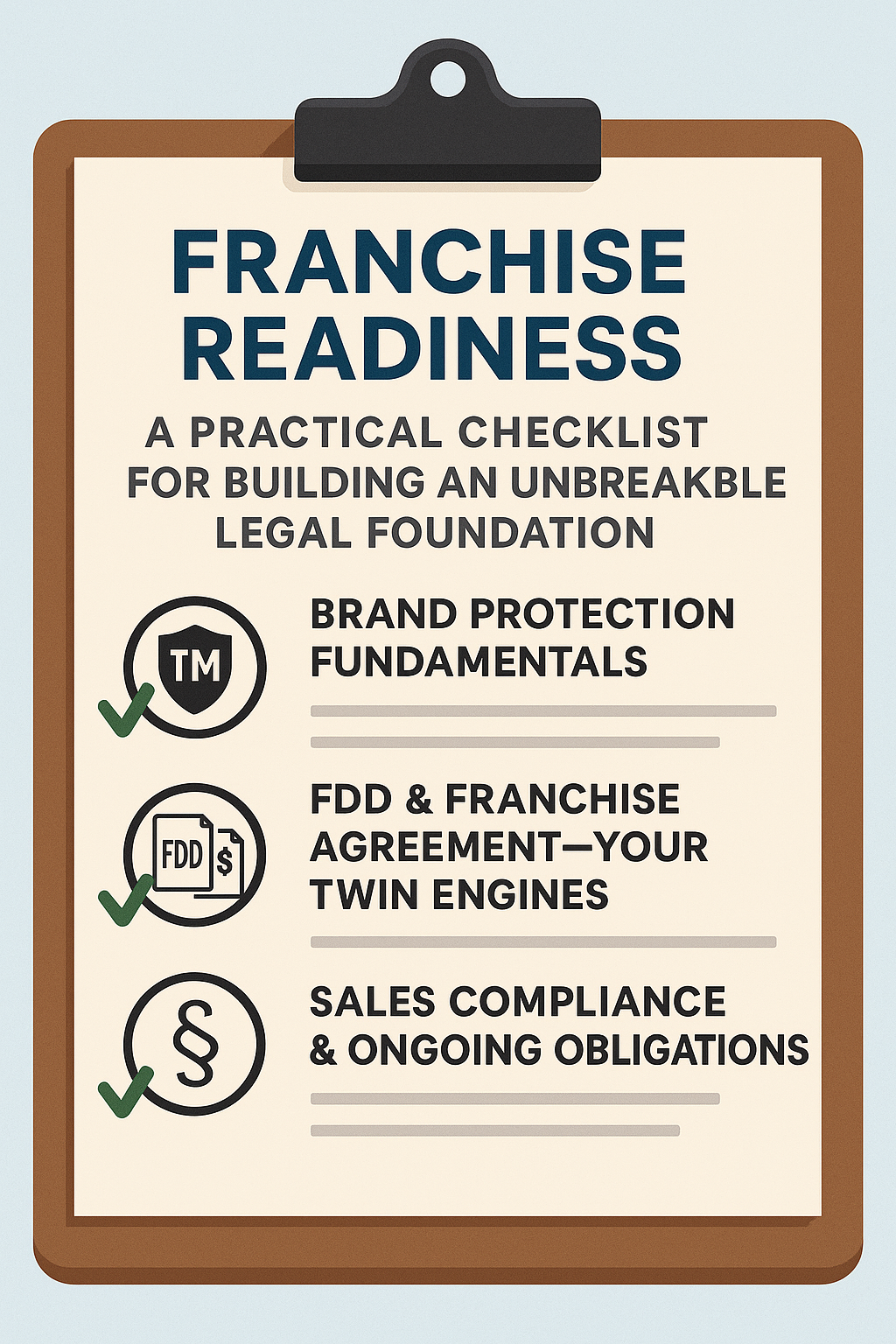

In franchising, two documents are vital: the Franchise Disclosure Document (FDD) and the franchise agreement. This handbook, “The Franchisors Handbook: Understanding FDD and Franchise Agreements,” helps franchisors understand these documents. It covers what each document is, why they matter, and how to use them effectively.

Key Takeaways

Franchising offers benefits such as brand recognition, lower failure rates, and economies of scale, making it an attractive business model for both franchisors and franchisees.

The Franchise Disclosure Document (FDD) is a legally mandated document that provides essential information about the franchisor, investment costs, and obligations, facilitating informed decision-making for prospective franchisees.

Understanding the franchise agreement and the associated fees, along with evaluating the franchisor’s background, is critical for prospective franchisees to assess the viability and financial commitments of the franchise opportunity.

The Basics of Franchising

Franchising allows a franchisor to license their business model to franchisees, who then operate new franchise locations as a franchise opportunity. This approach provides immediate brand recognition, drawing customers from the start and typically resulting in higher profits than independent businesses.

A notable advantage of franchising is its lower failure rate. Franchisees gain from existing support networks and training programs that maintain consistent service standards. They can also use collective purchasing power to cut supply costs and enhance profitability.

Despite its challenges, such as the need for ongoing support and legal compliance, franchising remains attractive due to benefits like increased system sales, economies of scale, and royalties.

Key Components of a Franchise Disclosure Document (FDD)

Legally required under franchise laws, the Franchise Disclosure Document (FDD) offers crucial information to prospective franchisees. It includes 23 sections, or Items, each covering various aspects of the franchise.

Topics in these sections include the franchisor’s background, fees, franchisee obligations, and financial performance. For example, the FDD outlines estimated investment costs, territory rights, and ongoing fees like royalties and marketing contributions, helping prospective franchisees make informed decisions.

The FDD must be clear and accessible, ensuring potential franchisees understand the information. Depending on local regulations, franchisors might also need to include additional documents like the franchise agreement and state-specific disclosures.

Legal Requirements of the FDD

The Federal Trade Commission (FTC) enforces the legal framework of the FDD through its Amended Franchise Rule, codified at 16 C.F.R. §436. This rule requires franchisors to provide a Franchise Disclosure Document to potential franchisees before any sale, ensuring transparency and fairness.

The FDD contains vital information about the franchisor’s history, business experience, legal history, and associated fees. Franchisors must also include exhibits like the franchise agreement and audited financial statements, depending on state laws.

A key part of the FDD process is the mandatory 14-day waiting period after signing. This gives prospective franchisees sufficient time to review the information and make an informed decision before entering any agreements.

Understanding the Franchise Agreement

The franchise agreement is central to the franchise relationship, protecting the franchisor’s brand and outlining the responsibilities and rights of both parties. Along with the FDD, it forms the foundation of the legal framework in franchising.

Key components include territory rights, minimum performance standards, and obligations for trademark use and advertising. These ensure franchisees operate within set parameters, maintaining brand integrity while benefiting from franchisor support.

Franchise agreements vary, including master franchises, product distribution, and business format agreements, each suited to different needs. Franchisees usually get extensive support from franchisors, including a complete operational setup for a smooth start and ongoing success.

Initial and Ongoing Franchise Fees

Understanding the various fees is a crucial financial aspect of franchising. The initial franchise fee, typically ranging from $10,000 to $50,000, is paid upon signing the agreement and often covers initial training, support, and brand development.

In addition to the initial fee, franchisees must pay ongoing royalty fees, usually 5% to 9% of their gross revenue. These fees are critical for franchisor support and brand maintenance. Franchise systems also often require contributions to an Advertising or Brand Fund, typically 1% to 4% of gross sales, for collective marketing efforts.

Market Introduction Program costs cover promotional activities before and after a franchise opens. Understanding these financial commitments helps prospective franchisees prepare for the financial obligations of running a franchise.

Financial Statements and Profit Projections

Prospective franchisees should evaluate a franchisor’s financial stability by reviewing financial statements, providing insights into the company’s financial health and assessing investment risk. This step helps prospective franchisee understand the potential profitability and sustainability of the franchise.

Only about 30 to 40 percent of franchisors share financial performance data with potential franchisees. Therefore, consulting a franchising-specialized accountant to thoroughly analyze these financial statements is advisable.

Such analysis offers a clearer picture of the franchisor’s financial performance and future prospects, helping to make an informed investment decision.

Evaluating the Franchisor’s Background

Investigating a franchisor’s background is vital for prospective franchisees. A thorough review of their history offers valuable insights into their credibility and support capabilities. Transparency is crucial; a lack of it, especially concerning past bankruptcies, is a major red flag.

Evaluating the franchisor’s executive team is equally important. Their expertise and leadership quality can indicate the franchise’s potential for success. Additionally, examining the success rates of existing franchisees can reflect the franchisor’s support effectiveness and overall profitability.

A high turnover rate in the last three years might suggest inadequate franchisor support or business model issues. Similarly, a lack of growth could indicate organizational problems or market saturation. Reviewing legal disputes involving the franchisor can also reveal underlying operational issues.

Dispute Resolution and Termination Clauses

Conflict is inevitable in business relationships, including franchising. Franchise agreements often include mediation and arbitration to resolve conflicts, promoting amicable resolutions. These methods provide a structured way to handle disputes without costly and time-consuming litigation.

Termination clauses are crucial in franchise agreements, outlining specific conditions under which either party can end the contract. Common reasons include contractual non-compliance, financial issues, and unauthorized use of brand materials, ensuring clarity and protecting interests.

Both parties must understand these clauses to know their rights and obligations in case of a dispute or contract breach.

Red Flags to Watch For

Identifying red flags in the FDD and franchise agreement is vital for making informed decisions. Excessive fees may indicate financial instability or mismanagement. Similarly, very small territory sizes could suggest the franchisor is desperate for revenue, which may not bode well for the franchise’s success.

A lack of transparency from the franchisor is another red flag. Prospective franchisees should be cautious if the franchisor is reluctant to provide clear, comprehensive information about the business. Early recognition of these signs can help avoid poor investment decisions and protect financial interests.

The Process of Signing and Submitting Documents

Signing and submitting franchising documents formalizes the franchise relationship. Franchisors often face delays in the FDD sign-off process due to challenges like time constraints and the need for timely signatures. Correctly signing and submitting all documents is crucial to avoid legal complications.

Prospective franchisees should carefully review and sign all necessary documents within the stipulated time frame, including the FDD, franchise agreement, and any state-specific disclosures. Timely submission ensures the franchisee can proceed with setting up their new location without delays.

Summary

Understanding the intricacies of the Franchise Disclosure Document (FDD) and franchise agreements is essential for anyone considering a franchise opportunity. These documents provide the foundation for a successful franchise relationship, outlining the rights, obligations, and financial commitments of both parties.

By thoroughly reviewing the FDD and franchise agreement, prospective franchisees can make informed decisions, minimizing risks and maximizing their chances of success. It’s also crucial to evaluate the franchisor’s background, assess financial statements, and be aware of potential red flags that could indicate underlying issues.

In conclusion, being well-informed and diligent in your research is the key to franchising success. Take the time to understand these documents, seek professional advice when needed, and approach the franchise opportunity with confidence and clarity.

Frequently Asked Questions

What is a franchise disclosure document (FDD)?

The Franchise Disclosure Document (FDD) is a legally mandated document that offers crucial information about a franchise to potential franchisees. It ensures transparency and informs prospective business owners about the franchise opportunity.

Why are franchise fees important?

Franchise fees are important because they provide essential funding for initial training, support, and brand development, which help maintain a consistent business model across franchises. This investment ultimately contributes to the overall success and sustainability of the franchise.

What should I look for in a franchise agreement?

In a franchise agreement, it is essential to pay close attention to territory rights, performance standards, and the obligations of the franchisee. These elements will significantly impact your business operations and success.

How can I evaluate a franchisor’s background?

To effectively evaluate a franchisor’s background, thoroughly investigate their history, leadership experience, and the success rates of their franchisees. This comprehensive assessment will provide valuable insights into the reliability and potential profitability of the franchise.

What are common red flags in franchising?

Common red flags in franchising include excessive fees, limited territorial rights, and a lack of transparency in operations. These indicators should prompt thorough due diligence before proceeding.