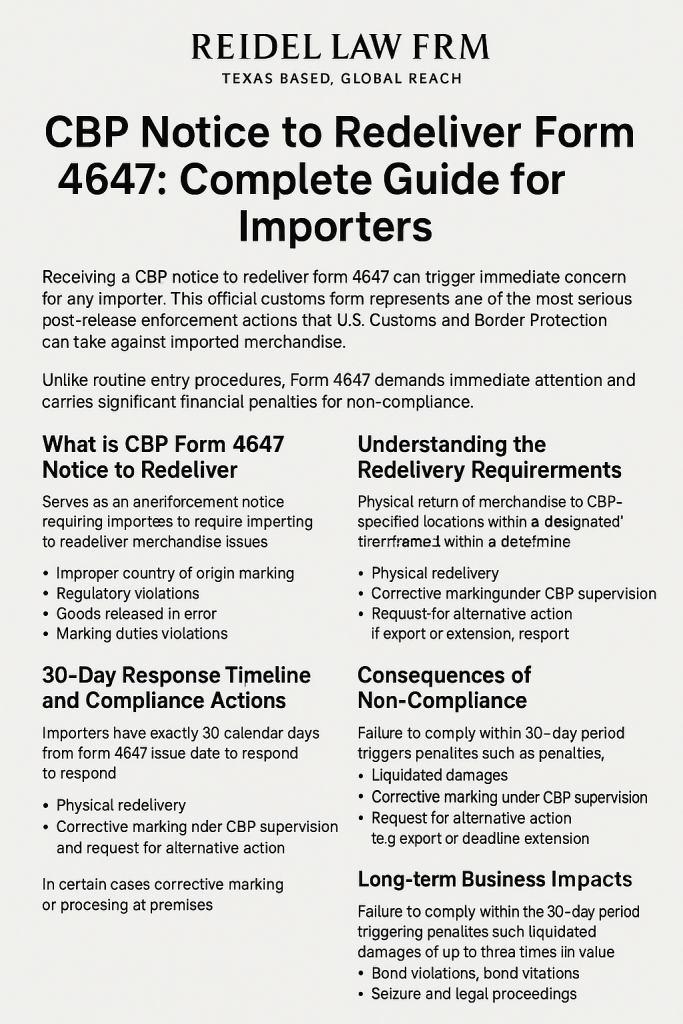

Receiving a CBP notice to redeliver form 4647 can trigger immediate concern for any importer. This official customs form represents one of the most serious post-release enforcement actions that U.S. Customs and Border Protection can take against imported merchandise. Unlike routine entry procedures, Form 4647 demands immediate attention and carries significant financial penalties for non-compliance.

When customs and border protection determines that previously released merchandise violates marking requirements, regulatory standards, or was released in error, they issue this redelivery demand with a strict 30-day compliance deadline. Understanding your obligations and response options can mean the difference between resolving the issue efficiently and facing substantial liquidated damages or even seizure proceedings.

This comprehensive guide covers everything importers need to know about CBP form 4647, from understanding the legal requirements to implementing effective prevention strategies. Whether you’re facing your first notice to redeliver or seeking to strengthen your compliance program, this article provides the practical insights and regulatory knowledge you need to navigate this complex area of customs law.

What is CBP Form 4647 Notice to Redeliver

CBP Form 4647, officially known as the Notice to Mark and/or Notice to Redeliver, serves as an official enforcement notice issued by U.S. Customs and Border Protection requiring importers to redeliver merchandise to CBP custody. This customs form differs fundamentally from initial entry documents like forms 3461 and 7501, as it addresses post-release compliance issues rather than pre-release procedures.

The form functions as a legal demand that activates when imported goods are found to be non-compliant after release into U.S. commerce. An authorized CBP official issues the notice when merchandise examined during post-release audits, investigations, or routine inspections fails to meet federal requirements under the harmonized tariff schedule or other applicable laws.

Common triggers for CBP form 4647 include:

- Improper country of origin marking – When imported articles lack required country of origin marking or display incorrect origin information

- Regulatory violations – FDA refusals for food safety, drug approval issues, or other agency compliance failures

- Goods released in error – Merchandise that should have been restricted but was mistakenly allowed entry

- Marking duties violations – Products that fail to meet specific marking requirements under 19 CFR Part 134

The notice to mark component allows for corrective action under CBP supervision, while the redelivery demand requires physical return of such merchandise to designated facilities. Unlike conditional release periods where importers can address issues before final entry, Form 4647 addresses violations discovered after goods have entered commerce, making the stakes considerably higher.

This customs form carries the full legal authority of the tariff act, meaning failure to comply triggers automatic penalty provisions. The document specifies exactly what corrective action must be taken, where merchandise must be delivered, and the precise timeline for compliance.

Understanding the Redelivery Requirements

Redelivery means physically returning merchandise to CBP custody at a designated bonded warehouse or CBP facility specified in the notice. The Importer of Record (IOR) bears complete legal responsibility for arranging and paying for this process, regardless of who currently possesses the goods or where they’re located.

When CBP issues a redelivery demand, importers must transport goods to the CBP-specified location within the mandated timeframe. This typically involves:

Physical Transport Requirements

- Arranging commercial transportation to move merchandise from the importer’s premises or current location

- Coordinating with bonded warehouse facilities or public stores designated by the port director

- Ensuring proper documentation accompanies the shipment during transport

- Meeting any special handling requirements for specific product categories like alcoholic beverages

Cost Responsibilities The actual owner or importer bears all financial responsibility for redelivery, including:

- Transportation costs from current location to the designated facility

- Storage fees at bonded warehouses or CBP facilities

- Handling charges and administrative fees

- Any specialized packaging or preparation required for transport

Alternative Compliance Options In certain circumstances, CBP may authorize alternatives to physical redelivery:

- Corrective marking under CBP supervision at the current location

- Remarking at the importer’s premises with CBP oversight

- Processing at such other appropriate places as determined by CBP

- Export of the merchandise if destruction or return to origin is more practical

CBP may require redelivery for goods that violate FDA regulations, lack proper marking, or were released in error. The electronic equivalent of paper forms enables faster processing, but the fundamental requirement to re deliver merchandise remains unchanged regardless of documentation format.

The redelivery process must ensure that merchandise contained in the original entry is properly accounted for and that any marking duties or regulatory violations are addressed according to applicable provisions of customs law.

30-Day Response Timeline and Compliance Actions

Importers have exactly 30 calendar days from the form 4647 issue date to complete their response to the redelivery notice. This timeline applies universally, regardless of the complexity of the violation or the volume of merchandise involved. The date calculation begins from when CBP officially issues the notice, not when the importer receives or acknowledges it.

Within the 30-day window, importers must choose from several compliance paths:

Physical Redelivery

- Transport merchandise to the CBP-designated facility

- Coordinate with bonded warehouse operators for receipt and storage

- Provide proper documentation proving the goods match the original entry

- Pay all associated transportation and storage costs

Corrective Marking Under Supervision

- Request CBP supervision for on-site marking corrections

- Demonstrate that goods can be properly marked to show the correct country of origin

- Ensure marking meets durability and visibility requirements under 19 CFR Part 134

- Document the marking process with photos and written response to CBP

Documentation for Unavailable Merchandise If merchandise has been sold, consumed, destroyed, or is otherwise unavailable, importers must:

- Immediately notify CBP with a detailed written response

- Provide proof of disposition (sales receipts, destruction certificates, consumption records)

- Submit an amended petition if the circumstances warrant penalty mitigation

- File supporting documentation through the ACE system or direct submission to the port director

Request for Alternative Action In exceptional circumstances, importers may request:

- Permission to export the merchandise rather than redeliver

- Authorization to destroy goods under CBP supervision

- Approval for corrective action at the current location

- Extension of the compliance deadline (rarely granted)

The 30-day deadline applies to all compliance actions, not just physical redelivery. Extensions require exceptional circumstances with formal CBP approval and are rarely granted. Even when filing a protest challenging the underlying violation, the compliance deadline typically remains in effect unless CBP explicitly grants a stay.

Critical Timeline Considerations

- Calendar days, not business days, determine the deadline

- Weekends and federal holidays count toward the 30-day limit

- Postmark dates for mailed responses may be accepted, but electronic submission through ACE is recommended

- Late responses automatically trigger penalty assessment procedures

- Partial compliance (such as redelivering only some of the merchandise) may not satisfy the legal requirement

Consequences of Non-Compliance

Failure to comply with a notice to redeliver within the 30-day period triggers automatic penalty assessment procedures that can result in substantial financial consequences. CBP’s enforcement authority under the tariff act provides multiple penalty mechanisms designed to ensure compliance with redelivery demands.

Liquidated Damages Assessment

The primary penalty for non-compliance involves liquidated damages calculated based on the merchandise value and violation type:

Violation Category | Penalty Amount |

|---|---|

Standard merchandise | Up to full value of goods |

Restricted/prohibited goods | Up to three times merchandise value |

Alcoholic beverages | Up to three times value |

Marking violations | Value-based assessment |

FDA refused merchandise | Enhanced penalty provisions |

Entry Bond Conditions and Forfeiture

Non-compliance directly violates entry bond conditions set forth in the original importation. This can result in:

- Bond forfeiture proceedings against the surety company

- Increased bonding requirements for future entries

- Potential suspension of import privileges until bonds are satisfied

- Additional scrutiny of all future shipments from the importer

Seizure and Legal Proceedings

CBP may initiate seizure proceedings for merchandise not returned as demanded. This process involves:

- Administrative seizure of goods if they can be located

- Legal proceedings to establish government ownership

- Forfeiture of merchandise to the U.S. government

- Potential criminal referral for willful violations

Long-term Business Impact

Persistent non-compliance creates lasting consequences:

- Enhanced examination rates for future shipments

- Loss of trusted trader program benefits (C-TPAT, FAST)

- Increased CBP scrutiny of all import activities

- Reputational damage affecting relationships with suppliers and customers

- Potential debarment from import privileges for egregious violations

Additional Penalties Under 19 USC 1592

Serious violations may trigger separate penalties for:

- Material omissions in entry documentation

- False statements about merchandise characteristics

- Negligent violations of customs law requirements

- Gross negligence in compliance procedures

The cumulative effect of these penalties can far exceed the original value of the merchandise, making prompt compliance with redelivery demands essential for maintaining viable import operations.

Working with Customs Brokers and Professional Support

Licensed customs brokers play a critical role in managing Form 4647 responses and coordinating compliance actions on behalf of importers. Their expertise in customs procedures and relationships with CBP officials can significantly improve the efficiency and success of redelivery operations.

Broker Services for Form 4647 Compliance

Professional customs brokers typically handle:

Documentation and Communication

- Preparing formal written responses to CBP notices

- Filing electronic submissions through the ACE Portal

- Coordinating with multiple CBP offices when merchandise spans different ports

- Managing correspondence with regulatory agencies like FDA when applicable

Logistics Coordination

- Arranging transportation from current merchandise location to designated facilities

- Coordinating with bonded warehouse operators for receipt and storage

- Scheduling CBP supervision for corrective marking procedures

- Managing the physical transfer of goods to CBP custody

Regulatory Compliance

- Interpreting specific requirements in the redelivery notice

- Ensuring proper documentation accompanies redelivered merchandise

- Coordinating with other agencies (FDA, CPSC, etc.) for multi-agency violations

- Managing compliance timelines to meet the 30-day deadline

Cost Management

- Negotiating transportation rates for emergency redelivery

- Coordinating storage at public stores or bonded facilities

- Managing examination fees and handling charges

- Providing cost estimates for different compliance options

Legal and Advisory Support

For complex cases or contested violations, customs attorneys provide specialized services:

Protest Preparation

- Analyzing the legal basis for Form 4647 issuance

- Researching regulatory exemptions and precedent cases

- Preparing comprehensive protest documentation

- Representing importers in administrative proceedings

Compliance Strategy

- Developing long-term compliance programs to prevent future violations

- Conducting internal audits of marking and documentation procedures

- Training importer personnel on regulatory requirements

- Implementing corrective action protocols

Multi-Agency Coordination Professional support becomes especially valuable when multiple agencies are involved. For example, FDA refused merchandise may require coordination between CBP for redelivery and FDA for admissibility determination, while still meeting CBP’s 30-day timeline.

The investment in professional support often proves cost-effective compared to the potential penalties and operational disruption of non-compliance or improperly handled redelivery procedures.

Filing Protests and Legal Challenges

Importers who believe a CBP notice to redeliver form 4647 was issued incorrectly can file a formal protest under 19 CFR §174.12 to challenge the underlying determination. However, the protest process requires careful navigation of both substantive legal requirements and critical timing considerations.

Protest Filing Requirements

Timeline for Protest Submission

- Protests must be filed within 180 days from the date of the contested CBP action

- The protest number should reference the specific entry and CBP determination being challenged

- Late-filed protests are generally dismissed without consideration of their merits

Critical Timing Consideration Filing a protest does not automatically suspend the 30-day redelivery deadline unless CBP specifically grants a stay. This means importers typically must comply with the redelivery demand while simultaneously pursuing their legal challenge. Failure to comply with the deadline while a protest is pending can still result in penalty assessment.

Common Protest Grounds

Country of Origin Determination Errors

- Challenging incorrect country of origin determinations

- Proving merchandise was legally marked with the correct country at importation

- Demonstrating proper application of marking requirements under applicable provisions

Marking Exemption Claims

- Citing specific exemptions under 19 CFR Part 134

- Proving merchandise qualifies for marking exceptions

- Demonstrating compliance with alternative marking provisions

Procedural Violations

- Challenging improper CBP procedures in issuing the notice

- Contesting inadequate opportunity for correction before redelivery demand

- Disputing CBP’s legal authority over specific merchandise categories

Documentation Required for Protests

Successful protests require comprehensive supporting evidence:

Physical Evidence of Compliance

- High-resolution photographs showing country of origin marking from multiple angles

- Product samples demonstrating marking visibility and permanence

- Packaging materials showing compliant origin labeling

- Manufacturing records proving the correct country of production

Legal Documentation

- Manufacturer certificates or affidavits verifying country of origin

- Production records demonstrating manufacturing processes and locations

- Shipping documentation tracing merchandise from origin to U.S. importation

- Previous CBP rulings or internal advice supporting the importer’s position

Regulatory Analysis

- Legal memoranda citing applicable exemptions or special provisions

- Comparative analysis with similar products that received favorable CBP treatment

- Technical specifications proving compliance with marking duties requirements

- Expert opinions on marking visibility or manufacturing processes

Protest Outcomes and Appeals

If CBP denies the protest, importers have additional legal options:

Administrative Appeals

- Request for review by CBP headquarters

- Submission of additional evidence or legal arguments

- Coordination with trade associations for industry-wide issues

Federal Court Litigation

- Filing suit in the U.S. Court of International Trade

- Seeking judicial review of CBP’s administrative determination

- Pursuing statutory remedies under customs law provisions

The protest process serves dual purposes: potentially overturning incorrect CBP determinations and creating a legal record for any subsequent penalty mitigation or court proceedings. Even unsuccessful protests can provide valuable documentation for future compliance efforts and demonstrate good faith efforts to comply with customs laws.

Best Practices for Prevention and Compliance

Implementing robust compliance measures significantly reduces the risk of receiving a notice to redeliver and ensures efficient resolution when issues arise. Successful prevention strategies focus on proactive compliance verification, comprehensive documentation, and professional guidance for complex scenarios.

Pre-Shipment Compliance Programs

Marking Verification Procedures

- Systematic inspection of merchandise before shipment to verify country of origin marking meets 19 CFR Part 134 requirements

- Quality control checkpoints ensuring marking durability and visibility

- Documentation protocols proving marking compliance for each shipment

- Supplier certification programs requiring marking compliance verification

- Comprehensive recordkeeping of manufacturing locations and processes

- Written agreements with suppliers specifying marking requirements

- Regular audits of supplier facilities to verify origin and marking compliance

- Backup documentation for complex manufacturing processes involving multiple countries

Regulatory Compliance Monitoring

- Regular review of FDA and other agency requirements for imported products

- Advance coordination with regulatory agencies for products requiring pre-approval

- Monitoring of regulatory changes affecting specific product categories

- Implementation of corrective action protocols for identified compliance gaps

Professional Guidance and Advance Planning

CBP Advance Rulings and Internal Advice For uncertain or complex situations, importers should request:

- Binding CBP rulings on country of origin determinations

- Internal advice on marking requirements for specific products

- Classification rulings for products with ambiguous harmonized tariff schedule positions

- Guidance on regulatory compliance for multi-agency oversight products

Customs Broker Partnerships

- Establish relationships with experienced customs brokers specializing in specific product categories

- Regular compliance reviews with broker teams

- Training programs for internal staff on customs requirements

- Emergency response protocols for compliance issues

Legal Consultation

- Periodic review of compliance programs by customs attorneys

- Legal analysis of regulatory changes affecting import operations

- Development of internal compliance manuals and procedures

- Training for management teams on customs law requirements

Technology and Documentation Systems

Electronic Recordkeeping

- Digital photo documentation of marking compliance for each shipment

- Electronic storage of supplier certificates and manufacturing records

- Automated tracking of regulatory requirements and compliance deadlines

- Integration with ACE system for efficient CBP communication

Compliance Monitoring Tools

- Regular internal audits of marking and documentation procedures

- Statistical tracking of examination rates and compliance issues

- Early warning systems for regulatory changes affecting operations

- Performance metrics for supplier compliance programs

Emergency Response Procedures

Form 4647 Response Protocols

- Designated response teams with clear roles and responsibilities

- Template procedures for different types of violations

- Pre-established relationships with bonded warehouses and transportation companies

- Emergency contact procedures for legal and broker support

Documentation Preparation

- Standardized protest documentation templates

- Pre-compiled evidence packages for common compliance scenarios

- Established procedures for rapid evidence gathering and legal analysis

- Communication protocols with suppliers and manufacturers for emergency support

These prevention strategies create multiple layers of protection against compliance violations while ensuring rapid, effective response when issues arise. The investment in comprehensive compliance programs typically pays for itself through reduced examination rates, faster cargo release, and avoidance of penalty assessments.

Regular review and updating of compliance procedures ensures they remain effective as CBP regulations and interpretations evolve, particularly for rapidly changing product categories or emerging technologies that may challenge traditional marking and classification approaches.

Conclusion

The CBP notice to redeliver form 4647 represents a serious enforcement mechanism that demands immediate attention and expert handling. With strict 30-day compliance deadlines, substantial penalty exposure, and complex legal requirements, importers cannot afford to treat these notices casually or attempt to navigate the process without proper preparation.

Understanding your legal obligations under the redelivery demand, implementing effective compliance strategies, and maintaining relationships with qualified customs professionals creates the foundation for successful resolution of Form 4647 issues. Whether addressing immediate compliance requirements or building long-term prevention programs, the key lies in prompt action, comprehensive documentation, and professional guidance.

The consequences of non-compliance extend far beyond immediate penalties, potentially affecting your entire import operation through increased scrutiny, bond forfeitures, and reputational damage. However, importers who invest in robust compliance programs and professional support consistently achieve better outcomes while maintaining efficient operations.

For importers facing a current Form 4647 notice or seeking to strengthen their compliance procedures, consulting with experienced customs brokers and attorneys provides the expertise necessary to navigate this complex area of customs law effectively. The investment in professional guidance typically proves far more cost-effective than the alternatives of non-compliance or inadequate response to CBP enforcement actions.