In today’s global marketplace, Delivered Duty Paid (DDP) shipping has become increasingly popular among businesses seeking to simplify international trade. While this shipping method promises convenience by having the seller handle all costs up to the buyer’s doorstep, beneath this seamless facade lurk significant risks that many companies overlook.

Understanding the hidden dangers of unpaid tariffs under DDP arrangements is essential for protecting your business from potentially devastating financial and legal consequences. This comprehensive guide will walk you through everything you need to know about DDP shipping, with a particular focus on the often-overlooked risks of unpaid duties.

Delivered Duty Paid (DDP) Shipping

Delivered Duty Paid (DDP) shipping is a method where the seller takes responsibility for all costs, including customs duties, taxes, and shipping fees, until the goods reach the buyer’s country. This international shipping term is part of the Incoterms defined by the International Chamber of Commerce, which standardizes global shipping rules to facilitate smoother international transactions.

Under DDP arrangements, the seller delivers goods to the buyer’s location with all duties and taxes paid. This means the seller handles customs clearance, pays import duties, and covers all shipping costs, effectively managing the entire shipping process from origin to destination.

DDP shipping simplifies international trade by minimizing the buyer’s involvement in customs procedures and shipping fees. For ecommerce businesses expanding into global markets, this approach can create a competitive advantage by offering customers a hassle-free purchasing experience with no surprise fees upon delivery.

However, what many businesses fail to realize is that this convenience comes with significant financial and legal risks when duties go unpaid—whether intentionally or through oversight.

Key Aspects of DDP Shipping

DDP shipping requires the seller to act as the importer of record in the buyer’s country, handling all customs formalities and paying import duties. This fundamental aspect creates both opportunities and challenges that businesses must carefully navigate.

As the importer of record, the seller assumes complete responsibility for:

- Managing transportation costs from origin to destination

- Obtaining necessary import licenses and permits

- Preparing and submitting all customs documentation

- Paying import duties, taxes, and customs fees

- Arranging shipping insurance throughout transit

- Ensuring compliance with the destination country’s regulations

DDP shipping benefits international buyers by providing a hassle-free import experience. With minimal involvement in customs procedures, buyers receive their goods without worrying about unexpected fees or complex paperwork. This arrangement is particularly valuable in regions with strict import regulations, where navigating customs requirements can be challenging for foreign buyers.

For sellers, however, the arrangement demands thorough cost analysis and management of compliance risks. Every shipment requires careful calculation of duties and taxes specific to the destination country—rates that may change without notice. Failure to perform adequate due diligence can result in significant financial losses and legal liabilities.

How DDP Shipping Works

DDP shipping works by shifting all responsibilities, including customs clearance and import duties, to the seller. The process typically follows these steps:

- The seller calculates all costs, including freight, insurance, and destination country duties, and includes these fees in the final commercial invoice for the buyer.

- The seller prepares required customs paperwork, such as commercial invoices, packing lists, and any necessary import licenses or certificates.

- The seller arranges international shipping to the destination country and pays delivery drivers and freight handlers throughout the journey.

- Upon arrival, the seller (typically through a customs broker) handles import customs clearance, submitting documentation and paying all customs duties and taxes.

- Once the shipment arrives at the buyer’s location, risk transfers to the buyer, who then unloads the goods and confirms proof of delivery.

This process creates a seamless experience for buyers when executed properly. However, the complexity of calculating accurate duties and taxes across different jurisdictions creates numerous opportunities for errors, underpayments, or compliance failures.

For example, a U.S.-based ecommerce business shipping products to the European Union under DDP must navigate VAT requirements, product-specific tariff codes, and country-specific regulations—all while ensuring accurate payment of all duties. Any miscalculation or missed payment becomes the seller’s liability but may eventually create problems for the buyer as well.

Customs Clearance and Compliance

Sellers must handle customs clearance and pay all customs duties, taxes, and fees under DDP shipping agreements. This critical responsibility requires meticulous attention to regulatory details and thorough understanding of the buyer’s country requirements.

Customs clearance involves preparing and submitting required documentation, including:

- Accurate commercial invoices with proper valuation

- Correct product classification using Harmonized System (HS) codes

- Certificates of origin and compliance documents

- Import licenses for restricted goods

- Complete and accurate customs declarations

Sellers must comply with all customs regulations and laws in the buyer’s country to avoid delays and penalties. This compliance extends beyond simple payment of duties to include adherence to product standards, labeling requirements, and restrictions on certain goods.

The risk of non-compliance is substantial. Customs authorities may impose fines or penalties that dramatically increase shipping costs. More seriously, customs officials can flag shipments for intensive inspection, hold goods indefinitely, or even seize products that fail to meet import requirements.

A common misconception is that these risks affect only the seller. In reality, when customs authorities discover unpaid duties—even months or years after importation—they often pursue the party with physical possession of the goods. This means buyers can face unexpected liability for the seller’s compliance failures.

Role of Freight Forwarders in DDP Shipping

Freight forwarders play a crucial role in DDP shipping by assisting sellers with customs clearance, transportation, and logistics management. These specialized intermediaries serve as an essential bridge between sellers and the complex web of international shipping requirements.

A competent freight forwarder can:

- Navigate complex customs regulations in multiple jurisdictions

- Prepare and review customs documentation for accuracy

- Coordinate with customs brokers in the destination country

- Advise on proper tariff classification and valuation

- Monitor regulatory changes that might affect duties

- Identify potential compliance issues before they become problems

When selecting a freight forwarder for DDP shipments, sellers should prioritize experience in the specific destination markets they serve. Different countries have unique customs procedures, and a forwarder with local expertise can prevent costly mistakes.

Many freight forwarders also provide value-added services such as shipping insurance, warehousing, and distribution. These capabilities can enhance the overall efficiency of DDP shipping operations while reducing compliance risks.

However, even the best freight forwarder cannot eliminate all risks. The seller remains ultimately responsible for all duties and compliance requirements. Some sellers mistakenly believe that outsourcing to a forwarder transfers this liability, when in fact it merely provides expert assistance in managing—not eliminating—these obligations.

International Shipping and Trade

DDP shipping is commonly used in international trade, particularly for ecommerce businesses that sell products globally. The growth of cross-border commerce has made DDP an attractive option for companies looking to expand their customer base without burdening international buyers with complex import procedures.

International shipping involves navigating a maze of customs formalities, strict regulations, and varying laws across different countries. Each destination market presents unique challenges, from Japan’s precise documentation requirements to Brazil’s complex tax structures.

For sellers, understanding international trade regulations, including Incoterms and country-specific import rules, is essential to navigate DDP shipping effectively. This knowledge helps prevent costly mistakes and ensures compliance with all relevant laws.

DDP shipping can help sellers expand their global market reach by removing barriers to purchase. International buyers often prefer suppliers who offer delivered duty paid terms, as this eliminates the uncertainty of calculating import costs and managing unfamiliar customs procedures.

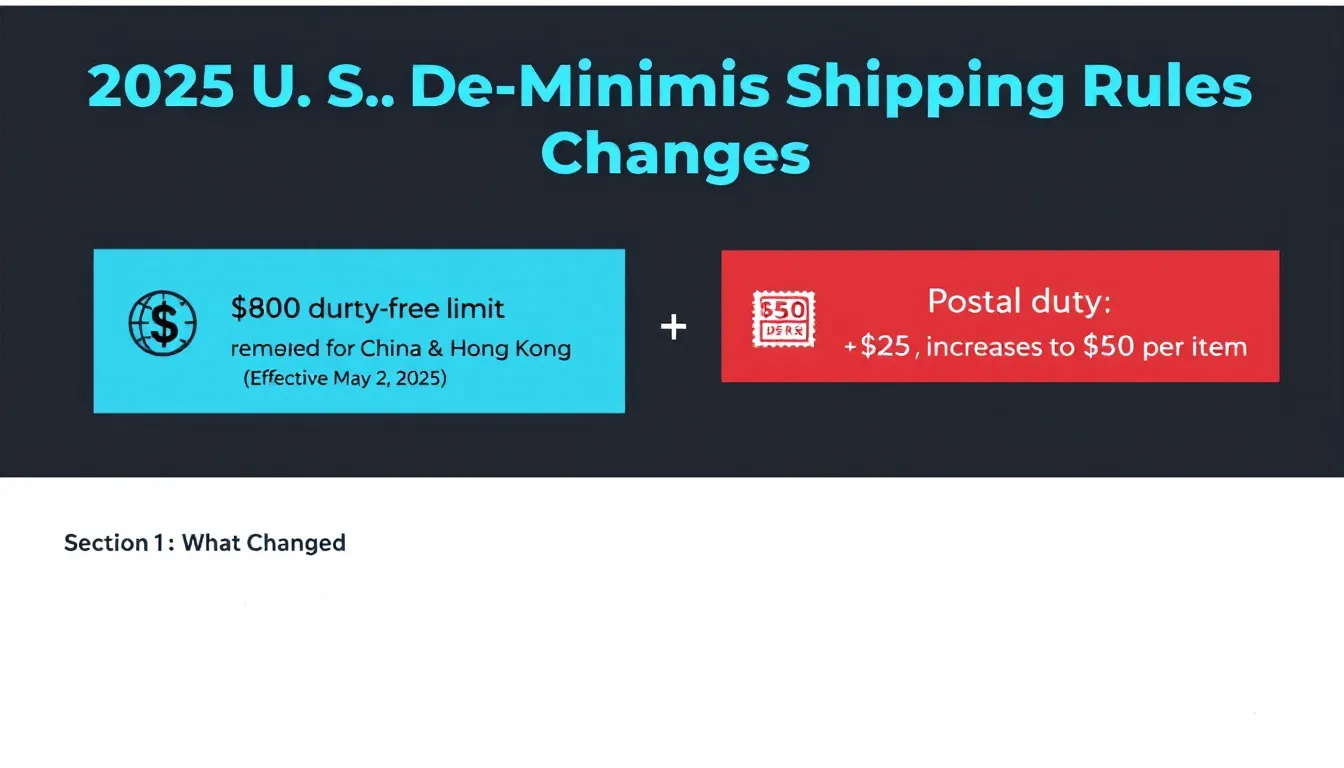

However, the complexity of international trade also magnifies the risks associated with DDP shipping. Customs regulations change frequently, duty rates fluctuate, and enforcement priorities shift. Sellers must remain vigilant and adaptable to avoid the pitfalls of unpaid or underpaid duties.

DDP Shipping FAQs

What is Delivered Duty Paid (DDP) shipping, and how does it work?

Delivered duty paid shipping is an international trade arrangement where the seller takes responsibility for the entire shipping process, including paying all customs duties, taxes, and fees until the goods reach the buyer’s specified location. The seller acts as the importer of record, handling all legal obligations in the buyer’s country.

What are the benefits and risks of using DDP shipping for international trade?

The primary benefits include a hassle-free import experience for buyers, predictable all-inclusive pricing, and simplified purchasing. The main risks include the seller’s exposure to unexpected costs, customs delays, and significant compliance liabilities if duties go unpaid or regulations aren’t followed correctly.

How do sellers handle customs clearance and compliance under DDP shipping agreements?

Sellers typically work with customs brokers or freight forwarders who prepare and submit all required documentation, calculate applicable duties and taxes, make payments to customs authorities, and ensure compliance with import regulations. The seller remains legally responsible even when using these intermediaries.

What is the role of freight forwarders in DDP shipping?

Freight forwarders provide expertise in logistics, compliance, and documentation. They help sellers navigate complex customs requirements, arrange transportation, submit necessary paperwork, and resolve any issues that arise during customs clearance.

How can sellers manage DDP shipping costs, including customs duties, taxes, and shipping fees?

Effective management requires thorough research of destination country requirements, accurate product classification, proper valuation, and building relationships with experienced freight forwarders. Sellers should include buffer margins in their pricing to account for unexpected costs and regulatory changes.

Duty Unpaid Risks

The most significant risk in DDP arrangements occurs when sellers fail to properly pay customs fees, resulting in unpaid duties that can trigger severe consequences for both parties. This situation creates a cascade of financial and legal problems that may not become apparent until months after delivery.

When duties go unpaid, customs authorities have several powerful enforcement tools at their disposal:

- Retroactive collection of unpaid duties plus interest

- Substantial penalties that can exceed the original duty amount

- Seizure of future shipments from the same seller

- Legal action against both seller and buyer

- Blacklisting of companies in customs databases

For sellers, the financial impact can be devastating. A company that has underestimated or deliberately underpaid duties may suddenly face significant financial burden when customs authorities conduct post-entry audits. These investigations can reach back several years, compounding the liability.

Even more concerning, buyers are not necessarily shielded from these consequences simply because they purchased under DDP terms. Customs authorities in many jurisdictions consider the physical possessor of the goods jointly liable for any unpaid duties. This means buyers may receive unexpected demands for payment long after they believed the transaction was complete.

For example, an ecommerce business might import products under DDP, only to receive a customs bill months later because their supplier misclassified the goods or underreported value. The buyer then faces the difficult choice of paying these unexpected fees or engaging in a complex legal dispute with both the seller and customs authorities.

This scenario highlights why thorough due diligence on DDP partners is essential. Buyers should verify that sellers have robust compliance processes and sufficient financial stability to honor their duty payment obligations.

Delivered Duty Paid DDP Benefits

Despite the risks, properly executed delivered duty paid DDP shipping offers substantial benefits, particularly in creating a smoother purchasing experience with predictable costs for international buyers.

When managed correctly, DDP shipping provides:

- Complete transparency in landed costs, with no surprise fees for buyers

- Simplified purchasing process for international customers

- Reduced administrative burden for buyers unfamiliar with import procedures

- Faster customs clearance through professional handling

- Enhanced customer satisfaction through reliable delivery times

- Competitive advantage in markets where buyers value convenience

For sellers willing to invest in proper compliance infrastructure, DDP can dramatically increase sales conversion rates in international markets. By removing the uncertainty and complexity associated with importing, sellers eliminate a major barrier to purchase.

The arrangement is particularly valuable in regions with strict import regulations or complex customs procedures. Buyers in these markets often prefer suppliers who can navigate the local compliance landscape and deliver products without requiring the buyer’s involvement.

DDP shipping also creates opportunities for sellers to build stronger relationships with international customers. By taking responsibility for the entire shipping process, sellers demonstrate their commitment to customer service and their willingness to invest in the buyer’s convenience.

However, these benefits are only realized when sellers fully understand and properly manage their DDP obligations. The convenience and customer satisfaction advantages quickly disappear if unpaid duties or compliance issues disrupt the supply chain or create unexpected costs.

Conclusion: Balancing Opportunity and Risk

The hidden risks of unpaid tariffs under DDP represent a significant but manageable challenge for businesses engaged in international trade. While DDP shipping offers compelling benefits in terms of customer experience and market access, it requires careful planning, robust compliance processes, and thorough understanding of customs requirements.

For sellers, the key to successful DDP shipping lies in building relationships with knowledgeable partners—freight forwarders, customs brokers, and legal advisors with specific expertise in destination markets. These relationships, combined with internal compliance systems, can help identify and mitigate duty payment risks before they escalate into costly problems.

For buyers, due diligence remains essential even when purchasing under DDP terms. Verifying that sellers have appropriate compliance procedures and financial stability can prevent the unpleasant surprise of discovering unpaid duties after the fact.

Both parties should approach DDP shipping with a clear understanding of their respective responsibilities and the potential consequences of compliance failures. By recognizing these hidden dangers and implementing proper safeguards, businesses can enjoy DDP’s benefits while minimizing exposure to unpaid tariff risks.

Review your current DDP agreements today to ensure they include clear provisions for tariff compliance and verification. Consider consulting with a customs broker or freight forwarder with specific expertise in your destination markets to identify potential vulnerabilities in your current processes.

1 thought on “Unpaid Tariffs For DDP Imports: What You Need to Know”

Comments are closed.