compliance Policies and Procedures

Having gained a thorough understanding of your franchise’s adherence to regulations, you are equipped to create policies and procedures that serve as a manual for your franchise operators. These directives should balance the need for upholding the integrity of the brand while providing enough leeway for franchisees to adapt to their local markets. An exhaustive operations manual then serves as an authoritative source on compliance, detailing everything from standards in customer service to protocols pertaining to health and safety.

In this quest, specialists in regulatory compliance become invaluable partners by offering forward-thinking strategies and legal technology solutions tailored specifically for navigating a complex legal environment. The goal is thus constructing an infrastructure that not only encourages but also underpins consistent regulatory conformance whilst promoting operational superiority throughout all locations within the franchise network.

Implementing Training and Support

The effectiveness of a comprehensive compliance program hinges on its execution, where providing adequate training and support is essential. Franchisees must have a thorough understanding of the entire business framework, from everyday operational tasks to the overall strategies that promote expansion. This process goes beyond mere knowledge transfer. It embeds a culture in which adherence to compliance becomes instinctive and maintaining brand standards is carried out with enthusiasm.

Achieving consistent compliance can present challenges. At times franchisees may require encouragement toward correct practices. Offering incentives like recognition programs, commendations or even participation on the franchise advisory board can inspire them to exceed standard compliance expectations. Self-guided learning is vital as it equips franchisees with the resources they need for independent verification that their operations align with the stipulations set forth in the franchise agreement and safeguarding stakeholder interests.

Monitoring and Enforcing Compliance

Once a compliance foundation has been established, the attention shifts to persistent vigilance—the ongoing practice of monitoring and enforcement that preserves the longevity and integrity of your franchise. At this juncture, compliance officers become pivotal players, utilizing task management tools to provide franchisees with explicit tasks which are designed to ensure they meet all compliance standards. It’s not merely about handing down orders. Rather it’s about implementing an incremental approach toward enforcing those standards where responses correspond in scale with the gravity of infractions committed. This is crucial for fairness while preserving the equilibrium within the overall franchise relationship.

This stage stands as paramount since it’s at this point that a franchisor’s dedication towards maintaining compliance is put through its paces. It involves a nuanced juggling act consisting of:

fostering performance among franchisees

recording incidents when noncompliance occurs

ensuring adherence to terms detailed in the franchise agreement in order to protect the value invested across every partaker within entire network or system built by said franchises.

Regular Audits and Inspections

Regular audits serve as vital examinations of your franchise’s commitment to adherence, providing a gauge for the health of its compliance efforts. These comprehensive checks scrutinize everything from compliance with legal and fiscal responsibilities to maintaining operational standards and brand consistency, thus functioning as an essential quality control tool that boosts the attractiveness of your brand to prospective franchisees. Through these extensive evaluations, not only are discrepancies in sales reporting pinpointed, but also avenues for performance improvement are identified, fostering best practices throughout the entire franchise network.

The auditing procedure is all-encompassing and involves:

Scrutiny of documents

Physical assessments of sites

Conversations with personnel

Incognito initiatives such as ‘mystery shoppers’ to guarantee impartial evaluations

This strategy covers a broad spectrum within the realm of compliance areas so that every element within the franchise—from cybersecurity measures down to human resources management—is upheld at optimum levels.

Addressing Non-Compliance Issues

Addressing issues of non-compliance in a franchise network isn’t just about enforcing penalties. It’s crucial to understand why the problem occurred and work together towards a solution that takes into account the distinct challenges faced by individual local markets, while preserving the relationship between franchisor and franchisee. Assessing whether non-compliance is due to intentional or unintentional actions is key, which then guides whether support should be offered, or if legal measures need to be pursued.

Tailoring corrective strategies to each specific instance of non-compliance helps maintain uniformity and compliance with laws across all franchises within the network. This precise adjustment may involve several approaches such as:

Delivering Training or resources for bridging knowledge gaps or improving skill sets

Introducing more rigorous oversight or reporting systems to curtail future instances of non-compliance

Executing disciplinary measures like warnings or contract termination when facing continuous defiance

By taking these steps, not only are standards within the franchise upheld, but also an environment nurturing equity and cooperative effort—fundamental factors for any successful enterprise—is fortified.

Continuous Improvement

In the world of franchising, remaining static is counterproductive to achievement. Continuous improvement stands as a vital component of any effective compliance program. By harnessing data analytics, those who lead franchises can detect patterns in performance, preempt potential complications and consequently adjust their compliance strategies. This proactive approach capitalizes on technological progress and insights specific to the industry with the goal of elevating franchisee operations while cultivating an atmosphere where adherence to compliance serves not just as a duty but also as a conduit for distinction.

It is this dedication to perpetual learning and flexibility that positions a franchise at the pinnacle of its field. The essence lies in leveraging collective wisdom from across the network in order to spark innovation and preserve an advantage over competitors.

Leveraging Technology for Franchise Compliance

In the contemporary franchise landscape, technology is no longer an extravagance, but a necessity that acts as a catalyst for efficient compliance management. From mobile apps to sophisticated software, technology provides the tools franchisors need to:

Keep a vigilant eye on compliance

Offer franchisees easy access to support and training

Automate complex tasks

Ensure adherence to even the most stringent labor laws

It’s a game-changer, making compliance management easier and more effective.

As franchises expand globally, navigating the legal aspects of digital transformation becomes an increasingly critical skill. It’s about embracing digital law and international business practices to secure the franchise’s future in a rapidly evolving world.

Compliance Management Software

Compliance management software serves as the critical support system for contemporary franchise operations, tailored specifically to maintain regulatory adherence and optimize business workflows. Applications such as ServiceTitan and Naranga deliver specialized features aimed at managing key elements of franchise administration, including supervising operations and enhancing staff training. Meanwhile, more extensive offerings like FranConnect and Configio present a comprehensive array of capabilities designed to oversee every stage of the franchise lifecycle.

The development of these software solutions is an ongoing process that incorporates both technological innovations and insights from user experiences, reflecting the core principle of perpetual enhancement vital for maintaining your franchise’s leadership in compliance management.

Communication Tools

In the modern era of instant connectivity, communication platforms act as vital links within the tapestry of a franchise network. These technologies allow franchisors to:

Quickly and consistently spread important updates throughout all franchises to maintain uniformity in operations

Promote dedicated exchange forums where individuals involved in the franchise can share information efficiently

Communication plays a crucial role in sustaining successful franchise operations. It is essential for making sure that compliance with standards is clear and that directives are executed accurately. Franchisors who select appropriate communication tools establish an open and agile environment for dialogue, which is fundamental for maintaining an orderly function within their franchise network.

Data Analytics

Utilizing data analytics serves as a navigational aid for franchisors, steering them through the voluminous swathes of operational information and helping pinpoint patterns, tendencies, and deviations indicative of compliance concerns. The application of sophisticated analytics can reveal nuanced yet impactful insights that might elude detection without such tools. This allows for early intervention to address potential issues. Early anomaly detection is vital. It enables franchisors to engage with franchise owners positively, promoting uniform adherence to compliance standards throughout the network.

When franchisors incorporate analytical instruments into their compliance frameworks, they are able to:

Refresh their strategies continually in response to dynamic shifts within the franchise sector

Reinforce protection against looming risks tied to compliance

Gain a tactical edge over rivals in this competitive industry

Persistent vigilance through regular monitoring is indispensable for upholding regulatory conformity and retaining a leading position within the franchise domain.

Legal Support and Partnerships

Embarking on the franchise adventure without proper legal guidance can be compared to navigating a ship without a map. Specialized knowledge from lawyers who focus on franchising is essential for maneuvering through the intricate federal and state laws concerning franchises. Such attorneys act as custodians of regulatory compliance, providing counsel and services that help keep the franchise within legal boundaries while it seeks to achieve its business goals.

The skillset of a franchise attorney becomes indispensable starting with crafting the Franchise Disclosure Document, extending to managing contract disagreements, and protecting intellectual property rights. Their expert analysis acts as armor against possible legal complications that may ensnare the franchise.

Franchise Attorneys

Franchise lawyers act as the masterminds behind creating the legal infrastructure upon which a franchise is built. They deliver an array of specific services, such as:

Rigorously crafting and scrutinizing franchise disclosure documents (FDD) and franchise agreements to ensure compliance with regulations while also being tactically advantageous

Resolving disputes related to contracts

Safeguarding rights associated with intellectual property

Providing counsel on employment laws

These essential services facilitate seamless functioning within a franchise business and during the process of selling franchises for both franchisors and potential franchisees, including matters involving the initial fee required to obtain a franchise.

These attorneys offer various functions that support not just compliance but also promote success in running a franchise. Their core duties encompass:

Assessing current performance levels against expectations from past strategic plans or market changes.

Renewal scrutiny for existing contracts

Managing registration tasks pertaining to Franchise Disclosure Documents (FDDs)

Sustaining foundational legalities imperative for franchising operations

[No second bullet point seems fitting]

Their profound dedication towards upholding standards in franchising law often shines through their active involvement in organizations like the American Bar Association Forum on Franchising—proof of their unwavering commitment combined with professional skill sets.

Regulatory Compliance Experts

Experts in regulatory compliance serve as navigators through the complex landscape of rules and regulations that franchises must adhere to. Their advice is essential for keeping up with changing laws and regulations, which can significantly affect the way franchises are run. This is especially true in FDD Registration States where there are specific legal obligations to fulfill before a franchise can be bought or sold, making their knowledge extremely valuable.

In jurisdictions like California, Maryland, New York, and Illinois—known for their rigorous demands on franchise compliance—the importance of these experts cannot be overstated. They deliver.

Insightful expertise and tactics necessary to navigate these complicated legal requirements

Assurance that franchises comply with all relevant statutes

The opportunity for franchisors to concentrate on expanding their business ventures successfully while being compliant.

Summary

As our exploration of the complex realm of franchise compliance comes to a close, it’s evident that balancing legal requirements, brand integrity, and relationship management is key. The true measure of a franchise’s success extends beyond its financial performance. It includes steadfast commitment to adherence to compliance standards which both bolster reputation and contribute to sustainable growth. Crafting an effective franchise compliance program requires clear understanding of duties, maintaining uniformity across the brand, cultivating strong relationships, and employing technology for more efficient operations.

Consider this journey through the intricacies of franchise compliance as your guidebook. Committing to ongoing evaluation measures such as policy formulation, delivering thorough training programs for staff members and diligent oversight is imperative in order ensuring enduring success within today’s competitive market place – always underpinned by professional legal guidance alongside technological advancements aiding process simplification so when harnessed correctly provides not just survival but ensures flourishing growth too – demonstrating yet again how inherent strength found within compliant practices can lay foundations upon which trust-worthy legacies built upon excellence stand time’s test.

Frequently Asked Questions

What is franchise compliance, and why is it important?

Upholding franchise compliance is crucial in preserving the integrity of a brand’s reputation and guaranteeing a uniform experience for customers. It also plays an integral role in sustaining the franchise model through adherence to pertinent laws and established brand standards.

What role do franchise attorneys play in franchise compliance?

Attorneys specializing in franchise law are essential in maintaining compliance within franchises. They offer expert legal assistance, meticulously prepare and scrutinize vital documents, navigate through conflicts, and confirm conformity with the regulations governing franchises.

How can technology be used to enhance franchise compliance?

Utilizing compliance management software, leveraging communication tools, and employing data analytics can optimize processes and boost operational efficacy. These resources assist in recognizing trends that facilitate proactive management of compliance matters, thereby significantly advancing franchise compliance.

What are some incentives that can motivate franchisees to comply with franchise agreements?

Providing rewards like monetary awards, accolades, and special privileges can serve as powerful motivation for franchisees to adhere to the terms of their franchise agreements and maintain the integrity of brand standards. Such incentives offer concrete advantages that encourage a franchisee’s dedication to meeting compliance obligations.

How often should franchise compliance audits be conducted?

Annual franchise compliance audits are essential to maintain consistent adherence to operational, brand, legal, and financial standards throughout the franchise network. These audits also foster continuous improvement and quality assurance within the franchise system.