Franchising has become a popular business model, allowing entrepreneurs to establish their own businesses—whether as an owner of a small business or a larger operation—with the support and guidance of an established brand. However, the failure of a franchisee’s business can lead to legal challenges for the franchisor. In this article, we will explore the various legal liabilities that franchisors may face when a franchisee’s business fails. Understanding these liabilities is crucial for both franchisors and potential franchisees, especially the franchise owner, to ensure a successful and mutually beneficial relationship.

Understanding the Franchise Relationship: A Brief Overview

Before delving into the legal liabilities, it is important to have a clear understanding of the franchise relationship. A franchise is a legal and commercial relationship, specifically a contractual relationship, between the franchisor, who owns the brand, and the franchisee, who operates the business under the franchisor’s brand and system. This contractual relationship is typically defined as an independent contractor relationship in the franchise agreement, meaning the franchisee is considered an independent contractor rather than an agent of the franchisor. The franchisor provides the franchisee with the necessary support, training, and guidance to establish and operate the business. In return, the franchisee pays fees and royalties to the franchisor.

While the franchise agreement establishes the terms and conditions of the relationship, it is crucial to note that franchisors typically exercise significant control over franchisees. The franchise agreement states that franchisees are independent contractors, not agents, to avoid creating an agency relationship. However, excessive control over the franchisee’s operations can risk establishing an actual or apparent agency relationship, which may result in the franchisor being vicariously liable for the franchisee’s actions. This control can include requirements related to branding, marketing, operation standards, and product or service offerings. This level of control creates a unique legal relationship that comes with inherent responsibilities and vicarious liability as a key legal risk for both parties involved.

The Role of Franchisors in Supporting Franchisee Success

Franchisors have a vested interest in the success of their franchisees’ businesses. As such, they typically provide ongoing support to ensure the franchisee’s success. Support can include initial and ongoing training, marketing and advertising assistance, operational guidance, and access to established supply chains, and other services tailored to franchisee needs. Franchisors may also have regular communication and site visits to monitor performance and address any concerns or challenges that arise.

While this support is intended to facilitate franchisee success, it also implies certain legal obligations for the franchisor. The benefits of these services include enhanced operational efficiency, risk mitigation, and increased financial protection for both franchisors and franchisees. By providing support and guidance, franchisors assume a duty to act reasonably and in good faith to help franchisees achieve success. Failure to fulfill these obligations may result in legal consequences and potential liability for the franchisor.

Exploring the Potential Risks and Liabilities for Franchisors

When a franchisee’s business fails, franchisors may face several potential risks and liabilities. These can arise from a variety of sources, including contractual obligations, statutory duties, and common law principles. Let’s explore some of the key areas where franchisors may face legal challenges. Liability may also be claimed by franchisees or third parties if they believe the franchisor failed in their obligations.

1. Legal Obligations of Franchisors towards Failed Franchisees

When a franchisee’s business fails, the franchisor may have certain legal obligations towards the failed franchisee. These obligations can include acting in good faith, providing reasonable support and guidance, and refraining from engaging in conduct that could undermine the franchisee’s business. Failure to fulfill these obligations may result in legal claims, such as breach of contract or breach of the duty of good faith and fair dealing.

2. Examining the Impact of a Franchisee’s Business Failure on the Franchisor

A franchisee’s business failure can have significant repercussions for the franchisor, including the loss of money and ongoing fees as a direct financial impact. Besides potential damage to the brand’s reputation and loss of revenue, the franchisor may face legal challenges from other franchisees or stakeholders. Other franchisees may claim that the franchisor’s failure to support the failed franchisee properly resulted in harm to their businesses. Additionally, stakeholders such as lenders or suppliers may take legal action against the franchisor if they suffer financial losses due to the failure of a franchisee’s business.

3. Identifying Common Legal Challenges Faced by Franchisors in Failed Businesses

Franchisors may encounter various legal challenges when a franchisee’s business fails. Some of the common legal issues in these cases include breach of contract, misrepresentation, negligence, and violation of franchise disclosure laws, particularly regarding the franchise disclosure document, which is a key legal requirement. Franchisees might argue that the franchisor failed to disclose relevant information or provided false or misleading information during the sales process. Such claims can give rise to substantial legal liabilities for franchisors, including potential damages and legal fees, and franchise owners may bring claims based on these legal challenges.

4. Mitigating Liability: Best Practices for Franchisors in Troubled Times

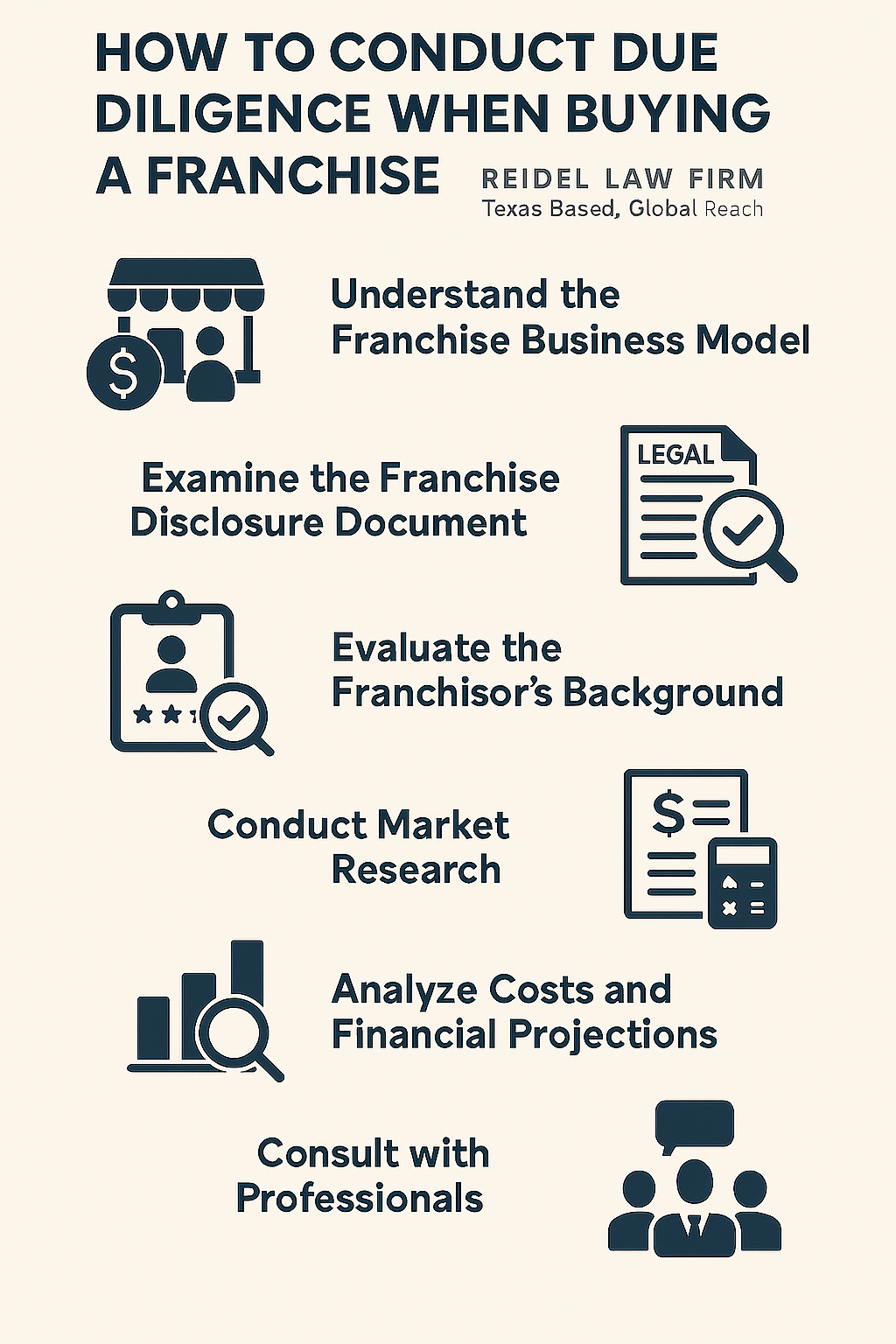

To mitigate legal liabilities arising from a franchisee’s business failure, franchisors should implement best practices from the outset. This includes conducting thorough due diligence before selecting franchisees, providing comprehensive training and ongoing support. It is also important to include clear disclaimers in the operations manual to limit the scope of control and avoid creating an agency relationship. Additionally, maintaining accurate and updated franchise disclosure documents, and complying with all relevant laws and regulations are essential. By taking proactive measures, franchisors can reduce the likelihood of legal challenges and potentially limit their liability when a franchisee’s business fails.

Analyzing Case Studies: High-Profile Lawsuits Involving Failed Franchise Businesses

Examining real-world case studies can provide valuable insights into the potential legal liabilities franchisors may face when a franchisee’s business fails. By studying these cases, franchisors can learn from past mistakes and better navigate the legal landscape. Some high-profile lawsuits involving failed franchise businesses include Case Study 1, [Case Study 2], and [Case Study 3]. These cases highlight the importance of proper due diligence, ongoing support, and compliance with all legal obligations to avoid or minimize legal liabilities.

Understanding the Legal Framework: Key Statutes and Regulations Relevant to Failed Franchises

Franchisors must be familiar with the various statutes and regulations that govern franchising to understand their legal obligations and potential liabilities. Key laws and regulations include the Federal Trade Commission’s Franchise Rule, which mandates specific disclosures to potential franchisees, as well as state-specific franchise laws that may impose additional requirements—most states have their own franchise regulations. By having a comprehensive understanding of these legal frameworks, franchisors can fulfill their obligations and minimize the risk of legal challenges when a franchisee’s business fails.

Assessing the Financial Consequences for Franchisors When a Franchisee Fails

When a franchisee’s business fails, franchisors may face significant financial consequences. These can include loss of royalty and fee payments, costs associated with legal disputes, damage to the brand’s reputation, and potential fallout from other franchisees or stakeholders. Franchisors should have contingency plans and financial reserves in place to mitigate these risks. Adequate insurance coverage is essential to protect against potential financial liabilities arising from failed franchise businesses. Business insurance helps both franchisors and franchisees recover from financial losses and legal claims, ensuring that the business is protected from unexpected events.

Property and casualty insurance policies are designed to provide coverage for damage caused by natural disasters, theft, or other events, as well as for personal injury and product liability claims. There are different coverage options available depending on the type of franchise, and individual franchisees may require tailored policies to address their specific risks. Insurance coverage protects not only the franchisor but also employees, customers, and the business as a whole, providing peace of mind and security for all parties involved. Workers’ compensation insurance is distinct from health insurance and is required to protect employees in case of work-related injuries.

The Importance of Proper Due Diligence in Selecting and Supporting Potential Franchisees

One of the most effective ways for franchisors to minimize legal liabilities is by conducting thorough due diligence when selecting and supporting potential franchisees. Franchisors should carefully evaluate candidates’ financial capabilities, business acumen, and organizational fit. Furthermore, ongoing monitoring and support are crucial to assist franchisees in overcoming challenges and ensuring their long-term success. By selecting and supporting franchisees wisely, franchisors can mitigate the risk of business failure and subsequent legal liabilities.

Navigating Contractual Obligations: How Agreements between Franchisors and Franchisees Impact Liability

The franchise agreement is a legally binding contract that outlines the rights and responsibilities of both the franchisor and franchisee. Properly drafted agreements can help clarify the parties’ obligations, minimize potential disputes, and allocate risks and liabilities. Franchise agreements should address issues such as termination rights, non-compete clauses, indemnification clauses, dispute resolution mechanisms, and obligations upon business failure. Clear and comprehensive agreements can provide a framework for managing legal liabilities in the event of a franchisee’s business failure.

Effective Risk Management Strategies for Minimizing Legal Exposure in a Failing Business Scenario

Risk management is a crucial aspect of minimizing legal exposure for franchisors. By implementing effective risk management strategies, franchisors can identify potential risks and develop appropriate mitigation plans. These strategies can include regular monitoring of franchisee performance, implementing robust quality control measures. It is also important to classify franchisees as independent contractors to limit liability. Risk management should focus on monitoring overall franchisee’s operations and performance standards without interfering in their daily activities, to avoid creating an agency relationship. Additional strategies include providing ongoing training and support, maintaining accurate and up-to-date documentation, securing adequate insurance coverage, and promptly addressing any compliance issues or disputes. Proactive risk management can significantly reduce the probability of legal challenges when a franchisee’s business fails.

Property Protection: Safeguarding Franchise Assets in the Event of Failure

Protecting property is a fundamental concern for franchise owners, especially in the face of business failure or unexpected events. Property and casualty insurance is a cornerstone of franchise insurance, providing essential coverage to safeguard valuable assets such as equipment, inventory, and physical locations. Franchisees should carefully review their franchise agreement to understand their contractual obligations regarding property protection, as most franchisors require specific insurance coverage to protect both the brand and individual franchise businesses.

Commercial property insurance is particularly important, as it helps shield franchise owners from financial losses caused by natural disasters, theft, vandalism, or other unforeseen incidents. This coverage protects not only the physical property but also supports the continuity of business operations during challenging times. Franchisors and franchisees alike should ensure that their insurance policies are comprehensive and up-to-date, reflecting the unique risks associated with their business. By prioritizing property protection and maintaining adequate insurance coverage, franchisees can minimize potential losses and help secure the long-term success of their franchise, while franchisors can fulfill their contractual obligations and protect the integrity of their franchise system.

Casualty and Commercial Auto: Addressing Specialized Insurance Needs for Franchisors

Casualty and commercial auto insurance are vital components of a robust franchise insurance strategy, addressing specialized risks that can impact both franchisors and franchisees. Casualty insurance provides protection against work related injuries or illnesses that may occur during day to day operations, helping to cover medical expenses and legal costs associated with such incidents. This type of coverage is essential for safeguarding the business from unexpected liabilities and ensuring compliance with legal requirements.

Commercial auto insurance is equally important for franchises that utilize vehicles as part of their business operations. This insurance policy offers coverage for accidents involving company vehicles, protecting against financial losses from property damage, bodily injury, or legal claims. Franchisors should also consider additional coverages, such as employment practices liability insurance, which protects against wrongful acts like discrimination, harassment, or wrongful termination claims.

By working closely with their insurance provider, franchisors can develop tailored insurance policies that address the unique needs of their franchisees, including casualty insurance, commercial auto, and other relevant coverages. This proactive approach not only helps protect the business and its assets but also supports franchisees in managing potential risks and maintaining a safe, compliant operation.

Evaluating the Role of Insurance Coverage in Protecting Franchisors from Liability in Failed Businesses

Insurance coverage plays a vital role in protecting franchisors from financial liabilities in the event of a franchisee’s business failure. Franchisors should carefully evaluate their insurance needs and secure appropriate coverage, including general liability insurance, errors and omissions insurance, and directors and officers insurance. Additionally, franchise agreements should require franchisees to maintain certain minimum levels of insurance coverage to safeguard against potential claims. By having comprehensive insurance coverage in place, franchisors can mitigate the financial impact of legal disputes arising from failed franchise businesses. Many insurance policies also provide services such as legal defense and claims management.

Creating an Insurance Policy: Steps for Franchisors to Ensure Comprehensive Coverage

Developing a comprehensive insurance policy is a critical responsibility for franchisors seeking to protect their franchise network from potential liabilities and financial losses. The process begins with a thorough review of the franchise agreement to identify all contractual obligations related to insurance coverage. Understanding these requirements helps franchisors determine the types and levels of insurance needed for their franchise operations.

Next, franchisors should collaborate with experienced insurance providers to assess the specific risks associated with their business model. This assessment should include general liability insurance to cover claims of bodily injury or property damage, professional liability insurance for protection against errors or omissions, and property and casualty insurance to safeguard physical assets. Additional coverages, such as cyber insurance and business interruption insurance, can provide extra protection against emerging threats and operational disruptions.

Regularly reviewing and updating the insurance policy is essential to ensure it remains relevant as the business evolves. Franchise owners should be aware of the importance of due diligence when selecting insurance policies, seeking professional guidance to navigate the complexities of franchise insurance. By taking these steps, franchisors can create a robust insurance policy that not only meets contractual obligations but also provides comprehensive protection for both franchisors and franchisees, minimizing potential losses and supporting the long-term success of the franchise system.

Lessons Learned: Insights from Industry Experts on Dealing with Failed Franchise Ventures

Industry experts can provide valuable insights into the legal liabilities franchisors may face when a franchisee’s business fails. Learning from the experiences of others can help franchisors navigate potential challenges more effectively. Consulting experienced franchise attorneys, attending industry conferences and seminars, and engaging with franchisor associations can provide a wealth of knowledge and guidance in managing legal liabilities associated with failed franchise ventures.

The Pros and Cons of Alternative Dispute Resolution Methods for Resolving Disputes Related to Failed Businesses

Disputes related to failed franchise businesses can often escalate into lengthy and costly litigation. However, alternative dispute resolution (ADR) methods offer an alternative approach to resolving disputes. ADR methods, such as mediation or arbitration, can be less adversarial, more cost-effective, and allow for more timely resolutions. Franchisors should weigh the pros and cons of ADR, keeping in mind the potential impact on their legal liabilities and overall reputation.

Examining Recent Legal Precedents and Court Decisions Affecting Liability for Failed Franchises

Legal precedents and court decisions can have a significant impact on the liabilities franchisors face when a franchisee’s business fails. Staying up-to-date with recent legal precedents is crucial for franchisors to understand the current legal landscape. Engaging with legal counsel, monitoring relevant court decisions, and reviewing industry publications can provide valuable insights into emerging trends and potential changes in liability for failed franchise businesses.

The Future of Liability: Anticipating Potential Changes and Trends in Lawsuits Involving Failed Businesses

The landscape of liability for failed franchise businesses is subject to constant change. Anticipating potential future changes and trends is essential for franchisors to stay ahead and manage their legal liabilities effectively. Factors such as shifts in consumer behavior, regulatory updates, and emerging technologies can all impact legal obligations and potential liabilities. By remaining proactive and adaptable, franchisors can mitigate risks and position themselves for success in the face of evolving legal challenges.

Conclusion: Key Takeaways for Balancing Legal Responsibilities as a Franchisor

As a franchisor, understanding and managing the legal liabilities associated with a franchisee’s business failure is crucial for maintaining a successful and sustainable franchising system. By providing proper support, conducting due diligence, implementing risk management strategies, securing adequate insurance coverage, and staying informed on the legal landscape, franchisors can minimize their exposure to legal challenges. Ultimately, maintaining open communication, acting in good faith, and fulfilling contractual and statutory obligations are essential for fostering mutually beneficial relationships with franchisees and navigating potential legal pitfalls.

Franchisors should always consult with legal professionals experienced in franchise law to ensure compliance with all relevant laws and regulations and to address any specific concerns or circumstances.

3 thoughts on “What legal liabilities might a franchisor face if a franchisee’s business fails?”

Comments are closed.